Davide Campari-Milano (BIT:CPR) shareholders have endured a 56% loss from investing in the stock three years ago

If you love investing in stocks you're bound to buy some losers. But the long term shareholders of Davide Campari-Milano N.V. (BIT:CPR) have had an unfortunate run in the last three years. Sadly for them, the share price is down 56% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 43% lower in that time. The falls have accelerated recently, with the share price down 30% in the last three months.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Davide Campari-Milano

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Although the share price is down over three years, Davide Campari-Milano actually managed to grow EPS by 0.6% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Or else the company was over-hyped in the past, and so its growth has disappointed.

After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. Looking to other metrics might better explain the share price change.

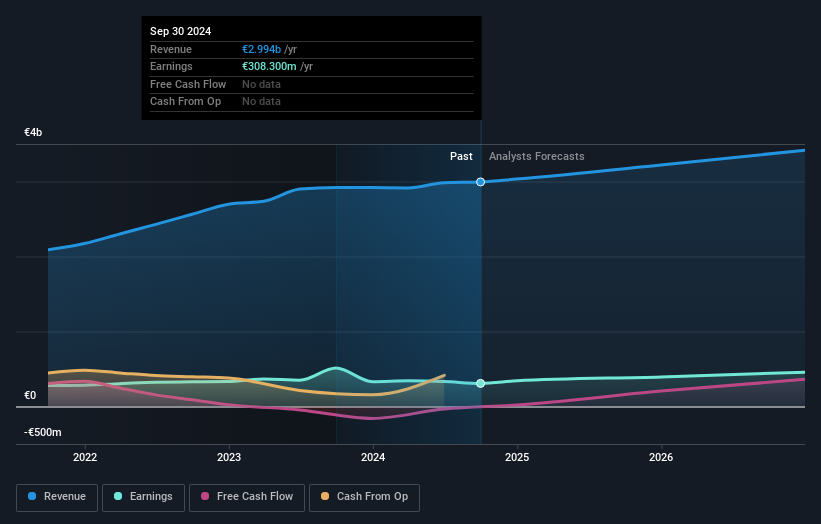

The modest 1.1% dividend yield is unlikely to be guiding the market view of the stock. We note that, in three years, revenue has actually grown at a 12% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating Davide Campari-Milano further; while we may be missing something on this analysis, there might also be an opportunity.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Davide Campari-Milano in this interactive graph of future profit estimates.

A Different Perspective

Davide Campari-Milano shareholders are down 43% for the year (even including dividends), but the market itself is up 17%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Davide Campari-Milano better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Davide Campari-Milano (of which 1 can't be ignored!) you should know about.

Davide Campari-Milano is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Italian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:CPR

Davide Campari-Milano

Davide Campari-Milano N.V., together with its subsidiaries, markets and distributes alcoholic and non-alcoholic beverages in the Americas, the Middle East, Africa, Europe, and the Asia-Pacific.

Average dividend payer with moderate growth potential.

Market Insights

Community Narratives