- Italy

- /

- Energy Services

- /

- BIT:YRM

Exploring Rosetti Marino And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

As European markets reach new heights, driven by a rally in technology stocks and expectations for lower U.S. borrowing costs, investors are increasingly turning their attention to small-cap opportunities that may benefit from this favorable environment. In this context of rising indices and improving consumer confidence, identifying companies with strong fundamentals and growth potential becomes crucial for those looking to capitalize on the current market momentum.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Dn Agrar Group | 63.27% | 15.46% | 33.00% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Rosetti Marino (BIT:YRM)

Simply Wall St Value Rating: ★★★★★★

Overview: Rosetti Marino SpA, along with its subsidiaries, operates in the energy, energy transition, and shipbuilding sectors across Italy, the European Union, and internationally with a market capitalization of €1.14 billion.

Operations: Rosetti Marino generates revenue through its operations in the energy, energy transition, and shipbuilding sectors. The company's financial performance is highlighted by its market capitalization of €1.14 billion.

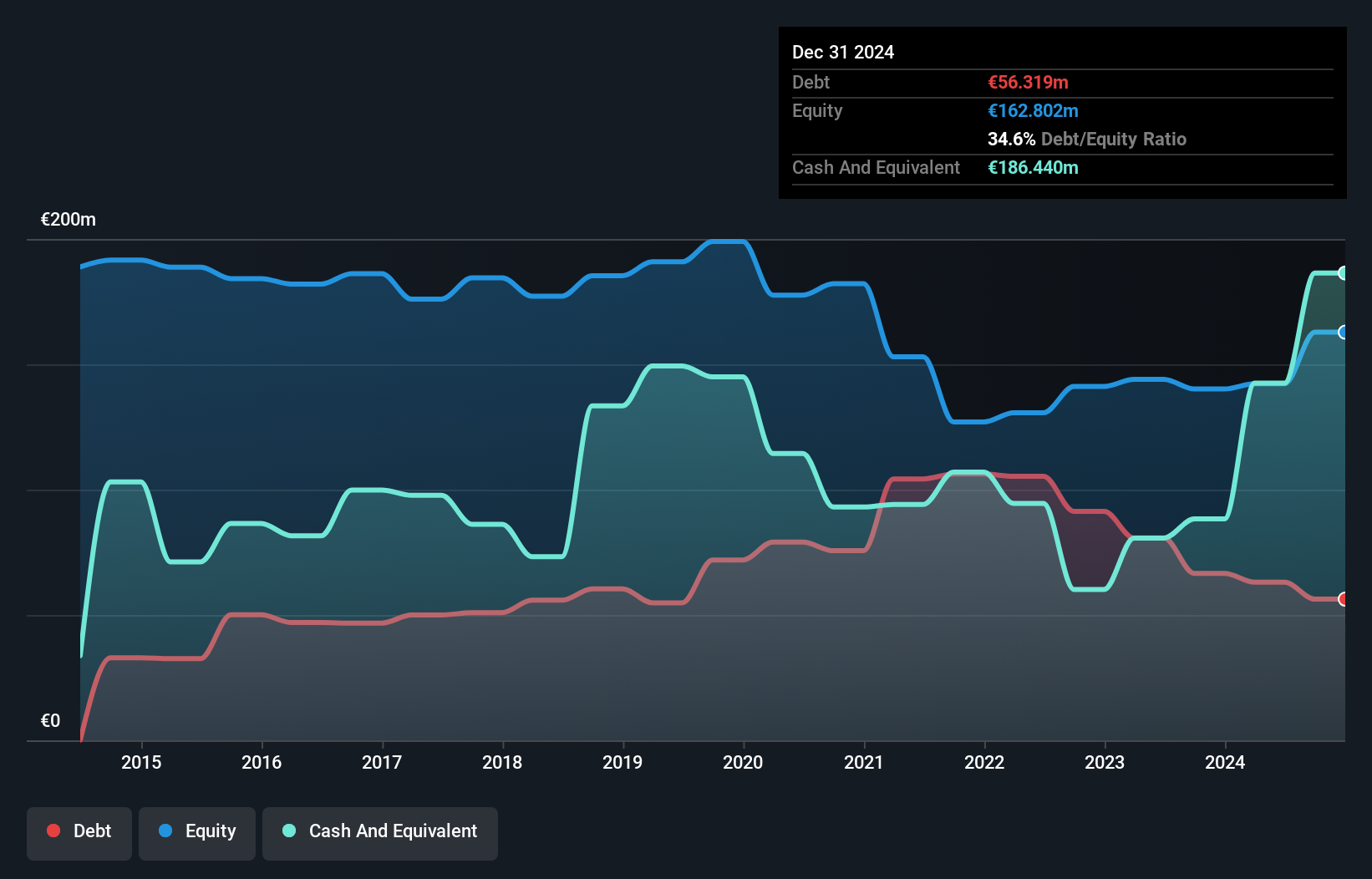

Rosetti Marino, a nimble player in the energy services sector, showcases impressive financial health with more cash than its total debt and a reduced debt-to-equity ratio from 44.5% to 39.3% over five years. The company's earnings surged by 293.7%, outpacing the industry average of 10.6%. Despite recent volatility in its share price, Rosetti Marino reported half-year sales of €318.95 million and net income of €11.67 million, reflecting solid growth compared to last year’s figures of €210.35 million and €7.87 million respectively, though future earnings are expected to decline slightly by 1.1% annually over three years.

- Unlock comprehensive insights into our analysis of Rosetti Marino stock in this health report.

Explore historical data to track Rosetti Marino's performance over time in our Past section.

Brødrene A & O Johansen (CPSE:AOJ B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Brødrene A & O Johansen A/S, along with its subsidiaries, operates in the sale and distribution of technical installation materials and tools for construction companies across Denmark, Sweden, Norway, and internationally with a market cap of DKK2.83 billion.

Operations: The company generates revenue primarily from B2B sales, amounting to DKK4.86 billion, and B2C sales at DKK1 billion.

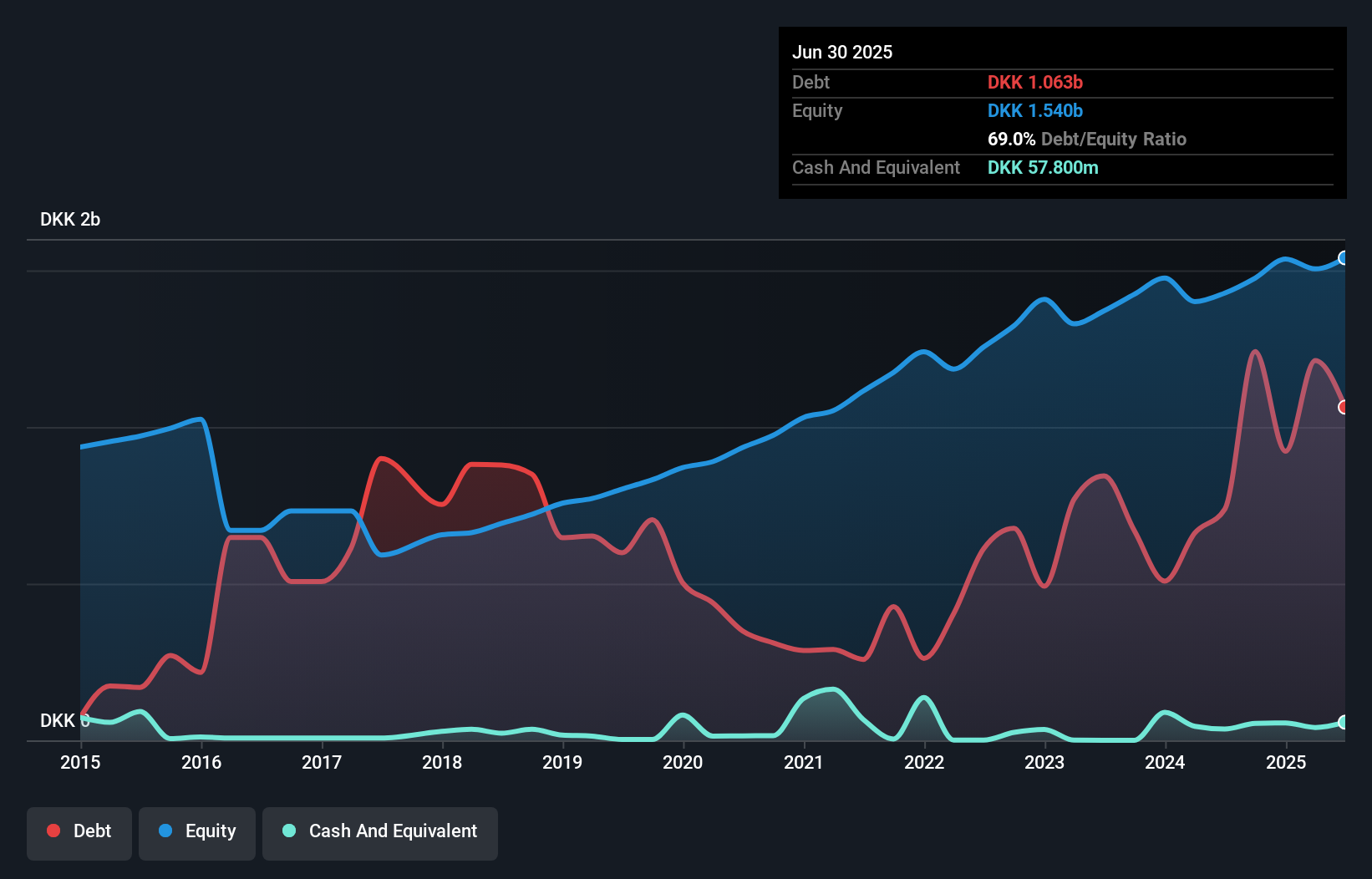

Brødrene A & O Johansen, a noteworthy player in the trade distribution sector, has shown robust earnings growth of 23.7% over the past year, outpacing its industry peers. Despite carrying a high net debt to equity ratio at 65.3%, its interest payments are well covered by EBIT at 7.2x coverage, indicating sound financial management amidst elevated debt levels which have risen from 37.3% to 69% in five years. The company's price-to-earnings ratio of 15.1x remains attractive compared to the industry average of 16.3x, suggesting potential value for investors looking beyond mainstream options in Europe’s market landscape.

Rusta (OM:RUSTA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rusta AB (publ) operates as a retailer specializing in home decoration, consumables, seasonal products, leisure, and DIY categories across Sweden, Norway, Finland, and Germany with a market cap of approximately SEK9.61 billion.

Operations: Rusta generates revenue primarily from its operations in Sweden, Norway, and other markets, with Sweden contributing SEK6.99 billion and Norway SEK2.56 billion.

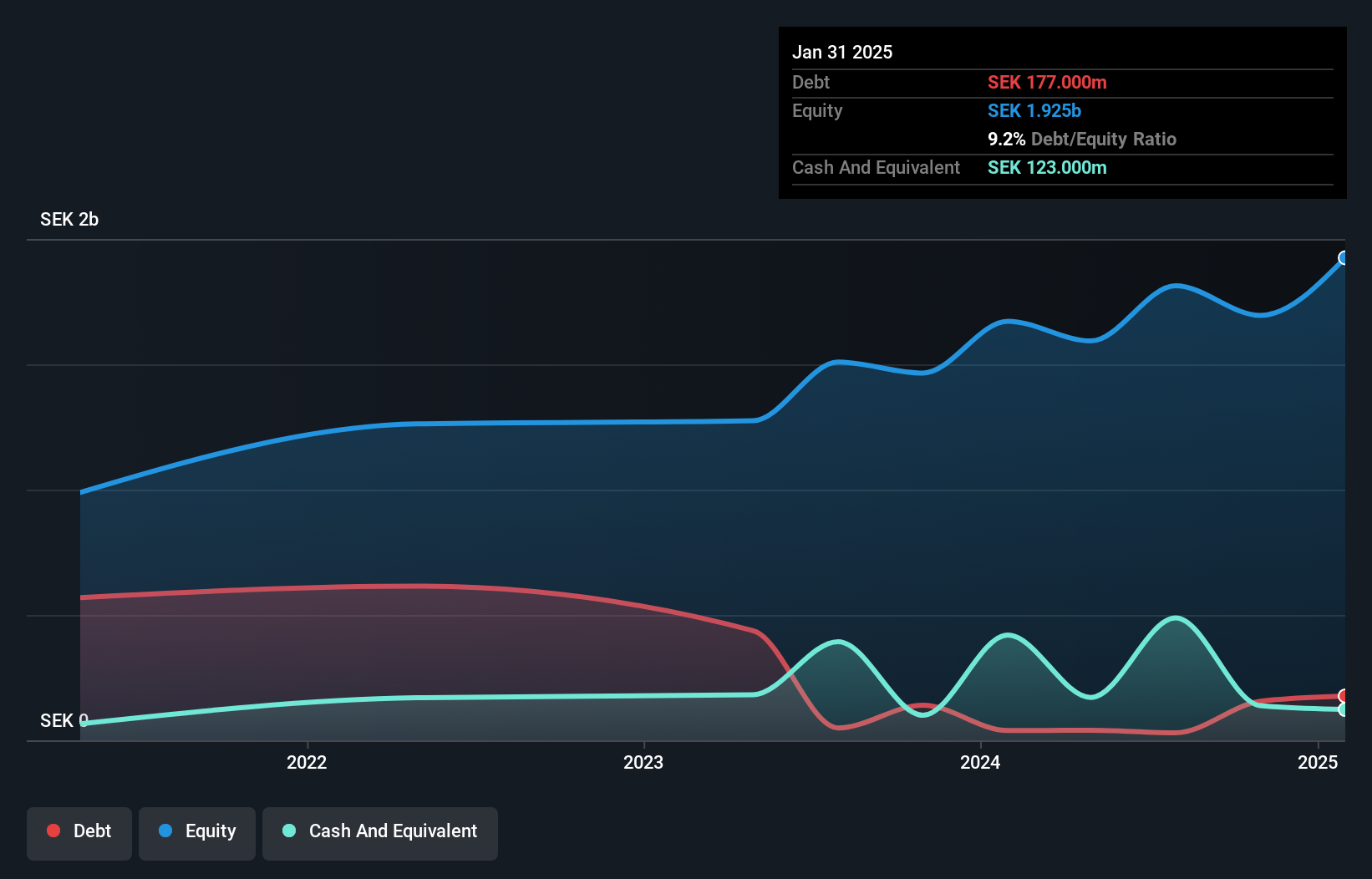

Rusta, a home and leisure retailer, is expanding aggressively with plans for 50 to 80 new stores over three years. The company reported first-quarter sales of SEK 3.17 billion, up from SEK 3.07 billion the previous year, although net income dipped to SEK 174 million from SEK 231 million. Despite this earnings drop of -6.9% compared to the industry average growth of 25%, Rusta's EBIT covers interest payments by a comfortable margin of 3.3 times, indicating financial stability without bank loans. Trading at a significant discount to its estimated fair value and with high-quality earnings, Rusta appears poised for future growth despite competitive pressures in Germany and potential currency volatility risks impacting profitability.

Where To Now?

- Access the full spectrum of 330 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:YRM

Rosetti Marino

Engages in the energy, energy transition, and shipbuilding businesses in Italy, rest of the European Union, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives