- Italy

- /

- Diversified Financial

- /

- BIT:IF

Here's Why We're Wary Of Buying Banca IFIS' (BIT:IF) For Its Upcoming Dividend

Banca IFIS S.p.A. (BIT:IF) is about to trade ex-dividend in the next three days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Thus, you can purchase Banca IFIS' shares before the 18th of November in order to receive the dividend, which the company will pay on the 20th of November.

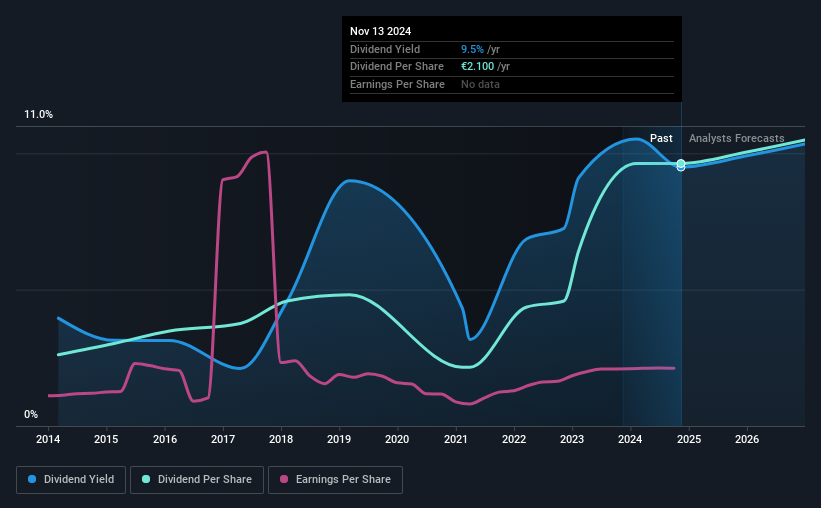

The company's next dividend payment will be €1.20 per share, and in the last 12 months, the company paid a total of €2.10 per share. Last year's total dividend payments show that Banca IFIS has a trailing yield of 9.5% on the current share price of €22.12. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for Banca IFIS

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Banca IFIS paid out 107% of its earnings, which is more than we're comfortable with, unless there are mitigating circumstances.

When the dividend payout ratio is high, as it is in this case, the dividend is usually at greater risk of being cut in the future.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're encouraged by the steady growth at Banca IFIS, with earnings per share up 2.3% on average over the last five years.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Banca IFIS has delivered an average of 14% per year annual increase in its dividend, based on the past 10 years of dividend payments. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders.

To Sum It Up

Should investors buy Banca IFIS for the upcoming dividend? While we like that its earnings are growing somewhat, we're not enamored that it's paying out 107% of last year's earnings. This is not an overtly appealing combination of characteristics, and we're just not that interested in this company's dividend.

Although, if you're still interested in Banca IFIS and want to know more, you'll find it very useful to know what risks this stock faces. Case in point: We've spotted 1 warning sign for Banca IFIS you should be aware of.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Banca IFIS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:IF

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in