- Italy

- /

- Diversified Financial

- /

- BIT:IF

Assessing Banca IFIS (BIT:IF) Valuation After Recent Share Price Fluctuations

Reviewed by Simply Wall St

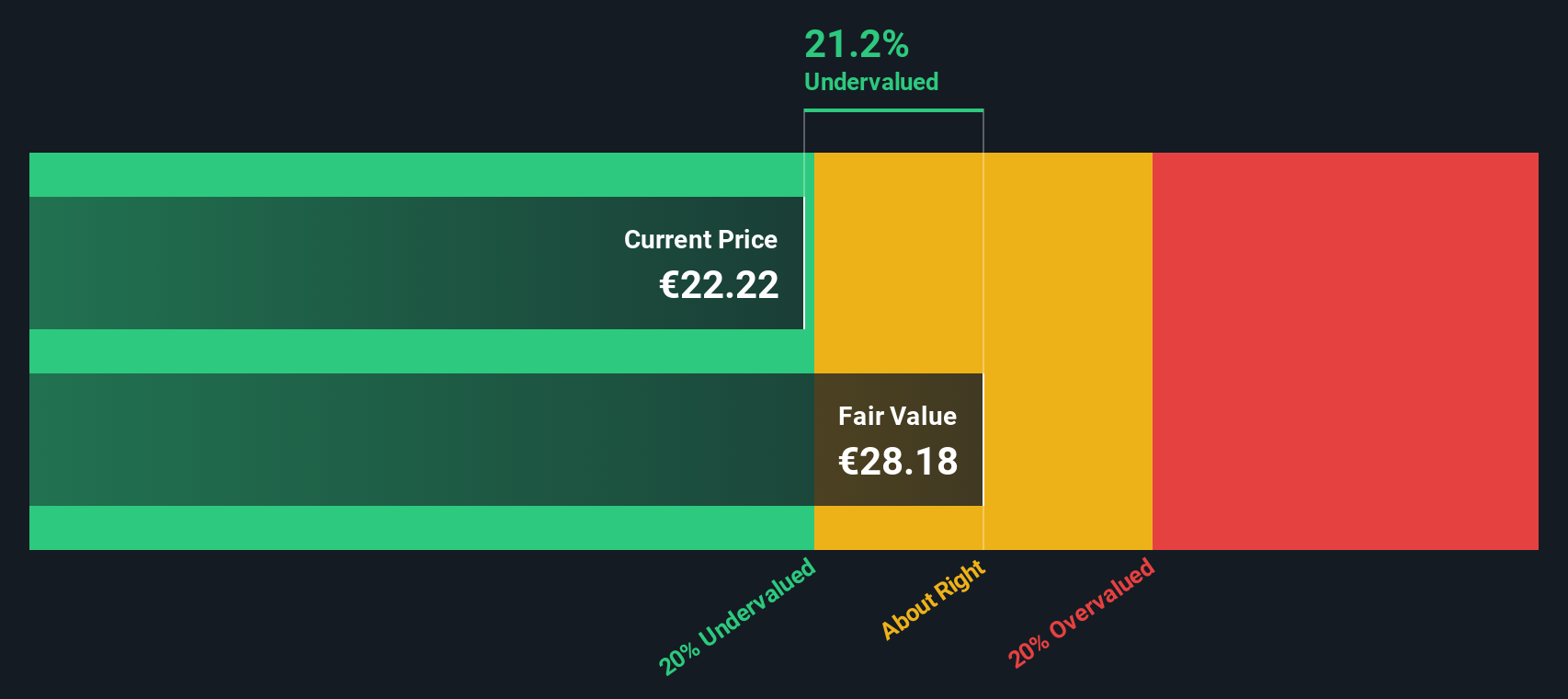

Most Popular Narrative: 11.3% Undervalued

According to the most widely followed narrative, Banca IFIS shares are currently undervalued by 11.3% compared to their estimated fair value. This valuation reflects a combination of projected earnings growth, margin expectations, and anticipated synergies from recent strategic moves.

Continued digital transformation investments and adoption of automation are set to enhance operational leverage and customer service, which should drive higher cost efficiency and support expanding net margins over the medium to long term.

Curious what fuels this bullish outlook? The analysts are betting on a dramatic operational shift and ambitious financial milestones, including rising revenues, evolving margins, and a valuation multiple that breaks the current mold. Want to unravel the precise assumptions and see what sets this price target apart? The narrative reveals the full blueprint behind the fair value estimate.

Result: Fair Value of €25.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent margin compression or slow progress integrating illimity could quickly undermine these bullish forecasts and weigh on Banca IFIS’s growth trajectory.

Find out about the key risks to this Banca IFIS narrative.Another View: Checking Value With Our DCF Model

Looking at Banca IFIS through the lens of our DCF model paints a similar picture, also pointing to undervaluation at current prices. However, as always, every model relies on its own assumptions. Could a different take tell a new story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Banca IFIS for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Banca IFIS Narrative

If you see things differently or want to dig into the data on your own terms, you can create and share your own view in just a few minutes. Do it your way

A great starting point for your Banca IFIS research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always look beyond the obvious winners. Open the door to a new batch of market opportunities by searching for companies set to outperform, no matter where the headlines are pointing.

- Compare stable dividend growers and boost your income strategy by checking out the opportunities in dividend stocks with yields > 3%.

- Uncover tomorrow’s leaders in artificial intelligence by examining stocks that are driving rapid innovation in the sector with AI penny stocks.

- Target true value deals and upgrade your watchlist with companies trading below their cash flow potential, found through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Banca IFIS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BIT:IF

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)