- Italy

- /

- Hospitality

- /

- BIT:LTMC

Taking Stock of Lottomatica Group (BIT:LTMC)’s Valuation After Morgan Stanley’s Overweight Upgrade

Reviewed by Simply Wall St

Morgan Stanley just shifted Lottomatica Group (BIT:LTMC) to Overweight, pointing to Italy's upcoming licensing round, market share opportunities, a recovering PWO platform, and an enhanced buyback program as key drivers for shareholder returns.

See our latest analysis for Lottomatica Group.

That upgrade drops into a backdrop where Lottomatica’s share price has climbed to €21.92 and delivered a hefty year to date share price return of 69.27%, with a 1 year total shareholder return of 73.41%. This signals that momentum has clearly been building as investors warm to its growth and cash return story.

If this kind of rerating has you thinking bigger picture, it could be a smart time to explore fast growing stocks with high insider ownership as you hunt for the next wave of compelling ideas.

With earnings growing faster than revenue, a 30% gap to analyst targets and the licensing round still ahead, the key question now is whether Lottomatica remains mispriced upside or if the market already sees tomorrow’s growth today.

Most Popular Narrative Narrative: 23.2% Undervalued

With Lottomatica last closing at €21.92 against a narrative fair value near €28.53, the current share price implies significant upside if the projections play out.

The upcoming consolidation opportunity from Italy's new online concession framework allows Lottomatica to capture an additional 7-10% of the total market share, with 2% already secured through deals, presenting a structural step-up in the company's addressable revenue base and long-term earnings potential.

Curious what kind of revenue runway and margin reset could justify that gap, and what future earnings multiple ties it all together? Read the complete narrative to uncover the assumptions powering this upside case.

Result: Fair Value of €28.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change quickly if Italian regulators tighten the rules or if traditional retail weakness outpaces the expected digital growth offset.

Find out about the key risks to this Lottomatica Group narrative.

Another Lens On Valuation

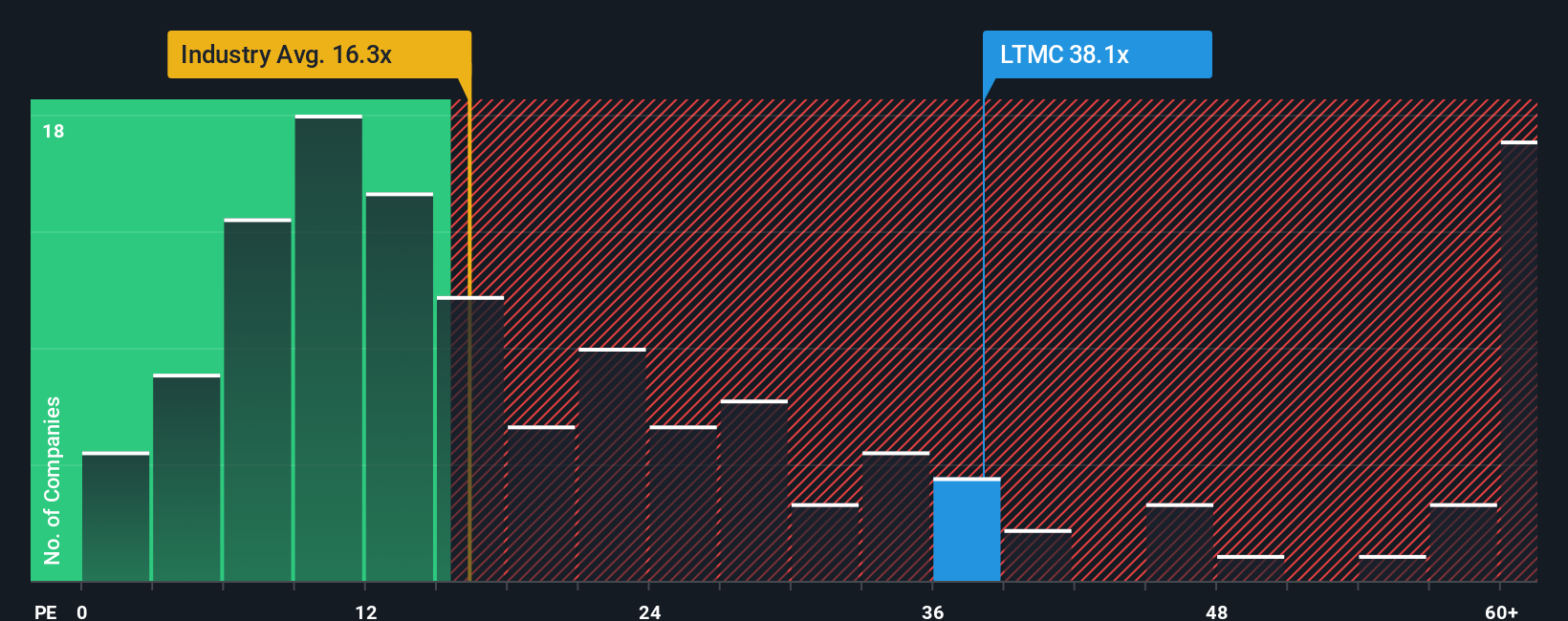

Step away from fair value models and the picture gets murkier. Lottomatica trades on a price to earnings ratio of 37.8x, far richer than both the European hospitality average at 16.2x and its own fair ratio of 42.5x. Is this a quality premium, or is valuation risk building?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lottomatica Group Narrative

If you see the numbers differently or prefer digging into the details yourself, you can build a complete view in just minutes: Do it your way.

A great starting point for your Lottomatica Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one opportunity; use the Simply Wall St Screener right now to uncover fresh stocks that match your strategy before the crowd moves.

- Capture early growth potential by scanning these 3612 penny stocks with strong financials that already pair tiny market caps with surprisingly solid balance sheets and momentum.

- Target tomorrow’s innovation leaders by focusing on these 26 AI penny stocks reshaping entire industries with real, revenue generating artificial intelligence solutions.

- Improve your risk and reward profile by zeroing in on these 901 undervalued stocks based on cash flows where strong cash flows are not yet fully reflected in the share price.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:LTMC

High growth potential with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)