As global markets navigate through a mix of geopolitical tensions and economic optimism, U.S. indexes have approached record highs with broad-based gains, driven by positive labor market reports and stabilizing mortgage rates. In this dynamic environment, dividend stocks remain an attractive option for investors seeking steady income, especially as the Federal Reserve hints at potential interest rate cuts; here we explore three top dividend stocks yielding up to 8%, highlighting their potential to provide reliable returns amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.01% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.47% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.25% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.57% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.51% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.30% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.30% | ★★★★★★ |

Click here to see the full list of 1948 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

MARR (BIT:MARR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MARR S.p.A. specializes in the marketing and distribution of fresh, dried, and frozen food products for catering in Italy, the European Union, and internationally with a market cap of €631.78 million.

Operations: MARR S.p.A.'s revenue is primarily derived from its €2.02 billion segment focused on the distribution of food products.

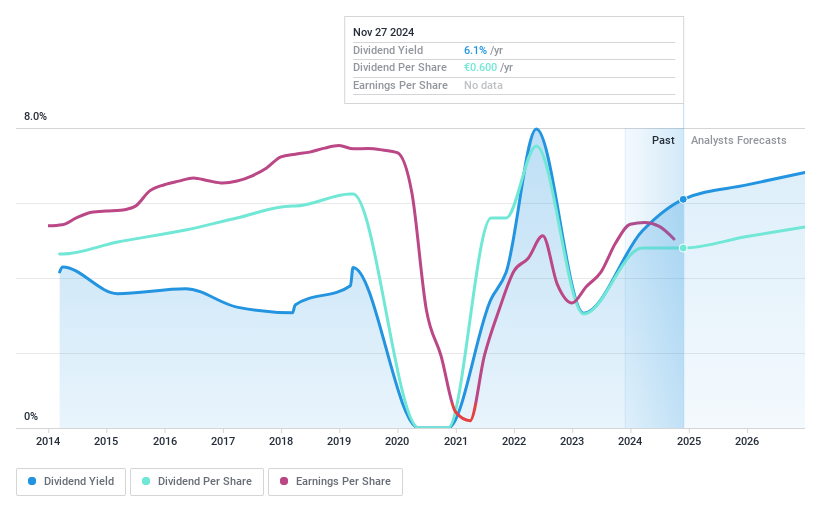

Dividend Yield: 6.1%

MARR's dividend yield is notable, ranking in the top 25% of Italian market payers. The dividends are covered by earnings and cash flows, with payout ratios at 84.9% and 54%, respectively. However, the dividend history is volatile despite recent increases over a decade. Recent earnings show slight declines in sales and net income compared to last year, reflecting potential challenges ahead. Despite this, analysts expect stock price growth and see it trading below fair value estimates.

- Get an in-depth perspective on MARR's performance by reading our dividend report here.

- According our valuation report, there's an indication that MARR's share price might be on the cheaper side.

Nasmedia (KOSDAQ:A089600)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nasmedia Co., Ltd. is a digital marketing platform company based in South Korea with a market cap of approximately ₩162.58 billion.

Operations: Nasmedia Co., Ltd. generates revenue primarily through its Advertising Media Sales Agency segment, which accounts for ₩108.33 billion, and its Advertising Agency segment, contributing ₩38.82 billion.

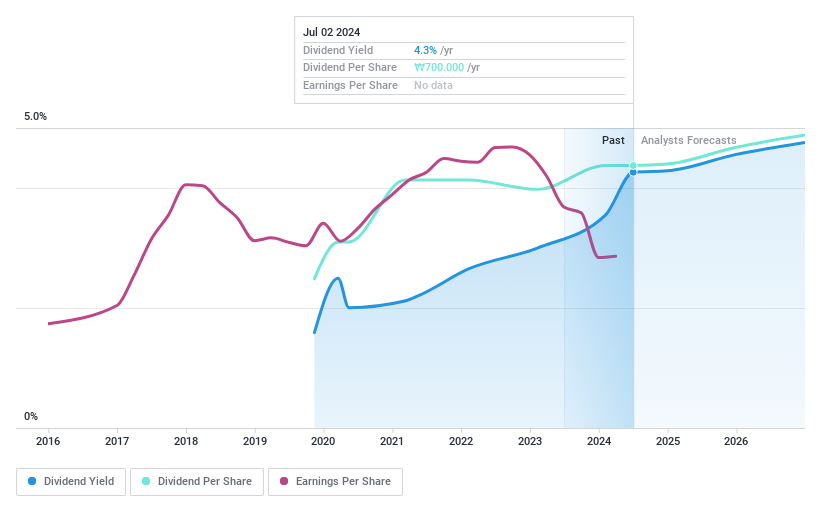

Dividend Yield: 4.9%

Nasmedia's dividend yield is among the top 25% in the Korean market, supported by a low payout ratio of 42.6% from earnings and 19.8% from cash flows, ensuring sustainability. Although dividends have been stable and growing over five years, their history is relatively short. The stock trades at a significant discount to its estimated fair value, indicating potential undervaluation compared to peers. Analysts forecast robust earnings growth, enhancing future dividend prospects.

- Take a closer look at Nasmedia's potential here in our dividend report.

- Our valuation report unveils the possibility Nasmedia's shares may be trading at a discount.

ProCredit Holding (XTRA:PCZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ProCredit Holding AG, with a market cap of €449.98 million, offers commercial banking services to small and medium enterprises and private customers across Europe, South America, and Germany.

Operations: ProCredit Holding AG generates its revenue primarily from its banking segment, which accounts for €422.15 million.

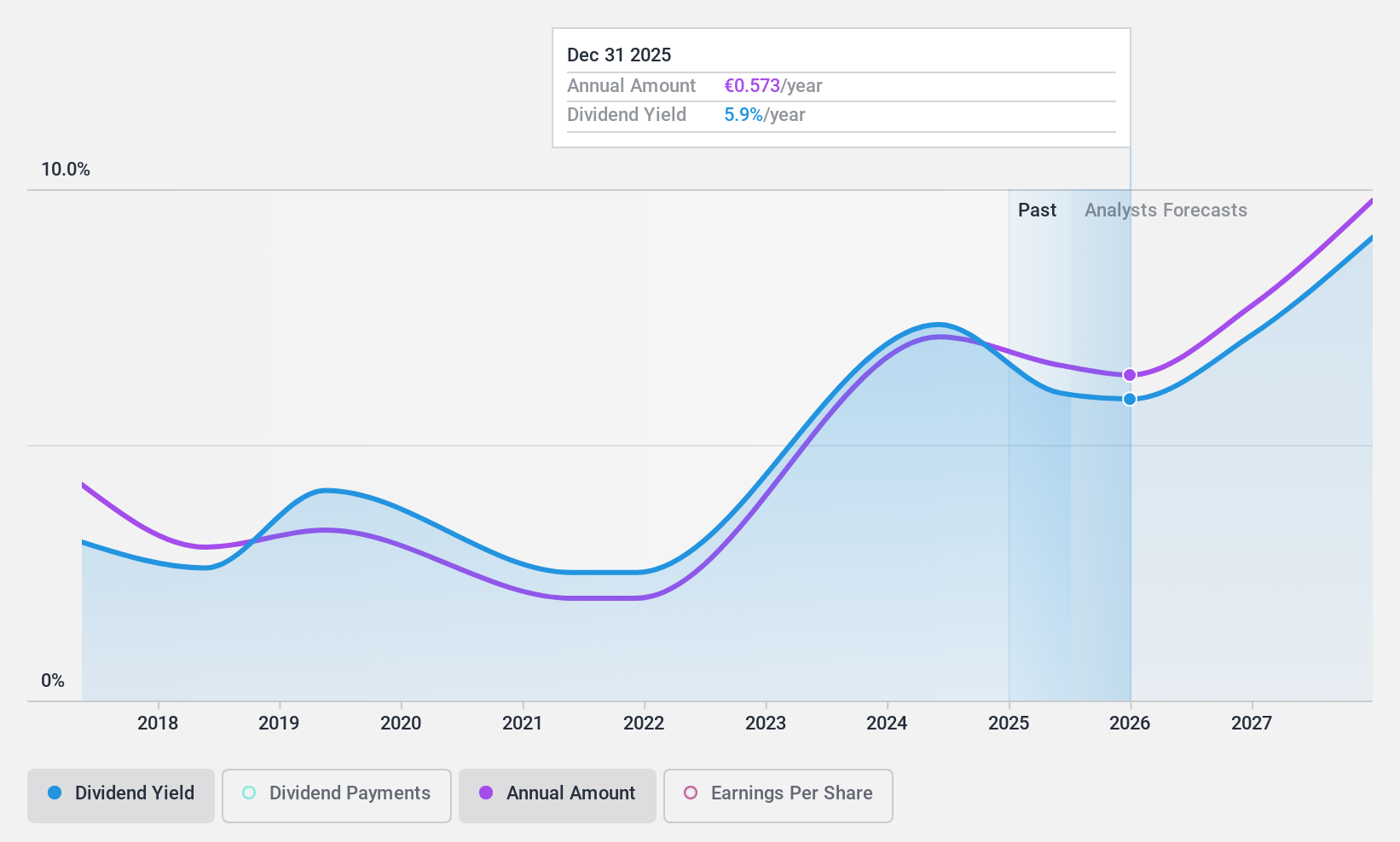

Dividend Yield: 8%

ProCredit Holding offers a high dividend yield of 8%, ranking in the top 25% of German market payers, and maintains a low payout ratio of 35.3%, suggesting coverage by earnings. However, its dividend history is marked by volatility over eight years, with payments not consistently growing. Despite this instability, the stock trades significantly below its estimated fair value and shows potential for price appreciation according to analysts' forecasts. Earnings have grown recently but net income has declined slightly year-over-year.

- Click to explore a detailed breakdown of our findings in ProCredit Holding's dividend report.

- In light of our recent valuation report, it seems possible that ProCredit Holding is trading behind its estimated value.

Where To Now?

- Delve into our full catalog of 1948 Top Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PCZ

ProCredit Holding

Provides commercial banking services for small and medium enterprises and private customers in Europe, South America, and Germany.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives