Brunello Cucinelli (BIT:BC): Assessing Valuation After Recent Modest Share Price Fluctuations

Reviewed by Simply Wall St

Most Popular Narrative: 14.9% Undervalued

The prevailing narrative sees Brunello Cucinelli shares as undervalued, suggesting investors may be underestimating its medium-term prospects despite the recent price action.

The company's long-standing commitment to sustainability, ethical sourcing, and direct relationships with a generationally renewed Italian artisanal network differentiates it in an industry facing heightened scrutiny and regulation. This further reinforces premium brand positioning and medium-term earnings resilience.

Curious about what’s driving that bullish price target? The narrative hinges on a set of aggressive growth assumptions, such as significant increases in future revenue, margins, and profits, that are built directly into the valuation model. Want to see which figures the narrative suggests Brunello Cucinelli can actually achieve, and how these projections compare to the wider European luxury sector? The real surprise comes when you see just how high a profit multiple analysts are betting on.

Result: Fair Value of €112.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising debt levels and accelerating operating costs could challenge Brunello Cucinelli’s momentum if revenue growth slows or if luxury demand weakens.

Find out about the key risks to this Brunello Cucinelli narrative.Another View: Market Signals Paint a Different Picture

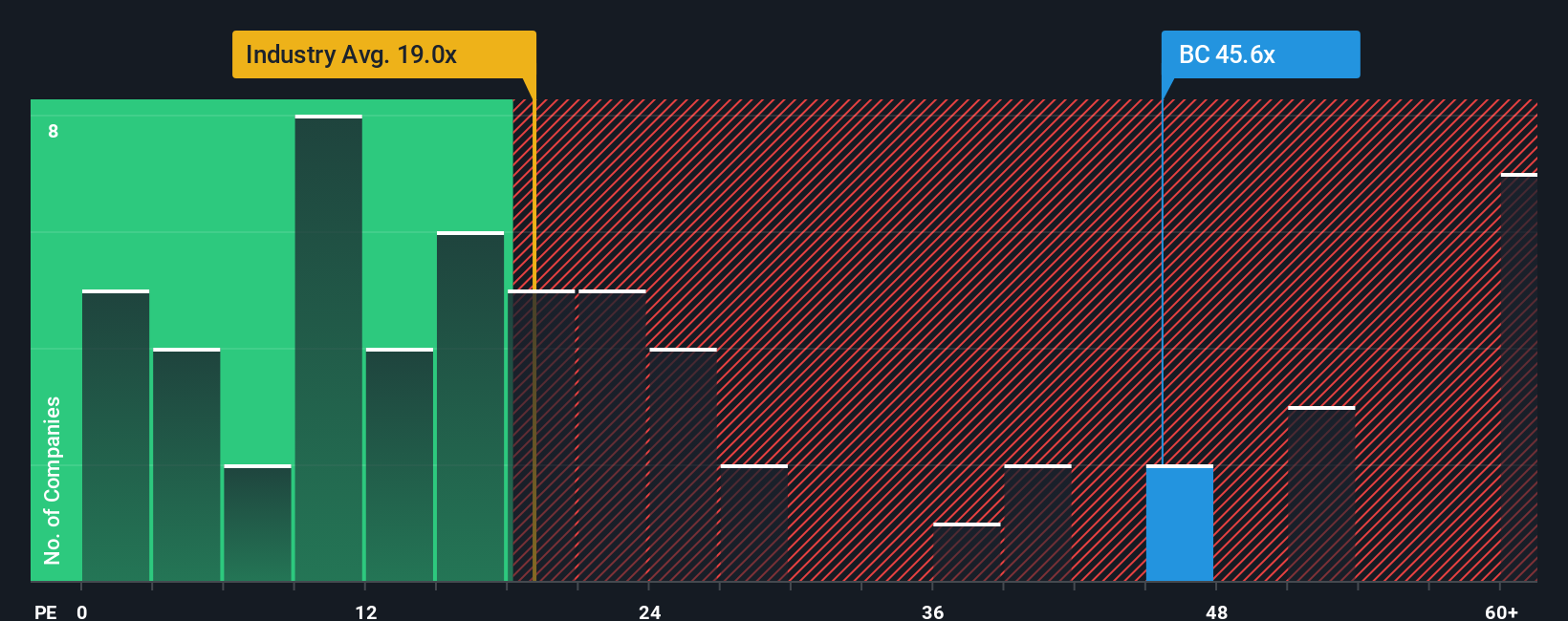

Not everyone agrees with the bullish narrative. When looking at how Brunello Cucinelli is priced compared to the rest of the European luxury industry, the shares appear expensive by this metric. Does this mean investors are over-optimistic, or is something being missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Brunello Cucinelli Narrative

Keep in mind, the story doesn’t end here. If you see things differently or want to run your own analysis, it only takes a few minutes to build your personal view. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Brunello Cucinelli.

Looking for more investment ideas?

Maximize your investment strategy by tapping into fresh opportunities. Simply Wall Street’s screeners can help you uncover potential winners you may have missed in today’s fast-moving markets.

- Unleash new income streams and build a steady cash flow foundation by searching for stocks that pay strong yields. Check out our selection of dividend stocks with yields > 3% for top ideas.

- Find tomorrow’s technology frontrunners as artificial intelligence transforms entire industries. Take advantage of our curated list of AI penny stocks.

- Seize value opportunities with companies trading below their intrinsic worth. Start with our hand-picked roster of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Brunello Cucinelli might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BIT:BC

Brunello Cucinelli

Engages in the production and sale of clothing, accessories, and lifestyle products in Italy, Europe, the United States, and Asia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)