- Italy

- /

- Commercial Services

- /

- BIT:FILA

F.I.L.A. - Fabbrica Italiana Lapis ed Affini S.p.A. (BIT:FILA) CEO Massimo Candela's holdings dropped 10% in value as a result of the recent pullback

Key Insights

- Significant insider control over F.I.L.A. - Fabbrica Italiana Lapis ed Affini implies vested interests in company growth

- 50% of the business is held by the top 5 shareholders

- 23% of F.I.L.A. - Fabbrica Italiana Lapis ed Affini is held by Institutions

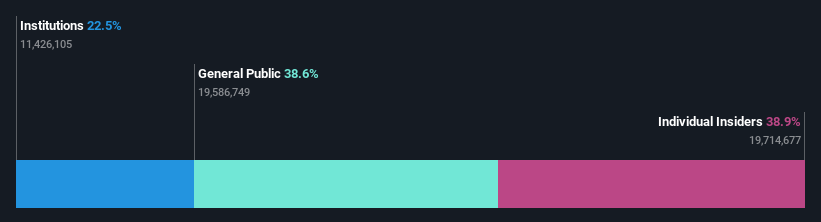

Every investor in F.I.L.A. - Fabbrica Italiana Lapis ed Affini S.p.A. (BIT:FILA) should be aware of the most powerful shareholder groups. And the group that holds the biggest piece of the pie are individual insiders with 39% ownership. Put another way, the group faces the maximum upside potential (or downside risk).

As a result, insiders as a group endured the highest losses after market cap fell by €60m.

In the chart below, we zoom in on the different ownership groups of F.I.L.A. - Fabbrica Italiana Lapis ed Affini.

See our latest analysis for F.I.L.A. - Fabbrica Italiana Lapis ed Affini

What Does The Institutional Ownership Tell Us About F.I.L.A. - Fabbrica Italiana Lapis ed Affini?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

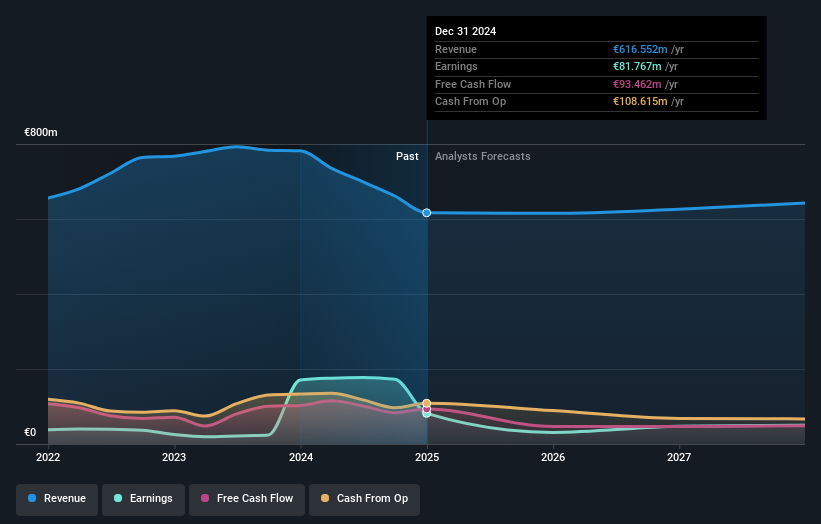

As you can see, institutional investors have a fair amount of stake in F.I.L.A. - Fabbrica Italiana Lapis ed Affini. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see F.I.L.A. - Fabbrica Italiana Lapis ed Affini's historic earnings and revenue below, but keep in mind there's always more to the story.

We note that hedge funds don't have a meaningful investment in F.I.L.A. - Fabbrica Italiana Lapis ed Affini. With a 39% stake, CEO Massimo Candela is the largest shareholder. With 4.9% and 2.5% of the shares outstanding respectively, Lazard Frères Gestion SAS and Mediolanum Gestione Fondi SGR PA are the second and third largest shareholders.

To make our study more interesting, we found that the top 5 shareholders control more than half of the company which implies that this group has considerable sway over the company's decision-making.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of F.I.L.A. - Fabbrica Italiana Lapis ed Affini

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own a reasonable proportion of F.I.L.A. - Fabbrica Italiana Lapis ed Affini S.p.A.. It has a market capitalization of just €526m, and insiders have €204m worth of shares in their own names. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

The general public-- including retail investors -- own 39% stake in the company, and hence can't easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand F.I.L.A. - Fabbrica Italiana Lapis ed Affini better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for F.I.L.A. - Fabbrica Italiana Lapis ed Affini you should be aware of, and 1 of them is significant.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:FILA

F.I.L.A. - Fabbrica Italiana Lapis ed Affini

F.I.L.A. - Fabbrica Italiana Lapis ed Affini S.p.A.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)