- Italy

- /

- Commercial Services

- /

- BIT:DOV

3 European Stocks Estimated To Be Trading Below Intrinsic Value By Up To 49.5%

Reviewed by Simply Wall St

As the European markets face pressures from proposed U.S. tariffs and unexpected contractions in business activity, investors are increasingly focused on identifying opportunities amidst volatility. In this environment, stocks trading below their intrinsic value present a potential for growth, as they may offer a margin of safety against market fluctuations and economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Micro Systemation (OM:MSAB B) | SEK48.70 | SEK96.45 | 49.5% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.91 | €3.70 | 48.4% |

| CTT Systems (OM:CTT) | SEK216.00 | SEK418.15 | 48.3% |

| adidas (XTRA:ADS) | €218.70 | €433.38 | 49.5% |

| Clemondo Group (OM:CLEM) | SEK10.70 | SEK21.24 | 49.6% |

| Lectra (ENXTPA:LSS) | €24.20 | €47.19 | 48.7% |

| Claranova (ENXTPA:CLA) | €2.805 | €5.45 | 48.5% |

| ATON Green Storage (BIT:ATON) | €1.98 | €3.82 | 48.1% |

| Nexstim (HLSE:NXTMH) | €7.86 | €15.69 | 49.9% |

| Northern Data (DB:NB2) | €24.78 | €49.42 | 49.9% |

Let's uncover some gems from our specialized screener.

doValue (BIT:DOV)

Overview: doValue S.p.A. specializes in managing non-performing loans, unlikely to pay loans, early arrears, and performing loans for banks and investors across Italy, Spain, Greece, and Cyprus with a market cap of €458.04 million.

Operations: doValue S.p.A.'s revenue is derived from managing non-performing loans, unlikely to pay loans, early arrears, and performing loans for banks and investors in its operating regions.

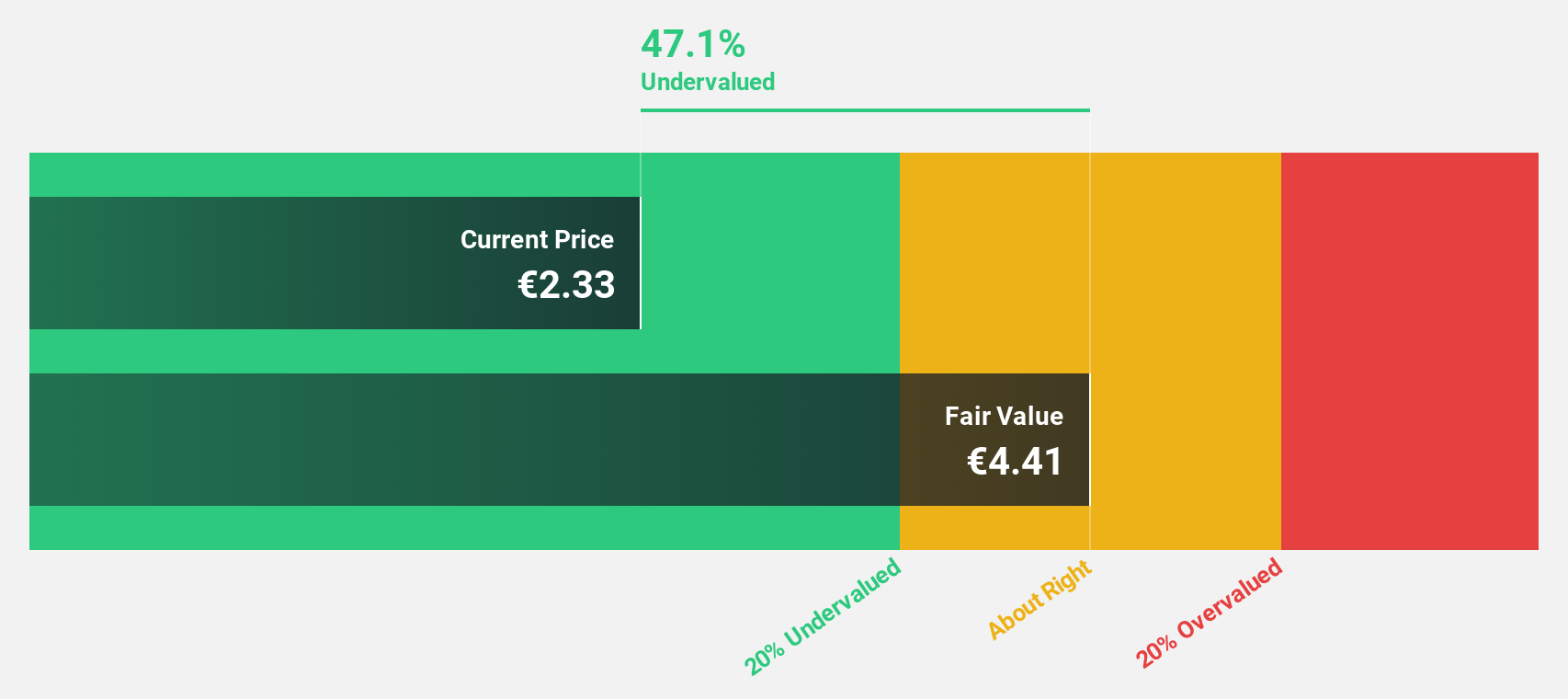

Estimated Discount To Fair Value: 46%

doValue is trading at €2.42, significantly below its estimated fair value of €4.47, suggesting it may be undervalued based on cash flows. Despite recent volatility and substantial shareholder dilution, the company has become profitable with a net income of €1.9 million for 2024 and forecasts indicate earnings growth of 60.1% annually, outpacing the Italian market's 7.4%. However, interest payments remain poorly covered by earnings and revenue growth is expected to lag behind market rates.

- In light of our recent growth report, it seems possible that doValue's financial performance will exceed current levels.

- Click here to discover the nuances of doValue with our detailed financial health report.

CTT - Correios De Portugal (ENXTLS:CTT)

Overview: CTT - Correios De Portugal, S.A. operates globally, offering postal and financial services through its subsidiaries, with a market cap of €945.06 million.

Operations: CTT's revenue is primarily derived from its logistics services, including €463.10 million from mail service and €502.29 million from express mail and orders, as well as banking and financial services, contributing €132.33 million from the bank segment and €34.64 million from financial service & retail.

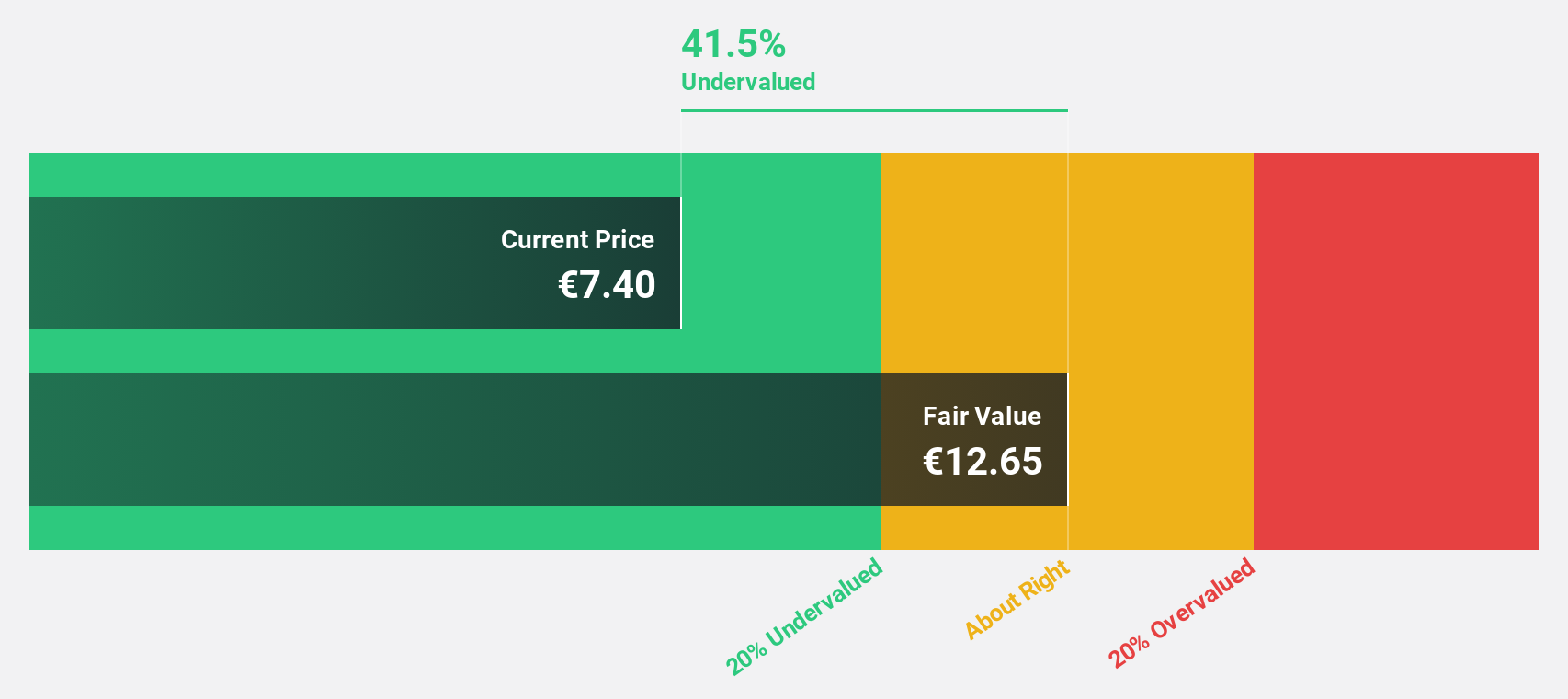

Estimated Discount To Fair Value: 42%

CTT - Correios De Portugal is trading at €7.36, significantly below its estimated fair value of €12.69, reflecting potential undervaluation based on cash flows. The company's revenue for Q1 2025 increased to €288.17 million from the previous year, though net income declined to €5.51 million. Forecasts suggest annual earnings growth of 17.3%, surpassing the Portuguese market's average and indicating positive future prospects despite recent earnings challenges and a modest dividend payout of €0.17 per share.

- Upon reviewing our latest growth report, CTT - Correios De Portugal's projected financial performance appears quite optimistic.

- Get an in-depth perspective on CTT - Correios De Portugal's balance sheet by reading our health report here.

adidas (XTRA:ADS)

Overview: adidas AG, with a market cap of €39.05 billion, designs, develops, produces, and markets athletic and sports lifestyle products across Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific region, and Latin America.

Operations: The company's revenue is primarily generated from Europe (€7.80 billion), North America (€5.19 billion), Greater China (€3.59 billion), Emerging Markets (€3.47 billion), Latin America (€2.86 billion), and Japan/South Korea (€1.37 billion).

Estimated Discount To Fair Value: 49.5%

adidas AG is trading at €218.7, considerably below its estimated fair value of €433.38, highlighting potential undervaluation based on cash flows. Recent Q1 2025 results showed sales of €6.15 billion and net income of €428 million, a significant improvement from the previous year. Earnings are forecast to grow 22.95% annually over the next three years, outpacing both revenue growth and the German market average, underscoring strong future profitability prospects despite current challenges.

- Our expertly prepared growth report on adidas implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of adidas.

Summing It All Up

- Unlock our comprehensive list of 189 Undervalued European Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:DOV

doValue

Engages in the management of non-performing loans (NLP), unlikely to pay (UTP), early arrears, and performing loans for banks and investors in Italy, Spain, Greece, and Cyprus.

High growth potential and good value.

Market Insights

Community Narratives