- Spain

- /

- Telecom Services and Carriers

- /

- BME:CLNX

European Stocks That May Be Trading Below Estimated Value In July 2025

Reviewed by Simply Wall St

As the European markets show signs of recovery, with the STOXX Europe 600 Index climbing 1.32% and Germany's DAX up by nearly 3%, investor optimism is bolstered by easing geopolitical tensions and potential economic stimulus measures. In this environment, identifying stocks that may be trading below their estimated value becomes crucial, as these opportunities can offer potential for growth when market conditions are favorable.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sulzer (SWX:SUN) | CHF140.60 | CHF278.20 | 49.5% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €55.30 | €110.26 | 49.8% |

| Ion Beam Applications (ENXTBR:IBAB) | €11.56 | €22.94 | 49.6% |

| I.CO.P.. Società Benefit (BIT:ICOP) | €13.30 | €26.49 | 49.8% |

| Green Oleo (BIT:GRN) | €0.79 | €1.57 | 49.6% |

| Galderma Group (SWX:GALD) | CHF115.50 | CHF229.73 | 49.7% |

| doValue (BIT:DOV) | €2.42 | €4.82 | 49.8% |

| Cavotec (OM:CCC) | SEK17.00 | SEK33.89 | 49.8% |

| Almirall (BME:ALM) | €10.64 | €21.21 | 49.8% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €37.80 | €75.09 | 49.7% |

Let's dive into some prime choices out of the screener.

Maire (BIT:MAIRE)

Overview: Maire S.p.A. develops and implements solutions for the energy transition, with a market cap of €3.68 billion.

Operations: The company's revenue is primarily derived from Integrated E&C Solutions, generating €5.97 billion, and Sustainable Technology Solutions, contributing €376.94 million.

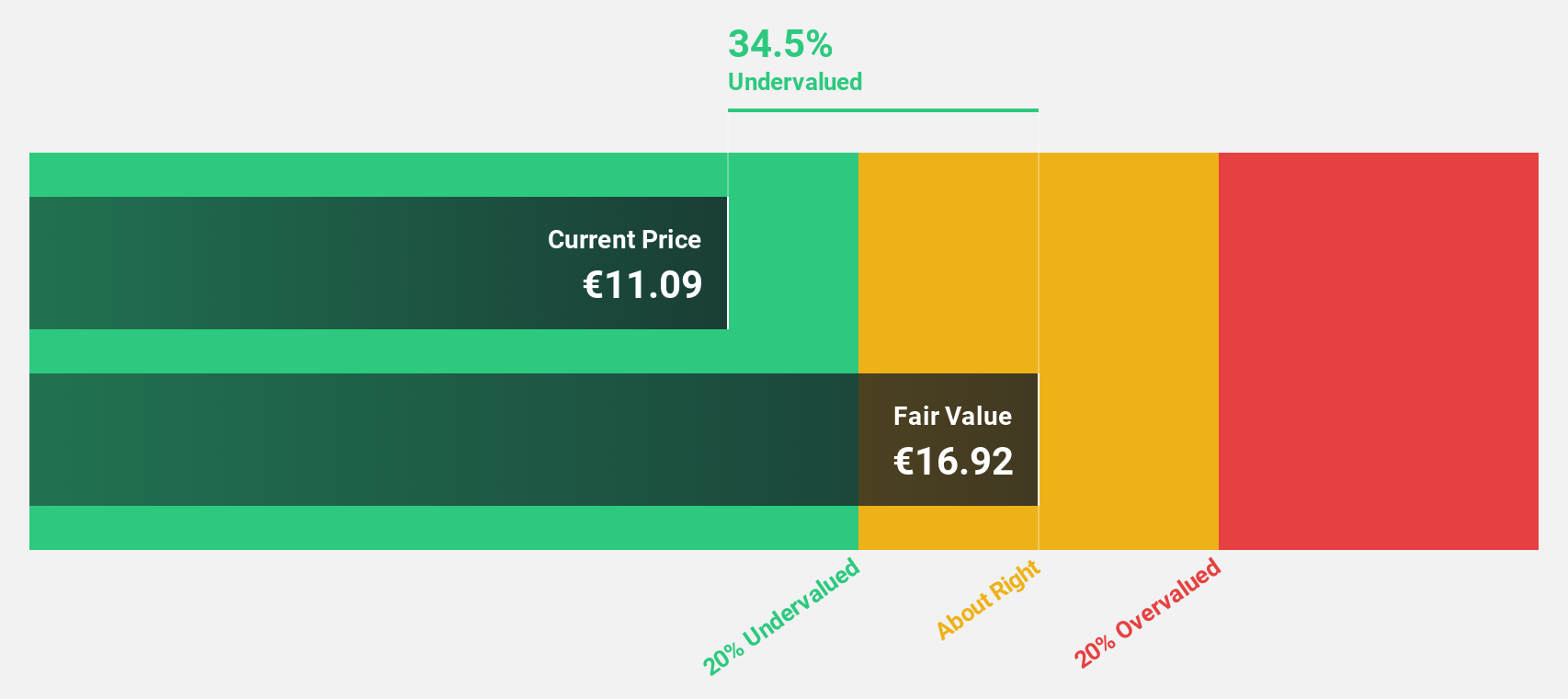

Estimated Discount To Fair Value: 39.8%

Maire S.p.A. is trading at €11.19, below its estimated fair value of €18.59, suggesting it may be undervalued based on cash flows. Recent earnings show a significant increase with net income rising to €61.54 million from €43.78 million year-over-year, and revenue growth outpacing the Italian market forecast at 6.8% annually compared to 4.1%. The company completed a follow-on equity offering of €51 million and expanded its cybersecurity services through Radware's solutions, enhancing operational resilience.

- Our expertly prepared growth report on Maire implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Maire's balance sheet by reading our health report here.

Cellnex Telecom (BME:CLNX)

Overview: Cellnex Telecom, S.A. operates in the management of terrestrial telecommunications infrastructures across several European countries including Austria, Denmark, and Spain, with a market cap of €24.05 billion.

Operations: Cellnex Telecom generates its revenue from managing terrestrial telecommunications infrastructures in various European countries such as Austria, Denmark, and Spain.

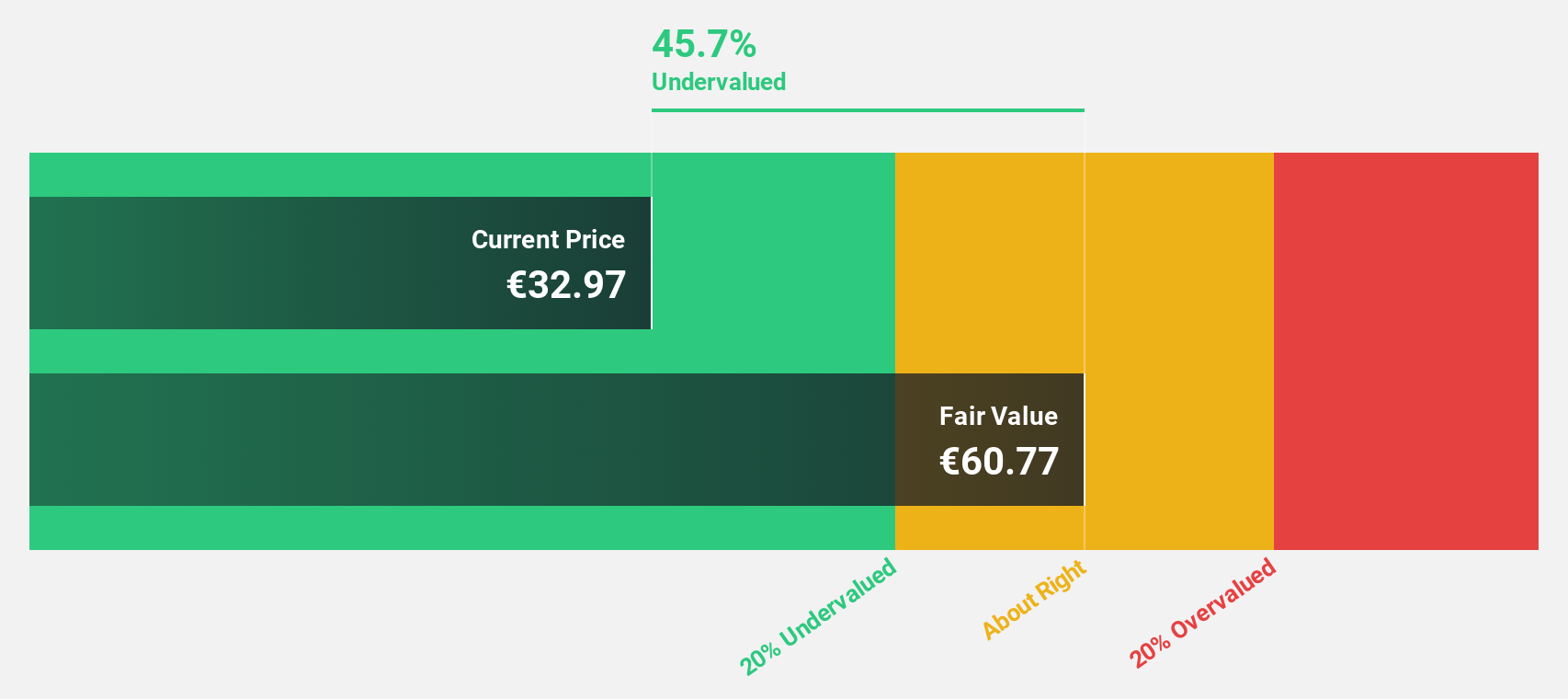

Estimated Discount To Fair Value: 45.5%

Cellnex Telecom, trading at €34.09, is significantly below its estimated fair value of €62.57, highlighting potential undervaluation based on cash flows. The company recently completed a share buyback of 24.06 million shares for €800 million, which could enhance shareholder value. Despite forecasted slower revenue growth at 4.8% annually compared to the broader market's expectations, Cellnex is anticipated to achieve profitability in three years with robust earnings growth of 53.25% per year.

- Our growth report here indicates Cellnex Telecom may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Cellnex Telecom.

Truecaller (OM:TRUE B)

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK22.53 billion.

Operations: The company's revenue is primarily generated from its Communications Software segment, which accounts for SEK1.95 billion.

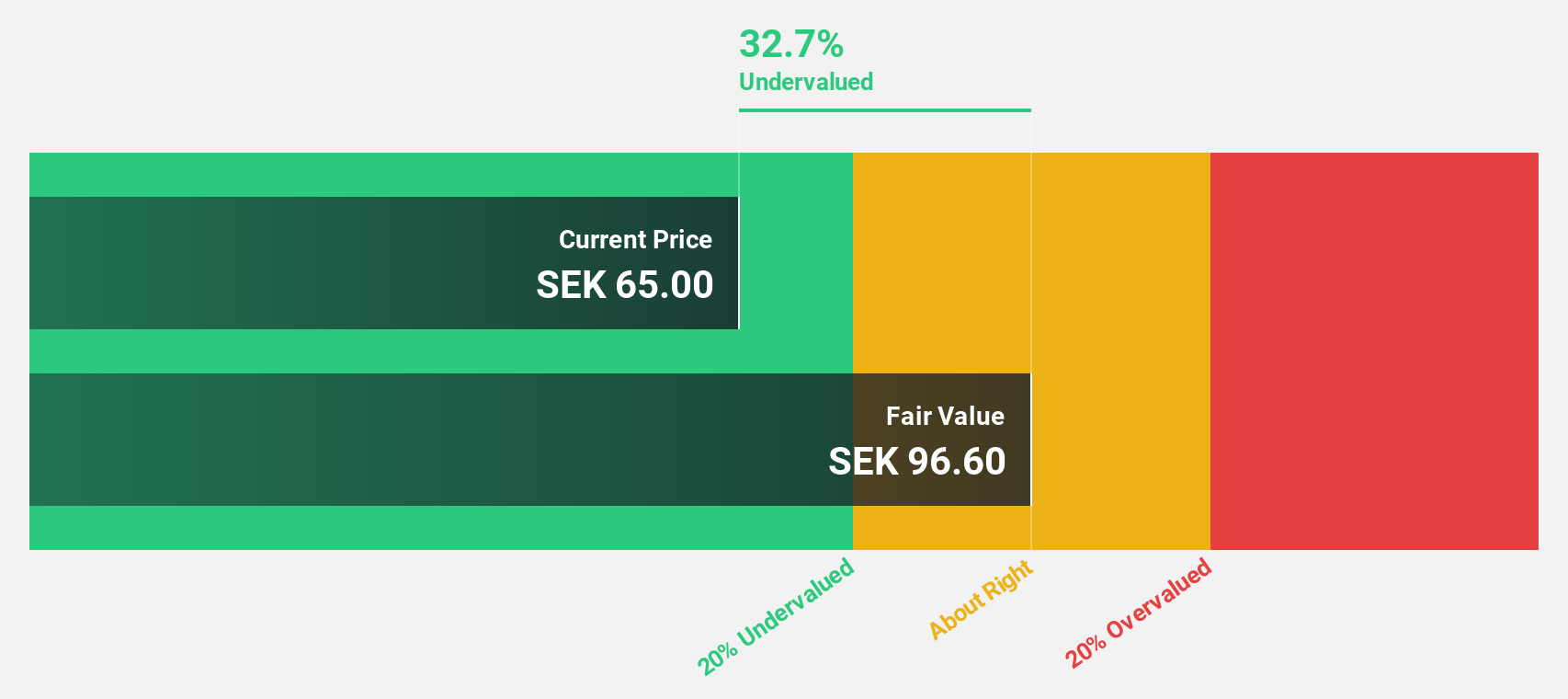

Estimated Discount To Fair Value: 32.1%

Truecaller is trading at SEK65.4, significantly below its estimated fair value of SEK96.28, indicating it may be undervalued based on cash flows. The company forecasts robust earnings growth of 26.2% annually, surpassing the Swedish market's average. Recent initiatives like Secure Calls enhance business credibility and user trust, potentially driving future revenue growth of 19.4% per year. Additionally, Truecaller's share repurchase program aims to optimize capital structure and increase shareholder value over time.

- Insights from our recent growth report point to a promising forecast for Truecaller's business outlook.

- Click to explore a detailed breakdown of our findings in Truecaller's balance sheet health report.

Summing It All Up

- Reveal the 189 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:CLNX

Cellnex Telecom

Engages in the management of terrestrial telecommunications infrastructures in Austria, Denmark, Spain, France, Ireland, Italy, the Netherlands, Poland, Portugal, the United Kingdom, Sweden, and Switzerland.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives