Interpump Group S.p.A.'s (BIT:IP) one-year returns climbed after last week's 5.5% gain, institutional investors must be happy

Key Insights

- Given the large stake in the stock by institutions, Interpump Group's stock price might be vulnerable to their trading decisions

- A total of 6 investors have a majority stake in the company with 51% ownership

- Using data from analyst forecasts alongside ownership research, one can better assess the future performance of a company

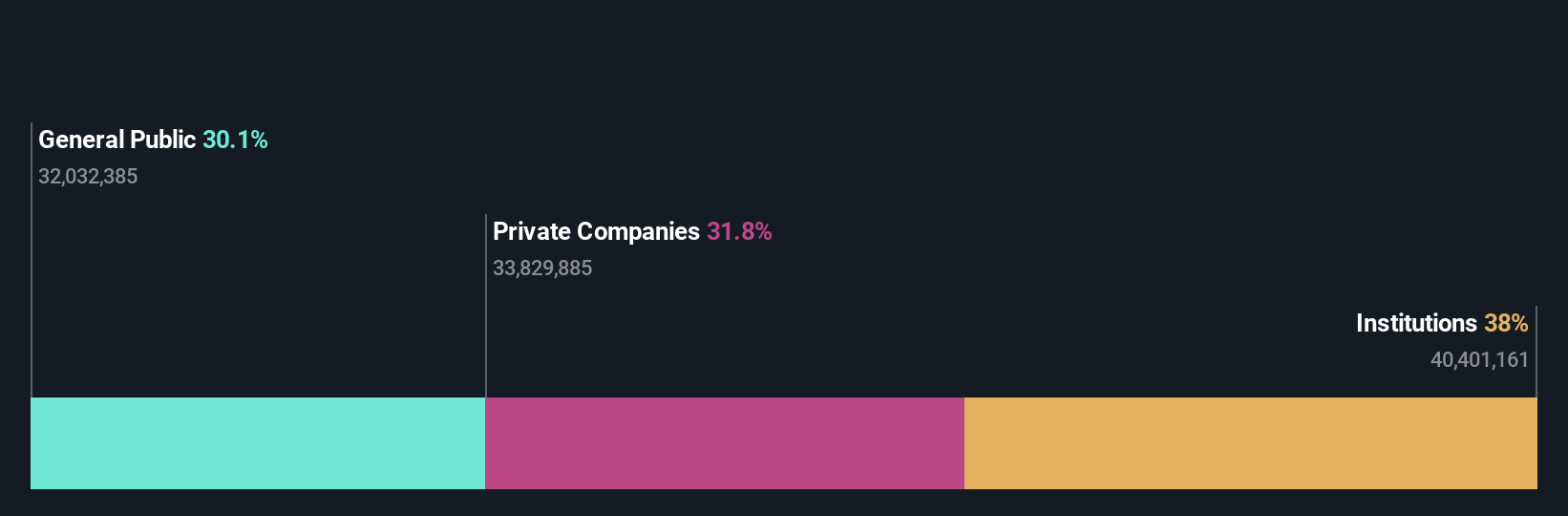

If you want to know who really controls Interpump Group S.p.A. (BIT:IP), then you'll have to look at the makeup of its share registry. With 38% stake, institutions possess the maximum shares in the company. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

And as as result, institutional investors reaped the most rewards after the company's stock price gained 5.5% last week. The one-year return on investment is currently 3.4% and last week's gain would have been more than welcomed.

Let's take a closer look to see what the different types of shareholders can tell us about Interpump Group.

See our latest analysis for Interpump Group

What Does The Institutional Ownership Tell Us About Interpump Group?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

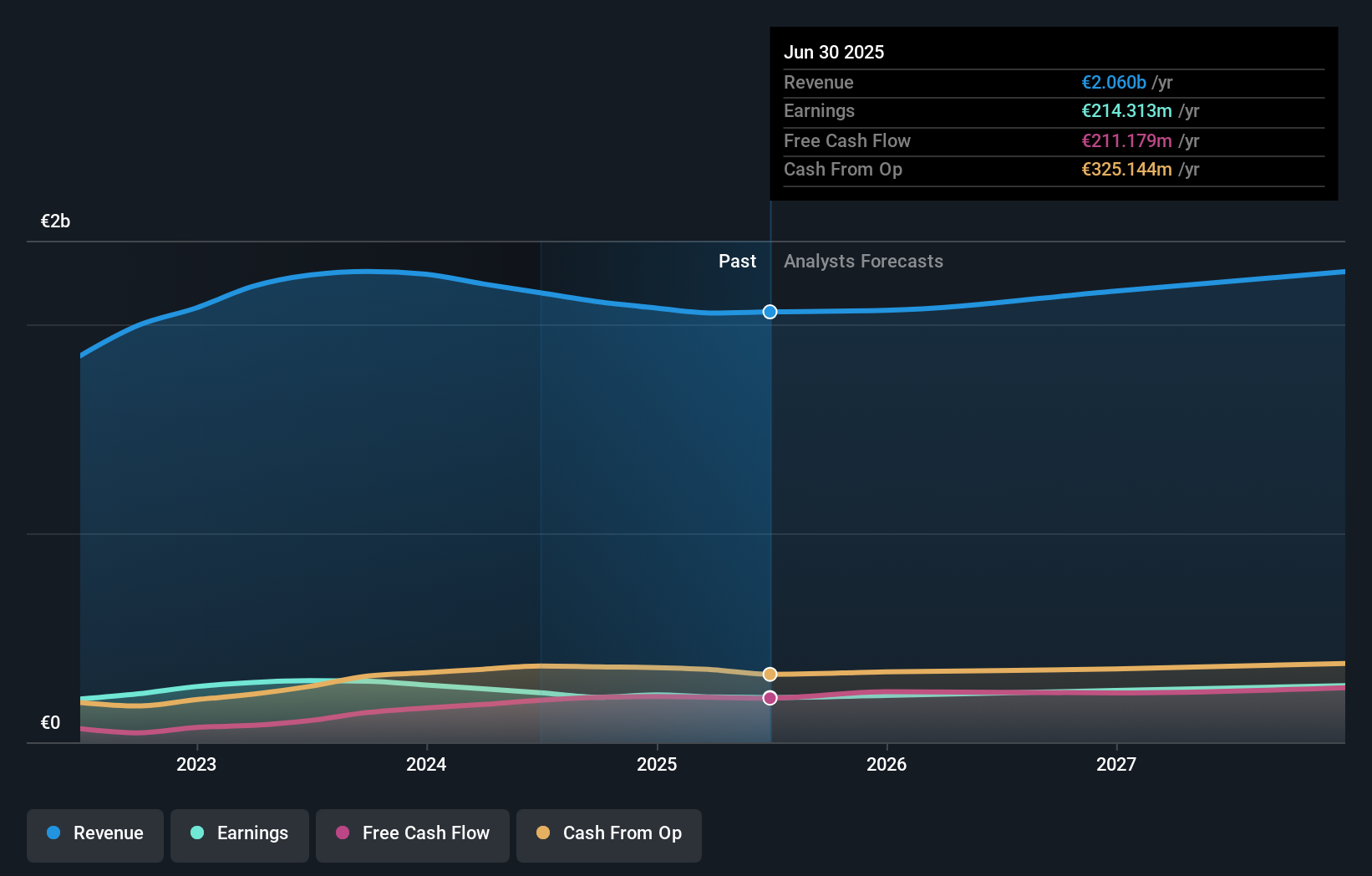

Interpump Group already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Interpump Group's historic earnings and revenue below, but keep in mind there's always more to the story.

Interpump Group is not owned by hedge funds. The company's largest shareholder is Gruppo IPG Holding S.p.A., with ownership of 24%. Capital Research and Management Company is the second largest shareholder owning 8.9% of common stock, and FMR LLC holds about 7.1% of the company stock.

We did some more digging and found that 6 of the top shareholders account for roughly 51% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Interpump Group

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our data suggests that insiders own under 1% of Interpump Group S.p.A. in their own names. But they may have an indirect interest through a corporate structure that we haven't picked up on. Keep in mind that it's a big company, and the insiders own -€20k worth of shares. The absolute value might be more important than the proportional share. It is always good to see at least some insider ownership, but it might be worth checking if those insiders have been selling.

General Public Ownership

With a 30% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Interpump Group. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

Our data indicates that Private Companies hold 32%, of the company's shares. It might be worth looking deeper into this. If related parties, such as insiders, have an interest in one of these private companies, that should be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow, for free.

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:IP

Interpump Group

Engages in the manufacturing and selling of high-pressure pumps in Italy, rest of Europe, North America, Far East and Pacific Area, and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)