- Italy

- /

- Construction

- /

- BIT:ESF

Edil San Felice (BIT:ESF) Margin Decline Challenges Bullish Growth Narrative

Reviewed by Simply Wall St

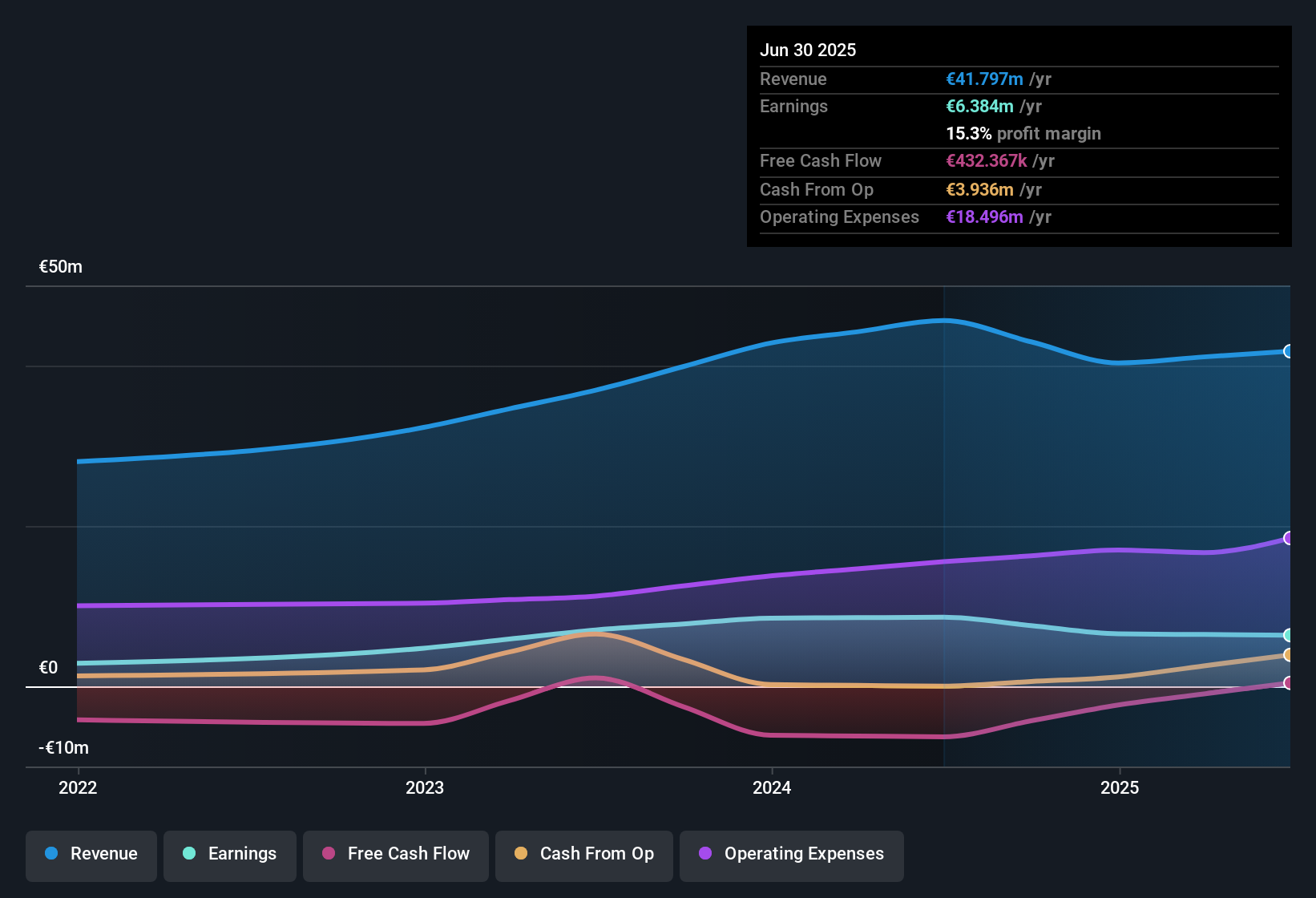

Edil San Felice (BIT:ESF) is forecasting robust earnings growth of 18.2% per year, far outpacing the Italian market's 9.4% annual rate. Revenue is projected to rise 15.1% per year, well ahead of the 4.9% growth expected across the local market. The current net profit margin stands at 15.3%, down from last year's 18.9%. After delivering 14% annualized earnings growth over the past five years, the company has reported negative earnings growth in the last year, making comparisons trickier. However, rising revenue forecasts and strong long-term trends are keeping investor sentiment positive.

See our full analysis for Edil San Felice.Next, we will look at how these headline results measure up against the narratives shaping market expectations and community discussions.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Flagged for Quality Concerns

- Profit margins currently sit at 15.3%, but the EDGAR filing notes that a high proportion of these earnings are non-cash, raising a flag around earnings quality even though headline margins still look solid relative to peers.

- What stands out is how the prevailing market view weighs the durability of these margins against growth expectations:

- The net profit margin has dropped from last year's 18.9%, shifting the conversation away from pure growth stories and emphasizing the importance of consistency in long-term operations.

- Despite these concerns, the company’s historical five-year earnings growth of 14% per year provides some reason for optimism, but year-on-year negative earnings growth disrupts this trend and is likely to attract closer scrutiny from fundamentals-focused investors.

Net Profit Trend Breaks Five-Year Growth

- Edil San Felice’s annual earnings over the past five years grew by 14%, but the last reported period showed negative growth, resulting in a break of this streak for the first time and drawing increased attention to whether future guidance can restore confidence.

- According to the prevailing market view, this shift introduces uncertainty to the previously strong trajectory:

- Steadily rising revenue forecasts, now at 15.1% per year compared to 4.9% for the market, may give management some breathing room. However, a single year of negative earnings growth raises the question of whether momentum is slipping.

- This break in earnings performance means both bulls and bears will be watching for evidence that it is only a temporary setback rather than the beginning of a new trend.

Valuation: DCF Discount but High P/E

- Shares trade at a price-to-earnings ratio of 14.1x, above peer averages but still below the broader European construction industry. At the same time, the current share price of €4.67 remains well under the DCF fair value estimate of €9.07, highlighting a potential disconnect between market price and modeled intrinsic value.

- The prevailing market view underscores this tension:

- Some investors may interpret the discount to fair value as an opportunity, while the higher P/E ratio compared to peers suggests the market still expects outperformance or is cautious due to risks related to earnings quality.

- This combination of positive DCF indicators and a cautionary premium versus competitors prompts discussion about whether Edil San Felice is truly undervalued or carries more uncertainty than it appears.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Edil San Felice's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

With Edil San Felice’s negative earnings growth breaking its multi-year streak and raising doubts about future consistency, stability is now in question.

If you value reliable and uninterrupted performance, use our stable growth stocks screener to discover companies delivering consistent revenue and earnings growth every year, regardless of market swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Edil San Felice might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:ESF

Edil San Felice

Engages in the civil and industrial construction business in Italy.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)