- Italy

- /

- Electrical

- /

- BIT:CMB

Undiscovered Gems in Europe for May 2025

Reviewed by Simply Wall St

As European markets experience a positive upswing, with the pan-European STOXX Europe 600 Index climbing 3.44% amid easing tariff concerns and accelerated economic growth in the eurozone, investors are increasingly looking towards small-cap stocks for potential opportunities. In this environment, identifying promising companies often involves seeking those that demonstrate resilience and adaptability to economic shifts while capitalizing on emerging trends within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Decora | 20.76% | 12.61% | 12.54% | ★★★★★☆ |

| Moury Construct | 2.93% | 10.42% | 27.28% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Cembre (BIT:CMB)

Simply Wall St Value Rating: ★★★★★★

Overview: Cembre S.p.A. specializes in manufacturing and selling electrical connectors, cable accessories, and tools across Italy, Europe, and globally with a market capitalization of €840.75 million.

Operations: Cembre generates revenue primarily from its electric connectors and related tools segment, amounting to €229.72 million.

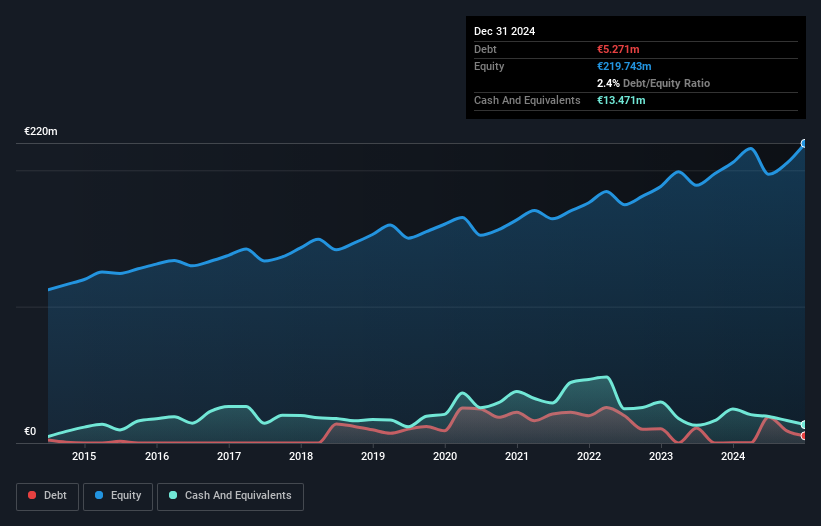

Cembre, a standout in the European market, showcases robust financial health with earnings growth of 4.3% over the past year, outpacing the Electrical industry’s -2.1%. Its debt-to-equity ratio has impressively decreased from 5.6 to 1.4 over five years, reflecting prudent financial management. The company reported annual revenue of €231.56 million and net income of €42.59 million for 2024, indicating steady performance with basic earnings per share at €2.53 compared to €2.43 previously. With high-quality earnings and strong interest coverage at 154x EBIT, Cembre seems well-positioned for continued stability in its niche market segment.

- Take a closer look at Cembre's potential here in our health report.

Review our historical performance report to gain insights into Cembre's's past performance.

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse client segments in France, with a market capitalization of approximately €1.10 billion.

Operations: The primary revenue stream for Crédit Agricole Languedoc comes from its Retail Banking operations in France, generating €456.43 million. Non-Business Activities contribute an additional €106.65 million to the company's revenue.

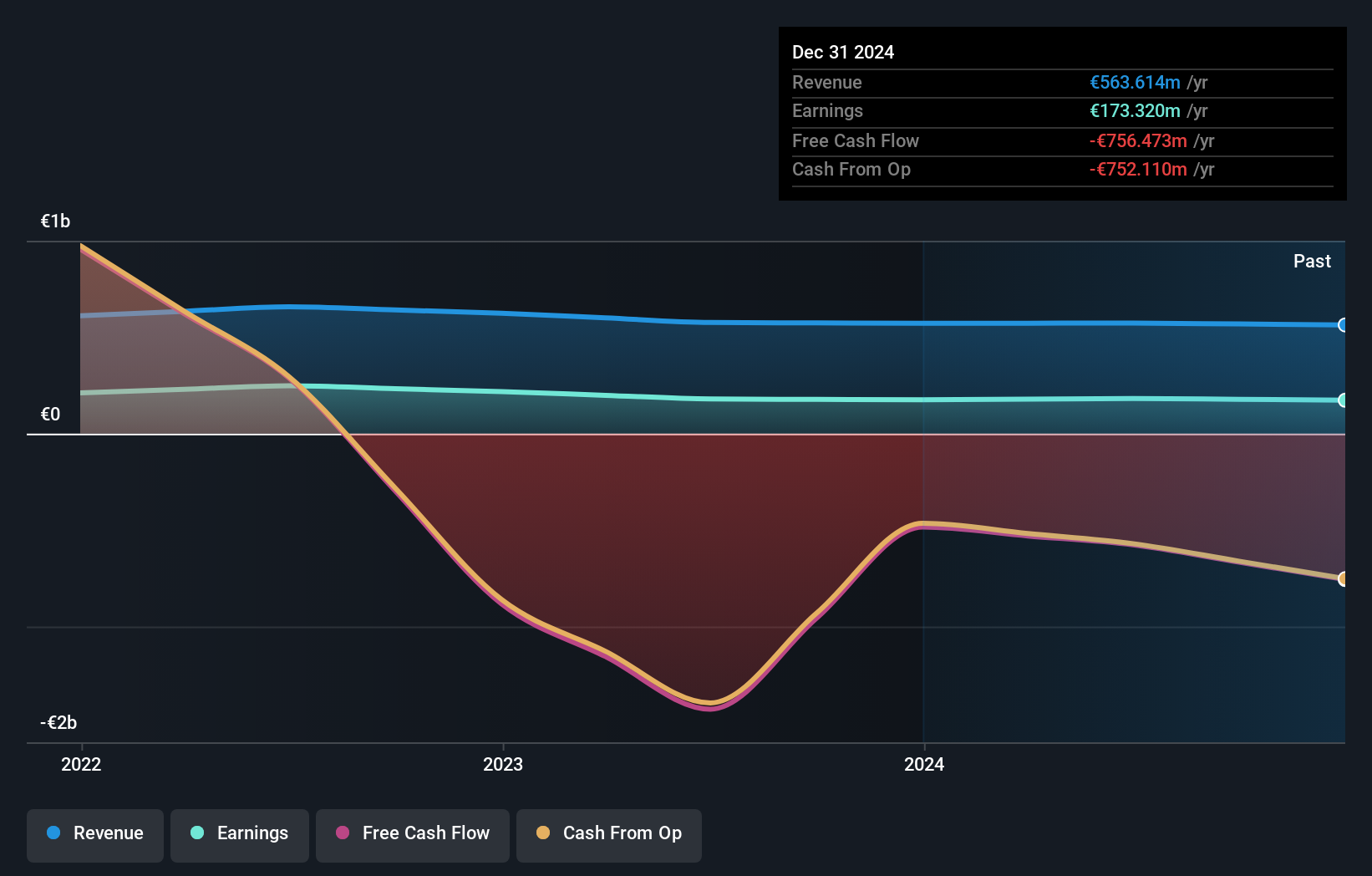

Caisse Régionale de Crédit Agricole Mutuel du Languedoc, a cooperative bank with €36.1 billion in assets and €5.5 billion in equity, operates with a strong foundation of low-risk funding, as 95% of its liabilities are customer deposits. The bank's allowance for bad loans stands at 137%, reflecting prudent risk management, while non-performing loans are maintained at an appropriate 1.4%. Despite trading at 47% below estimated fair value and experiencing negative earnings growth of -1.3% last year compared to the industry average of 3.3%, the bank continues to demonstrate high-quality past earnings performance amidst challenging market conditions.

Haypp Group (OM:HAYPP)

Simply Wall St Value Rating: ★★★★★★

Overview: Haypp Group AB (publ) is an online retailer specializing in tobacco-free nicotine pouches and snus products, serving markets in Sweden, Norway, the rest of Europe, and the United States with a market capitalization of approximately SEK3.28 billion.

Operations: Haypp Group generates revenue primarily from three segments: Core (SEK2.62 billion), Growth (SEK989.69 million), and Emerging Market (SEK71.12 million).

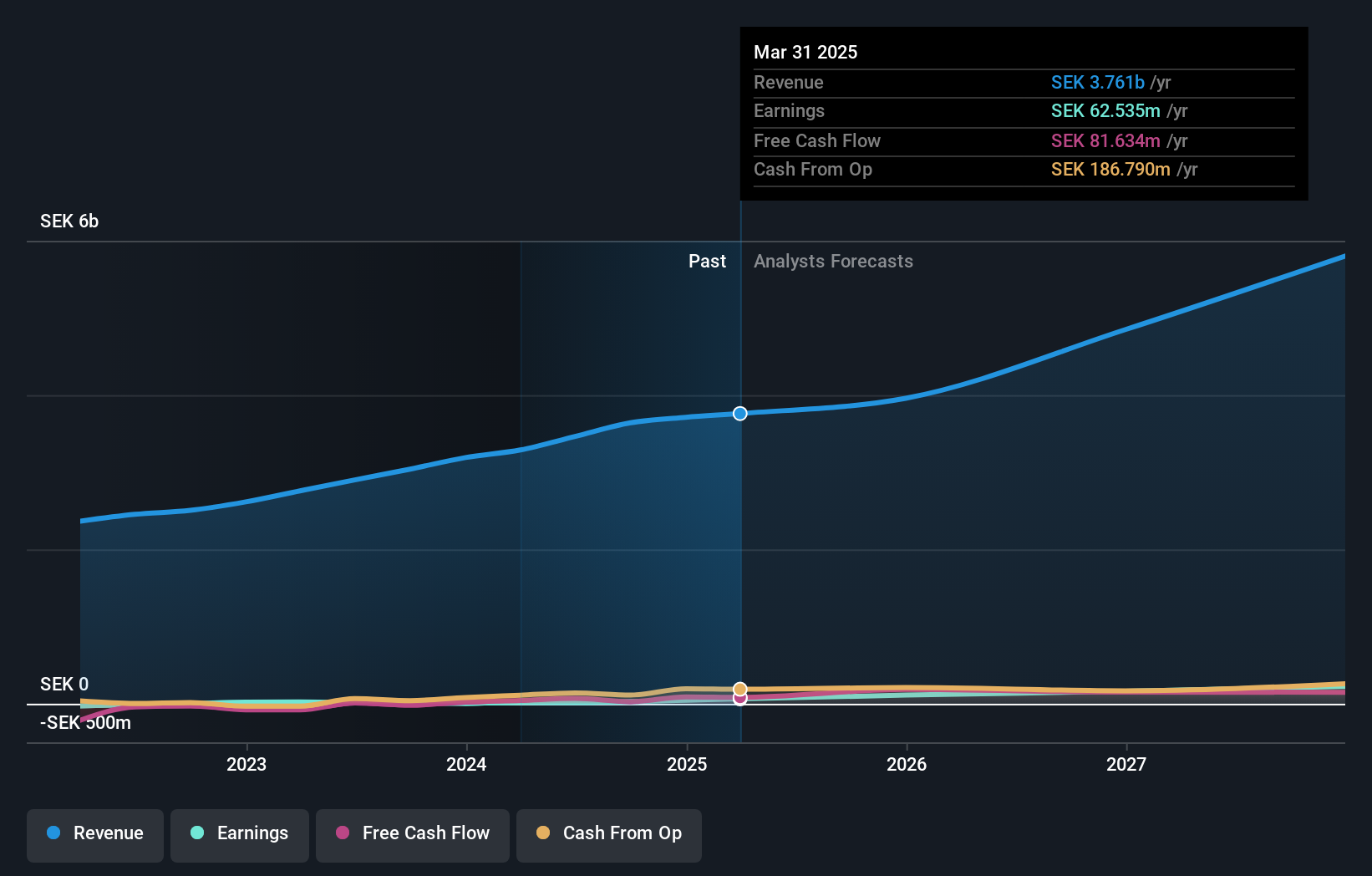

Haypp Group, a nimble player in the online tobacco-free nicotine market, is making strides with a net debt to equity ratio of 10.5%, reflecting prudent financial management. The company's earnings surged by an impressive 793% last year, outpacing the industry average significantly. Recent FDA approvals for flavored nicotine pouches are likely to boost its U.S. sales and improve profit margins from 1.2% to an anticipated 4.3%. Despite some supply chain challenges and regulatory hurdles, analysts forecast a promising annual revenue growth of 14%, with share prices potentially rising from SEK101.8 towards a fair value estimate of SEK116.5.

Summing It All Up

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 333 more companies for you to explore.Click here to unveil our expertly curated list of 336 European Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CMB

Cembre

Engages in the manufacture and sale of electrical connectors, cable accessories, and tools in Italy, the rest of Europe, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives