- Netherlands

- /

- Banks

- /

- ENXTAM:ABN

UniCredit And 2 Other Leading European Dividend Stocks

Reviewed by Simply Wall St

As European markets navigate a landscape marked by mixed performances in major stock indexes and hopes for easing trade tensions between China and the U.S., investors are increasingly focused on stable income-generating opportunities. In this context, dividend stocks like UniCredit stand out as attractive options for those seeking reliable returns amidst economic uncertainty, offering a potential buffer against market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.38% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.55% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.38% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.38% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.75% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.00% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.48% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.73% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.50% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.60% | ★★★★★★ |

Click here to see the full list of 230 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

UniCredit (BIT:UCG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UniCredit S.p.A. is a commercial banking company operating in Italy, Germany, Central Europe, and Eastern Europe with a market cap of €87.62 billion.

Operations: UniCredit S.p.A. generates revenue through its commercial banking services across Italy, Germany, Central Europe, and Eastern Europe.

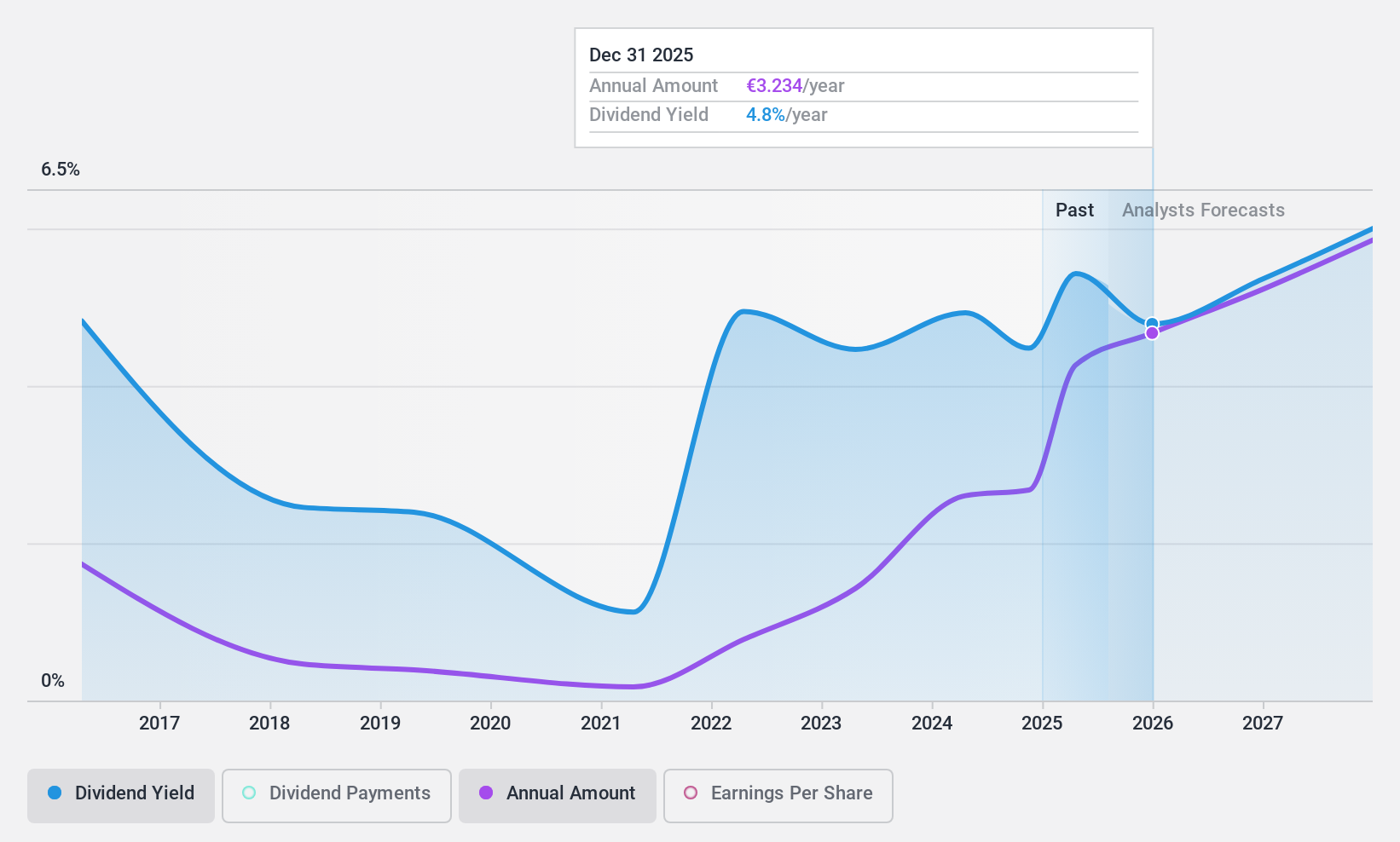

Dividend Yield: 5.2%

UniCredit's dividend payments have been volatile over the past decade, though they have shown growth. The current payout ratio of 38.4% suggests dividends are well covered by earnings, with forecasts indicating continued coverage in three years at a 52.2% payout ratio. Despite trading below fair value and recent earnings growth, UniCredit faces challenges with a high level of bad loans (2.4%). Recent announcements include a €3.6 billion share buyback program and an early redemption of €1 billion notes, reflecting strategic financial maneuvers to enhance shareholder value amidst ongoing market activities like its stake acquisition in Commerzbank AG.

- Get an in-depth perspective on UniCredit's performance by reading our dividend report here.

- Our valuation report here indicates UniCredit may be undervalued.

Südwestdeutsche Salzwerke (DB:SSH)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Südwestdeutsche Salzwerke AG, with a market cap of €577.91 million, operates in the mining, production, and sale of salt across Germany, the European Union, and internationally.

Operations: Südwestdeutsche Salzwerke AG generates its revenue primarily from the salt segment, which accounts for €273.17 million, supplemented by €63.75 million from waste management activities.

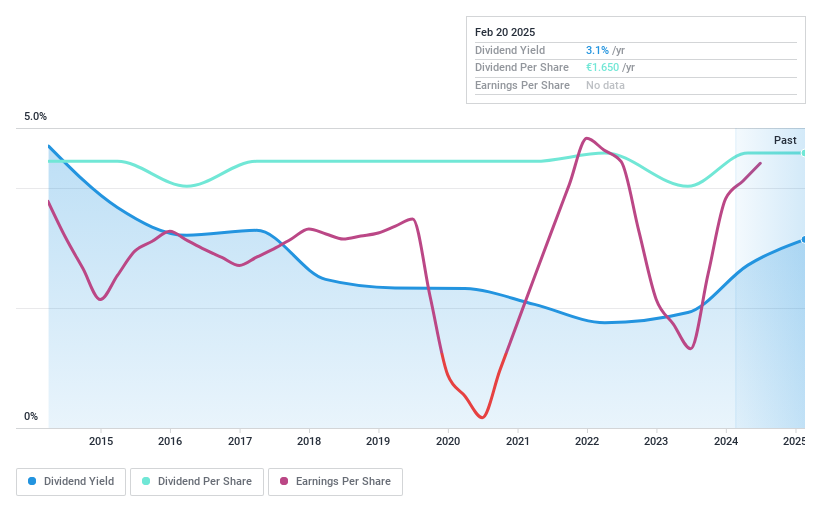

Dividend Yield: 3.2%

Südwestdeutsche Salzwerke AG offers a stable dividend profile with a payout ratio of 61.4%, indicating dividends are well-covered by earnings, while the cash payout ratio of 57% shows coverage by cash flows. Despite its dividend yield of 3.17% being below the top tier in Germany, SSH has consistently increased and maintained reliable dividends over the past decade. Recent financials show steady earnings growth, with net income at €32.53 million for 2024 and an upcoming annual dividend increase to €1.90 per share payable in late May 2025.

- Unlock comprehensive insights into our analysis of Südwestdeutsche Salzwerke stock in this dividend report.

- The valuation report we've compiled suggests that Südwestdeutsche Salzwerke's current price could be inflated.

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients across the Netherlands, Europe, the United States, Asia, and globally with a market cap of €17.35 billion.

Operations: ABN AMRO Bank's revenue is primarily derived from Personal & Business Banking (€3.82 billion), Corporate Banking (€3.43 billion), and Wealth Management (€1.58 billion).

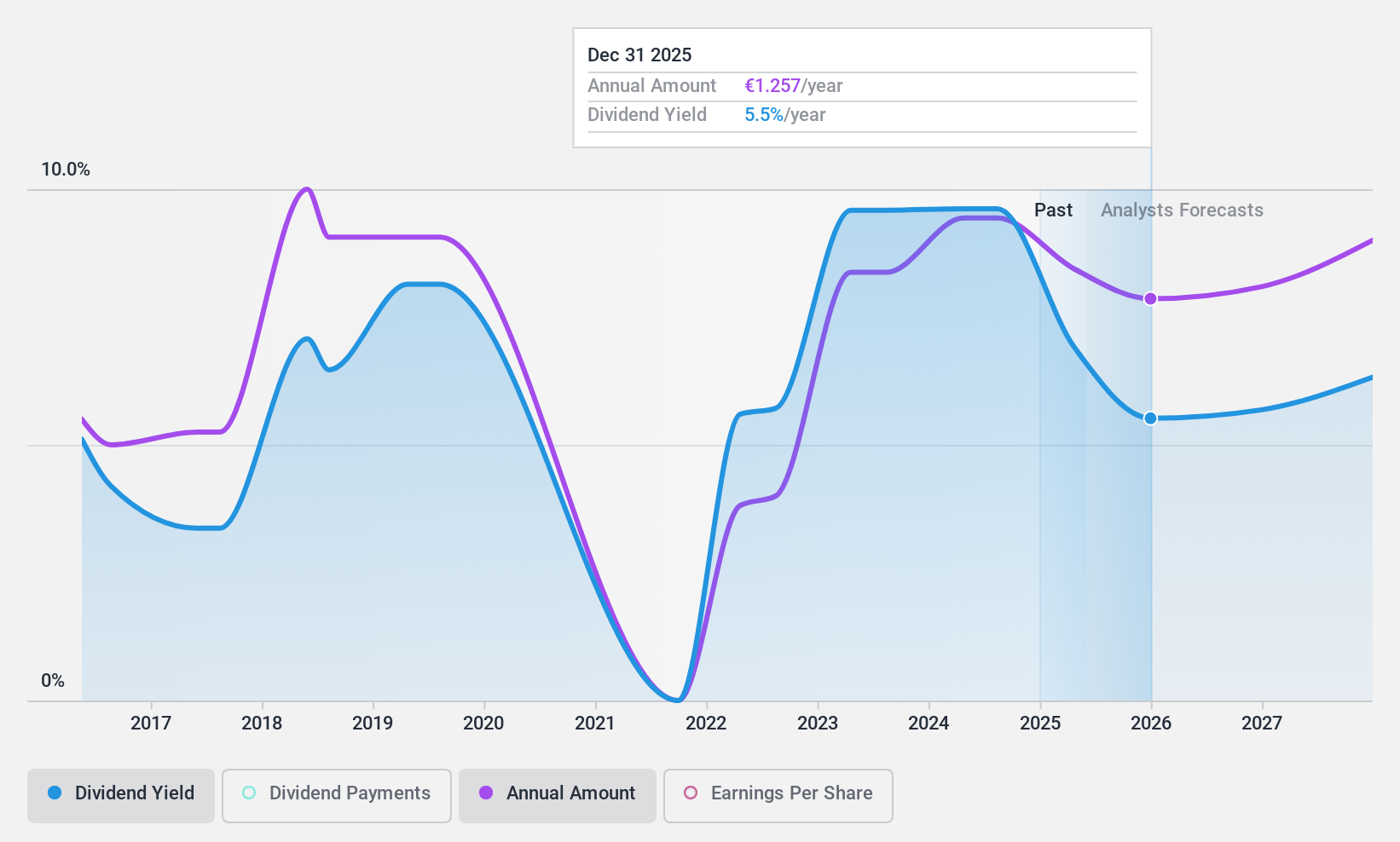

Dividend Yield: 6.5%

ABN AMRO Bank's dividend yield of 6.48% ranks in the top 25% of Dutch dividend payers, with a payout ratio of 49.7%, indicating solid coverage by earnings. However, its dividend history is less stable, showing volatility and unreliability over nine years. Recent Q1 2025 results reported net income at €619 million, down from €674 million a year prior. The bank also completed significant fixed-income offerings totaling €2.25 billion earlier this year.

- Delve into the full analysis dividend report here for a deeper understanding of ABN AMRO Bank.

- Our comprehensive valuation report raises the possibility that ABN AMRO Bank is priced lower than what may be justified by its financials.

Next Steps

- Gain an insight into the universe of 230 Top European Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ABN

ABN AMRO Bank

Provides various banking products and financial services to retail, private, and business clients in the Netherlands, rest of Europe, the United States, Asia, and internationally.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives