Banco BPM (BIT:BAMI): Evaluating Valuation After Recent 10% Stock Gain

Reviewed by Kshitija Bhandaru

See our latest analysis for Banco BPM.

Banco BPM's 1-year total shareholder return sits at a modest 1.4 percent. This month's share price momentum represents a noticeable shift from a period of slower gains. Recent movement suggests renewed optimism among investors, possibly reflecting changing risk perceptions or growth expectations for the bank.

If you're watching the banks but want to broaden your investing perspective, now's the perfect time to discover fast growing stocks with high insider ownership

With recent gains pulling Banco BPM’s stock closer to analyst targets, the key question is whether there is untapped value remaining, or if the market has already factored in the bank’s expected growth and left limited upside for new buyers.

Most Popular Narrative: 11% Overvalued

According to the most popular narrative, Banco BPM’s fair value is meaningfully below the last close price, raising debate about how much upside is left. This narrative frames current trading levels as ahead of fundamental outlook, setting the stage for a closer look at the assumptions that drive it.

The market appears optimistic about continued strong operating leverage and cost efficiency improvements from digital investments and process automation. However, much of the cost reduction so far has come from early retirements and integration synergies. Further digital transformation gains compared to peers may prove harder, and cost/income ratio improvements could plateau, compressing net margin growth.

Want to know why the market is pricing Banco BPM so aggressively? The real story is hidden in forecasts of tight margins, muted growth, and big assumptions about digital transformation payoffs. Which crucial number is the swing factor for fair value? Find out what makes or breaks this narrative. Don’t miss the inside track on what could move the price next.

Result: Fair Value of $11.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerated fee-based growth or stronger-than-expected cost control could still boost Banco BPM’s earnings outlook and challenge concerns about current overvaluation.

Find out about the key risks to this Banco BPM narrative.

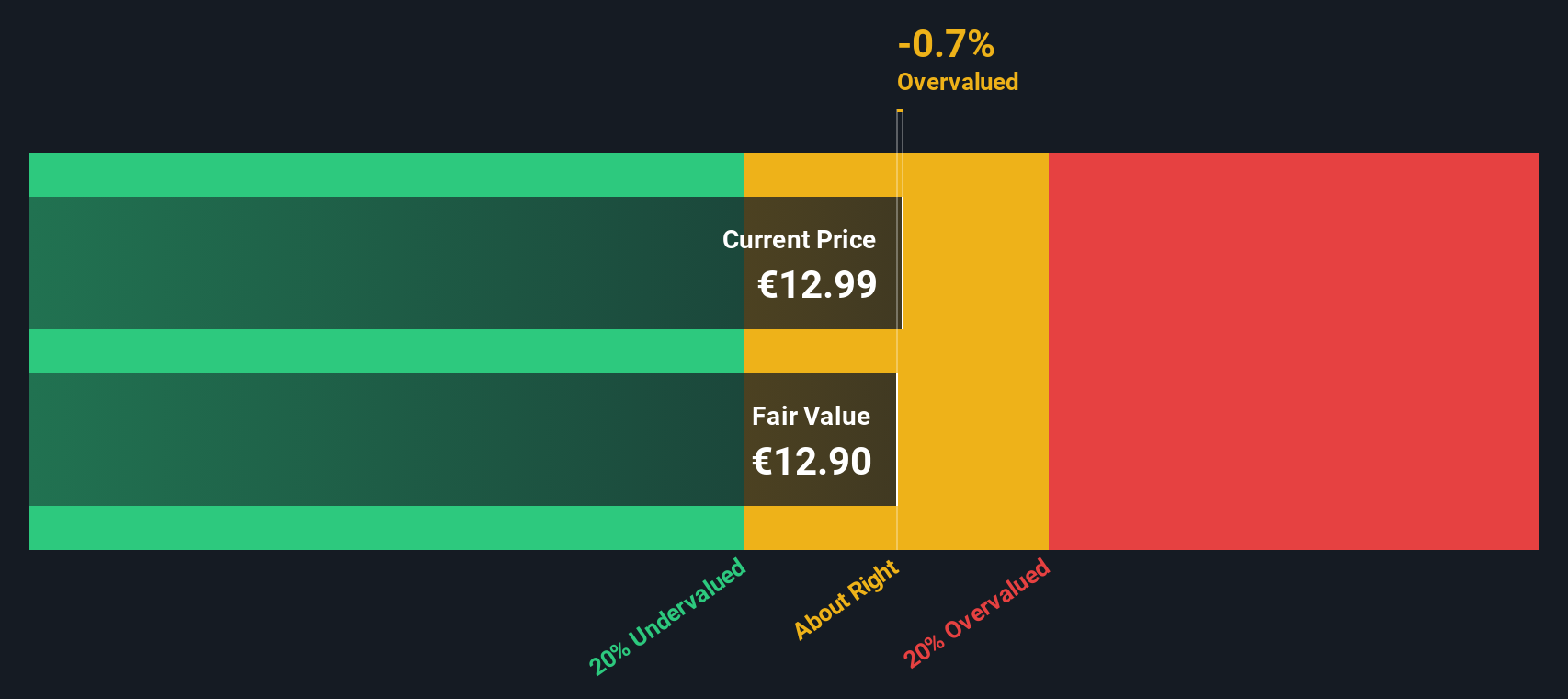

Another View: SWS DCF Model Challenges the Market

While the market focuses on valuation multiples, the SWS DCF model provides a different perspective. This model suggests Banco BPM’s shares are trading slightly above fair value. This highlights that future growth expectations might be priced in. Are investors fully accounting for all the risks that this model considers?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Banco BPM Narrative

If you want to dig into the numbers yourself or approach the story from your own angle, it only takes a few minutes to put your own view together. Do it your way

A great starting point for your Banco BPM research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

The smartest investors hunt for unique opportunities. Use the Simply Wall Street Screener now to target tomorrow’s winners and don’t let great stocks pass you by.

- Uncover the hidden potential of up-and-coming companies with these 3563 penny stocks with strong financials and see which could be the market’s next big mover.

- Maximize income with steady performers by checking out these 19 dividend stocks with yields > 3% to spot stocks offering reliable yields above 3 percent for your portfolio.

- Stay ahead of breakthrough trends as you tap into these 24 AI penny stocks, where companies at the forefront of AI innovation await your attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Banco BPM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BAMI

Banco BPM

Provides banking and financial products and services to individual, business, and corporate customers in Italy.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)