- Iceland

- /

- Food and Staples Retail

- /

- ICSE:ICESEA

Investors who have held Iceland Seafood International hf (ICE:ICESEA) over the last three years have watched its earnings decline along with their investment

Iceland Seafood International hf. (ICE:ICESEA) shareholders should be happy to see the share price up 13% in the last month. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 46% in the last three years, falling well short of the market return.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

We don't think that Iceland Seafood International hf's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

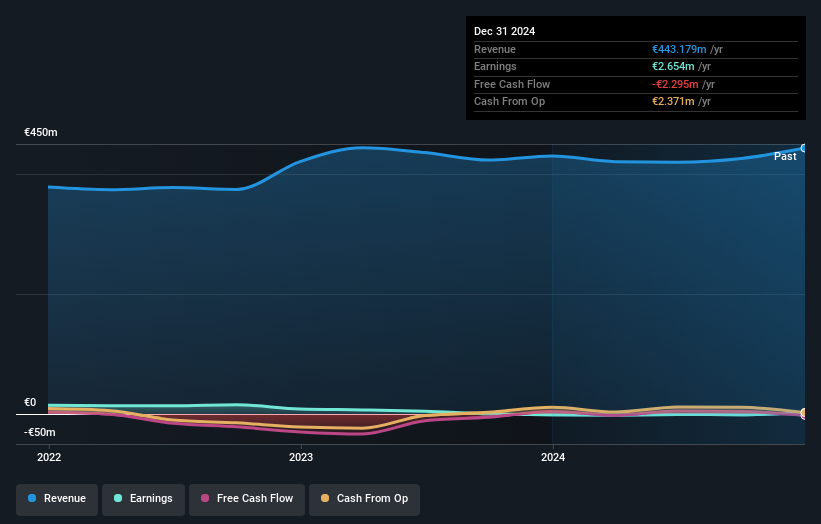

Over three years, Iceland Seafood International hf grew revenue at 5.1% per year. That's not a very high growth rate considering it doesn't make profits. The stock dropped 13% during that time. Shareholders will probably be hoping growth picks up soon. But the real upside for shareholders will be if the company can start generating profits.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Iceland Seafood International hf's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 19% in the last year, Iceland Seafood International hf shareholders lost 2.4%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 7% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Iceland Seafood International hf better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Iceland Seafood International hf you should be aware of, and 2 of them are significant.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Icelandic exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ICSE:ICESEA

Iceland Seafood International hf

Engages in exporting of seafood worldwide.

Low and slightly overvalued.

Market Insights

Community Narratives