- India

- /

- Oil and Gas

- /

- NSEI:ONGC

Top 3 Indian Dividend Stocks In September 2024

Reviewed by Simply Wall St

In the last week, the Indian market is up 1.7%, and over the past 12 months, it has surged by an impressive 41%. With earnings expected to grow by 17% per annum in the coming years, identifying strong dividend stocks can be a prudent strategy for investors looking to capitalize on this growth while receiving steady income.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.11% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 3.83% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 4.92% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.06% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.15% | ★★★★★☆ |

| NMDC (BSE:526371) | 3.31% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.27% | ★★★★★☆ |

| Canara Bank (NSEI:CANBK) | 3.02% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.22% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.18% | ★★★★★☆ |

Click here to see the full list of 17 stocks from our Top Indian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

D. B (NSEI:DBCORP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and digital news platforms for news and event management businesses in India and internationally, with a market cap of ₹62.09 billion.

Operations: D. B. Corp Limited generates revenue from radio broadcasting (₹1.62 billion) and printing/publishing and allied business (₹22.77 billion).

Dividend Yield: 4.9%

D. B. Corp Limited's recent dividend of ₹7 per share, with a payout ratio of 65.2%, is well-covered by both earnings and cash flows, reflecting sustainability despite past volatility in dividend payments. The company reported strong financials for Q1 2024 with net income rising to ₹1.18 billion from ₹787.59 million a year ago, indicating robust profitability that supports its dividends, though historical instability remains a concern for long-term reliability.

- Click to explore a detailed breakdown of our findings in D. B's dividend report.

- The analysis detailed in our D. B valuation report hints at an deflated share price compared to its estimated value.

Oil and Natural Gas (NSEI:ONGC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oil and Natural Gas Corporation Limited, along with its subsidiaries, is involved in the exploration, development, and production of crude oil and natural gas both in India and internationally, with a market cap of ₹3.68 trillion.

Operations: Oil and Natural Gas Corporation Limited generates revenue from various segments, including ₹95.69 billion from international operations, ₹5.72 billion from refining and marketing in India, ₹441.92 million from onshore exploration and production (E&P) in India, and ₹953.81 million from offshore E&P in India.

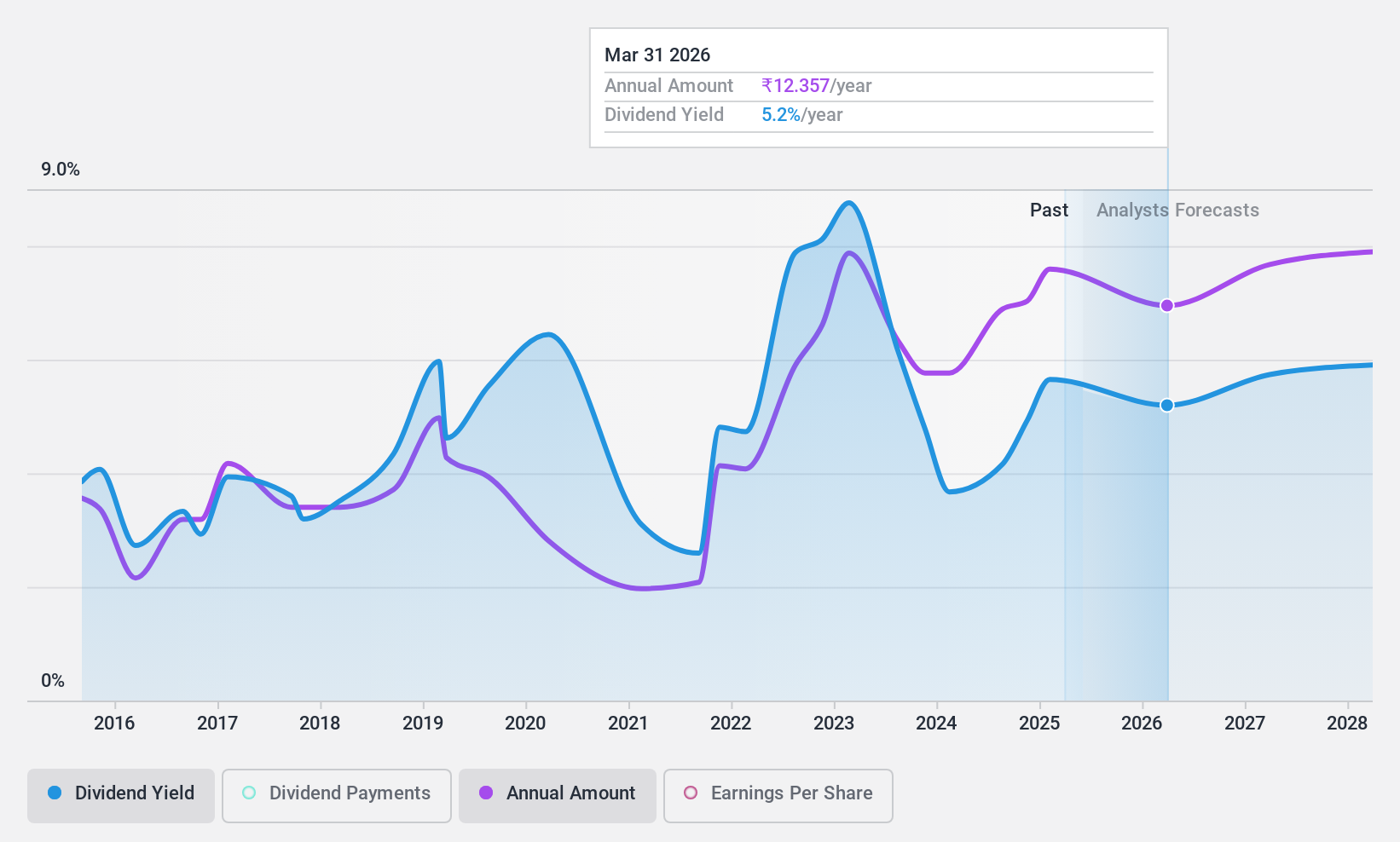

Dividend Yield: 4.2%

Oil and Natural Gas Corporation Limited's recent final dividend of ₹2.50 per share, declared at its AGM on August 30, 2024, is well-covered by earnings (payout ratio: 31.3%) and cash flows (cash payout ratio: 32.5%). Despite a volatile dividend history over the past decade, ONGC remains a top-tier dividend payer in India with a yield of 4.19%. Recent management changes and ongoing strategic investments in renewable energy projects may impact future stability.

- Navigate through the intricacies of Oil and Natural Gas with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Oil and Natural Gas is trading beyond its estimated value.

PTC India (NSEI:PTC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PTC India Limited, with a market cap of ₹71.71 billion, engages in the trading of power across India, Nepal, Bhutan, and Bangladesh through its subsidiaries.

Operations: PTC India Limited generates revenue primarily from power trading (₹159.67 billion) and its financing business (₹7.35 billion).

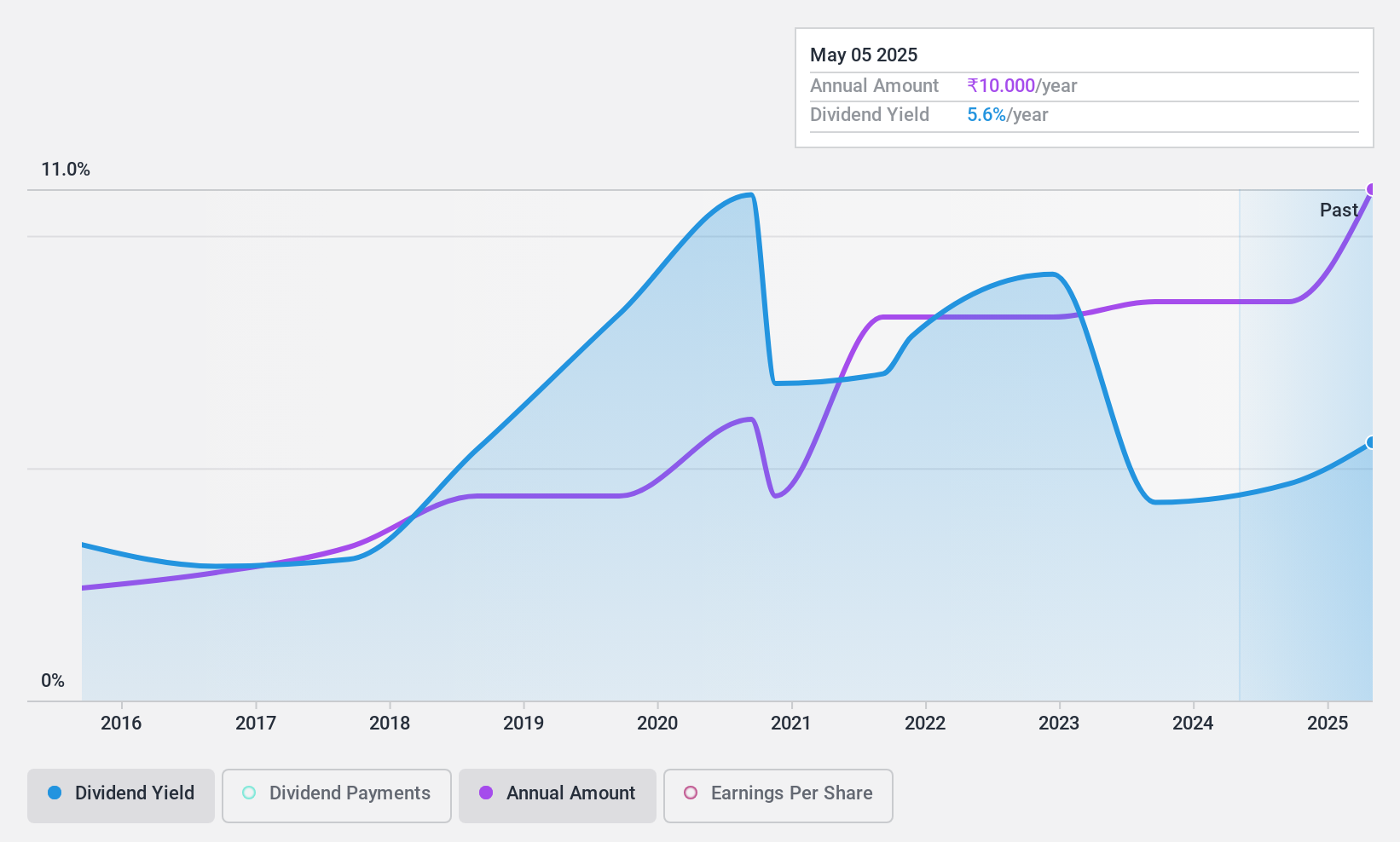

Dividend Yield: 3.2%

PTC India reported Q1 2025 net income of ₹1.74 billion, up from ₹1.30 billion a year ago, with earnings per share rising to ₹5.87 from ₹4.39. Despite a volatile dividend history, its current payout ratio of 54% and cash payout ratio of 9.4% indicate dividends are well-covered by earnings and cash flows. However, recent board changes might affect future stability in dividend payments despite the company's strong financial performance this quarter.

- Unlock comprehensive insights into our analysis of PTC India stock in this dividend report.

- Our comprehensive valuation report raises the possibility that PTC India is priced lower than what may be justified by its financials.

Summing It All Up

- Access the full spectrum of 17 Top Indian Dividend Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ONGC

Oil and Natural Gas

Engages in the exploration, development, production, and distribution of crude oil, natural gas, and value-added products in India and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026