- India

- /

- Renewable Energy

- /

- NSEI:NHPC

NHPC Limited Beat Analyst Estimates: See What The Consensus Is Forecasting For This Year

NHPC Limited (NSE:NHPC) shareholders are probably feeling a little disappointed, since its shares fell 5.4% to ₹97.77 in the week after its latest first-quarter results. It looks like a credible result overall - although revenues of ₹27b were in line with what the analysts predicted, NHPC surprised by delivering a statutory profit of ₹1.02 per share, a notable 12% above expectations. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on NHPC after the latest results.

Check out our latest analysis for NHPC

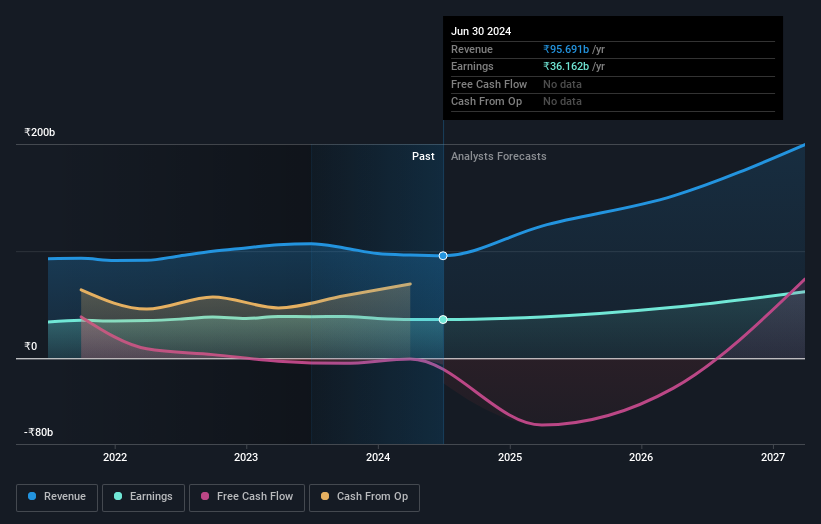

Taking into account the latest results, the consensus forecast from NHPC's seven analysts is for revenues of ₹123.4b in 2025. This reflects a huge 29% improvement in revenue compared to the last 12 months. Per-share earnings are expected to accumulate 7.4% to ₹3.87. Yet prior to the latest earnings, the analysts had been anticipated revenues of ₹131.2b and earnings per share (EPS) of ₹3.99 in 2025. It's pretty clear that pessimism has reared its head after the latest results, leading to a weaker revenue outlook and a minor downgrade to earnings per share estimates.

The analysts made no major changes to their price target of ₹98.56, suggesting the downgrades are not expected to have a long-term impact on NHPC's valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on NHPC, with the most bullish analyst valuing it at ₹126 and the most bearish at ₹63.00 per share. This is a fairly broad spread of estimates, suggesting that analysts are forecasting a wide range of possible outcomes for the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting NHPC's growth to accelerate, with the forecast 40% annualised growth to the end of 2025 ranking favourably alongside historical growth of 0.6% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 18% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect NHPC to grow faster than the wider industry.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for NHPC. They also downgraded NHPC's revenue estimates, but industry data suggests that it is expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple NHPC analysts - going out to 2027, and you can see them free on our platform here.

We don't want to rain on the parade too much, but we did also find 2 warning signs for NHPC that you need to be mindful of.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NHPC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NHPC

NHPC

Engages in the generation, sale, and trading of electricity through hydro, wind, and solar power stations in India and Nepal.

High growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)