- India

- /

- Transportation

- /

- NSEI:DRSDILIP

If EPS Growth Is Important To You, DRS Dilip Roadlines (NSE:DRSDILIP) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in DRS Dilip Roadlines (NSE:DRSDILIP). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide DRS Dilip Roadlines with the means to add long-term value to shareholders.

View our latest analysis for DRS Dilip Roadlines

How Quickly Is DRS Dilip Roadlines Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that DRS Dilip Roadlines' EPS has grown 25% each year, compound, over three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

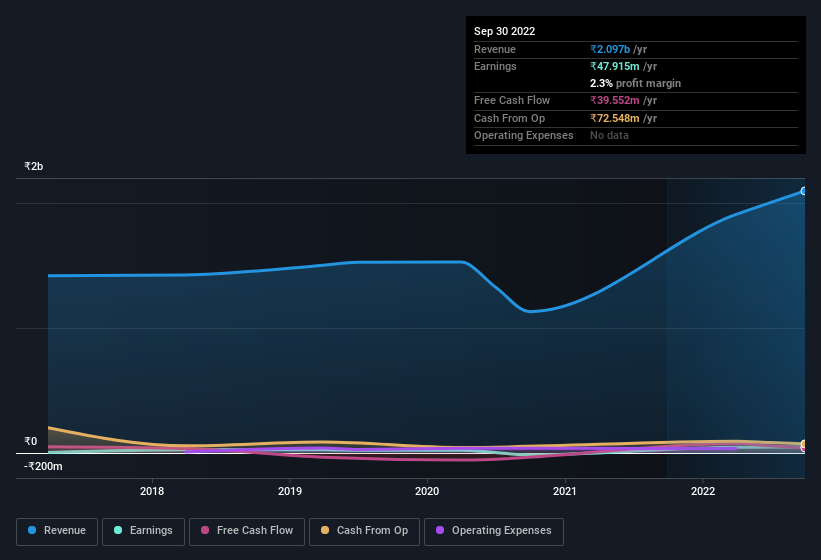

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for DRS Dilip Roadlines remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 27% to ₹2.1b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since DRS Dilip Roadlines is no giant, with a market capitalisation of ₹1.3b, you should definitely check its cash and debt before getting too excited about its prospects.

Are DRS Dilip Roadlines Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So we're pleased to report that DRS Dilip Roadlines insiders own a meaningful share of the business. To be exact, company insiders hold 73% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Valued at only ₹1.3b DRS Dilip Roadlines is really small for a listed company. That means insiders only have ₹983m worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. The median total compensation for CEOs of companies similar in size to DRS Dilip Roadlines, with market caps under ₹17b is around ₹3.6m.

The DRS Dilip Roadlines CEO received total compensation of only ₹1.8m in the year to March 2022. This could be considered a token amount, and indicates that the company does not need to use payment to motivate the CEO - that is often a good sign. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does DRS Dilip Roadlines Deserve A Spot On Your Watchlist?

You can't deny that DRS Dilip Roadlines has grown its earnings per share at a very impressive rate. That's attractive. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. This may only be a fast rundown, but the key takeaway is that DRS Dilip Roadlines is worth keeping an eye on. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with DRS Dilip Roadlines (at least 1 which makes us a bit uncomfortable) , and understanding these should be part of your investment process.

Although DRS Dilip Roadlines certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade DRS Dilip Roadlines, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:DRSDILIP

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives