- India

- /

- Electronic Equipment and Components

- /

- NSEI:RISHABH

Rishabh Instruments Limited's (NSE:RISHABH) 28% Share Price Plunge Could Signal Some Risk

The Rishabh Instruments Limited (NSE:RISHABH) share price has fared very poorly over the last month, falling by a substantial 28%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 58% loss during that time.

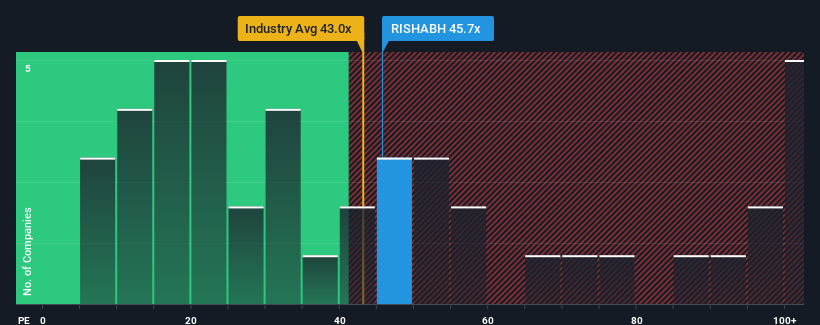

In spite of the heavy fall in price, Rishabh Instruments' price-to-earnings (or "P/E") ratio of 45.7x might still make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 26x and even P/E's below 15x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For example, consider that Rishabh Instruments' financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for Rishabh Instruments

How Is Rishabh Instruments' Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Rishabh Instruments' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 67%. The last three years don't look nice either as the company has shrunk EPS by 62% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 26% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that Rishabh Instruments is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

A significant share price dive has done very little to deflate Rishabh Instruments' very lofty P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Rishabh Instruments revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Rishabh Instruments (1 makes us a bit uncomfortable) you should be aware of.

You might be able to find a better investment than Rishabh Instruments. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RISHABH

Rishabh Instruments

Engages in the design, development, and manufacturing of global energy efficiency solutions in electrical automation, measurement, and industrial technology in Asia, the United States, Poland, other European countries, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)