- India

- /

- Tech Hardware

- /

- NSEI:NETWEB

Earnings Update: Netweb Technologies India Limited (NSE:NETWEB) Just Reported Its Third-Quarter Results And Analysts Are Updating Their Forecasts

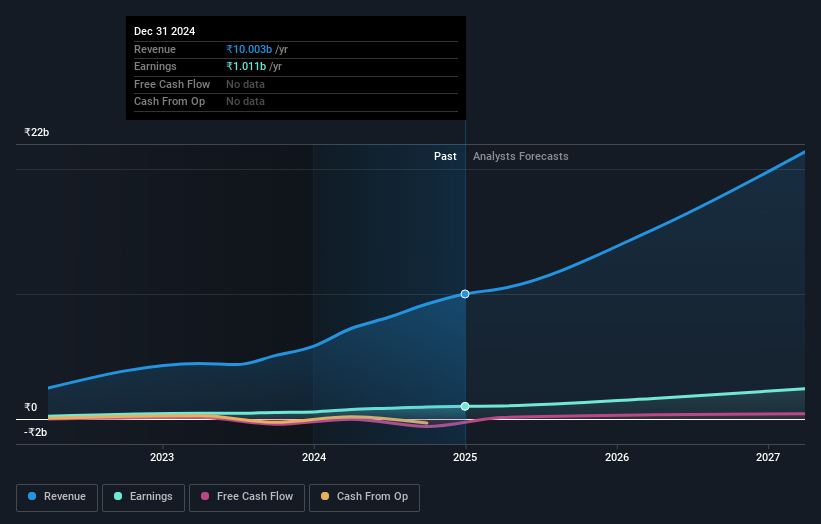

There's been a notable change in appetite for Netweb Technologies India Limited (NSE:NETWEB) shares in the week since its third-quarter report, with the stock down 15% to ₹2,144. Results overall were respectable, with statutory earnings of ₹13.88 per share roughly in line with what the analysts had forecast. Revenues of ₹3.3b came in 4.5% ahead of analyst predictions. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

View our latest analysis for Netweb Technologies India

After the latest results, the three analysts covering Netweb Technologies India are now predicting revenues of ₹15.2b in 2026. If met, this would reflect a major 52% improvement in revenue compared to the last 12 months. Per-share earnings are expected to shoot up 62% to ₹29.15. Before this earnings report, the analysts had been forecasting revenues of ₹15.2b and earnings per share (EPS) of ₹30.15 in 2026. The analysts seem to have become a little more negative on the business after the latest results, given the small dip in their earnings per share numbers for next year.

It might be a surprise to learn that the consensus price target was broadly unchanged at ₹2,905, with the analysts clearly implying that the forecast decline in earnings is not expected to have much of an impact on valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Netweb Technologies India at ₹3,380 per share, while the most bearish prices it at ₹2,655. This is a very narrow spread of estimates, implying either that Netweb Technologies India is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We can infer from the latest estimates that forecasts expect a continuation of Netweb Technologies India'shistorical trends, as the 40% annualised revenue growth to the end of 2026 is roughly in line with the 34% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 11% per year. So it's pretty clear that Netweb Technologies India is forecast to grow substantially faster than its industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that in mind, we wouldn't be too quick to come to a conclusion on Netweb Technologies India. Long-term earnings power is much more important than next year's profits. We have estimates - from multiple Netweb Technologies India analysts - going out to 2027, and you can see them free on our platform here.

You can also see our analysis of Netweb Technologies India's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Netweb Technologies India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NETWEB

Netweb Technologies India

Designs, manufactures, and sells high-end computing solutions in India.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)