The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Nelco Limited (NSE:NELCO) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Nelco

How Much Debt Does Nelco Carry?

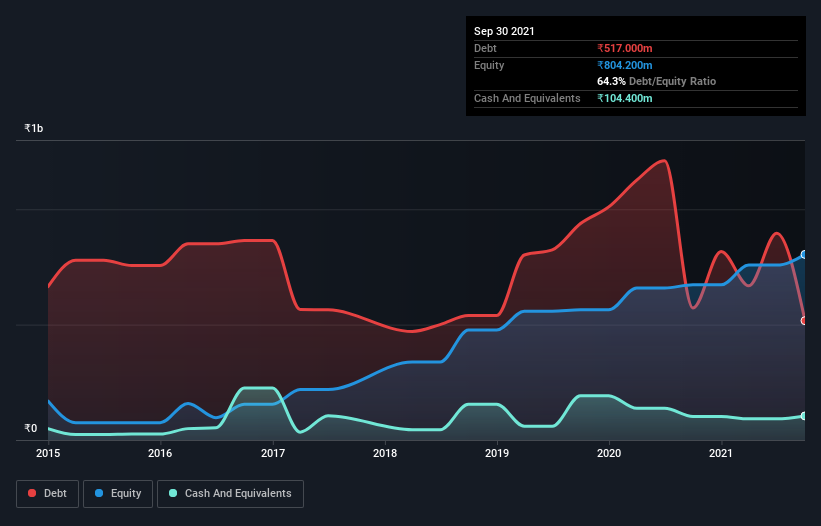

The image below, which you can click on for greater detail, shows that Nelco had debt of ₹517.0m at the end of September 2021, a reduction from ₹571.8m over a year. On the flip side, it has ₹104.4m in cash leading to net debt of about ₹412.6m.

How Healthy Is Nelco's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Nelco had liabilities of ₹1.47b due within 12 months and liabilities of ₹219.3m due beyond that. On the other hand, it had cash of ₹104.4m and ₹820.2m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹764.6m.

Of course, Nelco has a market capitalization of ₹17.2b, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While Nelco's low debt to EBITDA ratio of 0.95 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 4.7 times last year does give us pause. So we'd recommend keeping a close eye on the impact financing costs are having on the business. Unfortunately, Nelco saw its EBIT slide 9.5% in the last twelve months. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Nelco will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Looking at the most recent three years, Nelco recorded free cash flow of 33% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

Both Nelco's ability to handle its debt, based on its EBITDA, and its level of total liabilities gave us comfort that it can handle its debt. Having said that, its EBIT growth rate somewhat sensitizes us to potential future risks to the balance sheet. Looking at all this data makes us feel a little cautious about Nelco's debt levels. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Nelco is showing 2 warning signs in our investment analysis , you should know about...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Nelco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:NELCO

Nelco

Provides solutions in the areas of very small aperture terminals (VSAT) connectivity, satellite communication (Satcom) projects, and integrated security and surveillance solutions in India.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026