- India

- /

- Electronic Equipment and Components

- /

- NSEI:CYIENTDLM

Earnings Beat: Cyient DLM Limited Just Beat Analyst Forecasts, And Analysts Have Been Updating Their Models

Shareholders might have noticed that Cyient DLM Limited (NSE:CYIENTDLM) filed its second-quarter result this time last week. The early response was not positive, with shares down 3.4% to ₹442 in the past week. It looks to have been a decent result overall - while revenue fell marginally short of analyst estimates at ₹3.1b, statutory earnings beat expectations by a notable 76%, coming in at ₹4.05 per share. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

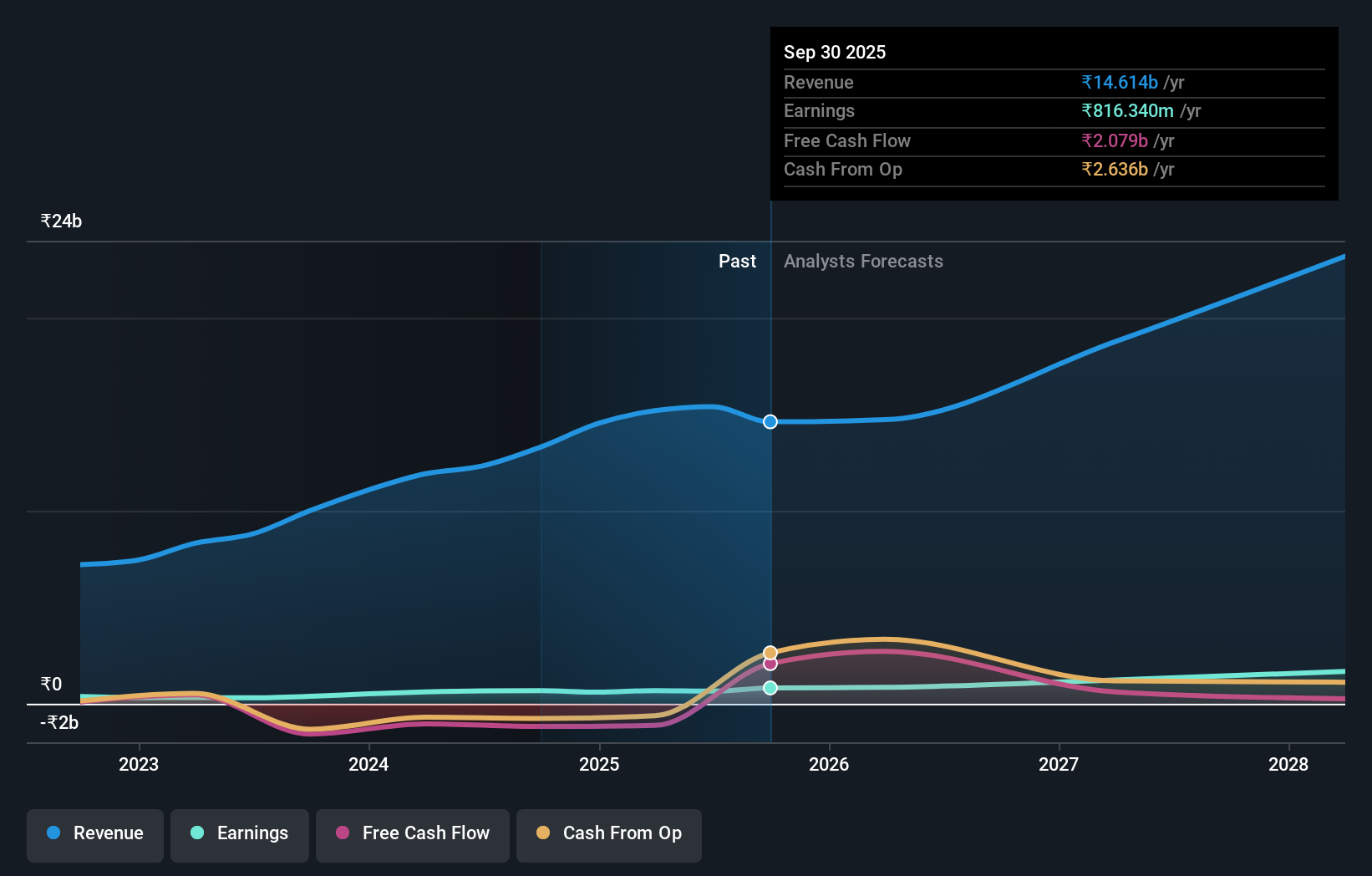

Following last week's earnings report, Cyient DLM's nine analysts are forecasting 2026 revenues to be ₹14.7b, approximately in line with the last 12 months. Statutory per-share earnings are expected to be ₹10.43, roughly flat on the last 12 months. Before this earnings report, the analysts had been forecasting revenues of ₹16.2b and earnings per share (EPS) of ₹11.13 in 2026. The analysts are less bullish than they were before these results, given the reduced revenue forecasts and the minor downgrade to earnings per share expectations.

Check out our latest analysis for Cyient DLM

Despite the cuts to forecast earnings, there was no real change to the ₹495 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Cyient DLM, with the most bullish analyst valuing it at ₹550 and the most bearish at ₹450 per share. Even so, with a relatively close grouping of estimates, it looks like the analysts are quite confident in their valuations, suggesting Cyient DLM is an easy business to forecast or the the analysts are all using similar assumptions.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. It's pretty clear that there is an expectation that Cyient DLM's revenue growth will slow down substantially, with revenues to the end of 2026 expected to display 1.5% growth on an annualised basis. This is compared to a historical growth rate of 26% over the past three years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 19% annually. Factoring in the forecast slowdown in growth, it seems obvious that Cyient DLM is also expected to grow slower than other industry participants.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Cyient DLM. Unfortunately, they also downgraded their revenue estimates, and our data indicates underperformance compared to the wider industry. Even so, earnings per share are more important to the intrinsic value of the business. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Following on from that line of thought, we think that the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Cyient DLM going out to 2028, and you can see them free on our platform here..

You can also see our analysis of Cyient DLM's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CYIENTDLM

Cyient DLM

Provides electronic manufacturing solutions in India, NAM, rest of the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)