While Avantel Limited (NSE:AVANTEL) shareholders have had a good week with the stock up 13%, they shouldn't let their guards down. The fact that insiders chose to dispose of ₹516m worth of stock in the past 12 months even though prices were relatively low could be indicative of some anticipated weakness.

Although we don't think shareholders should simply follow insider transactions, we would consider it foolish to ignore insider transactions altogether.

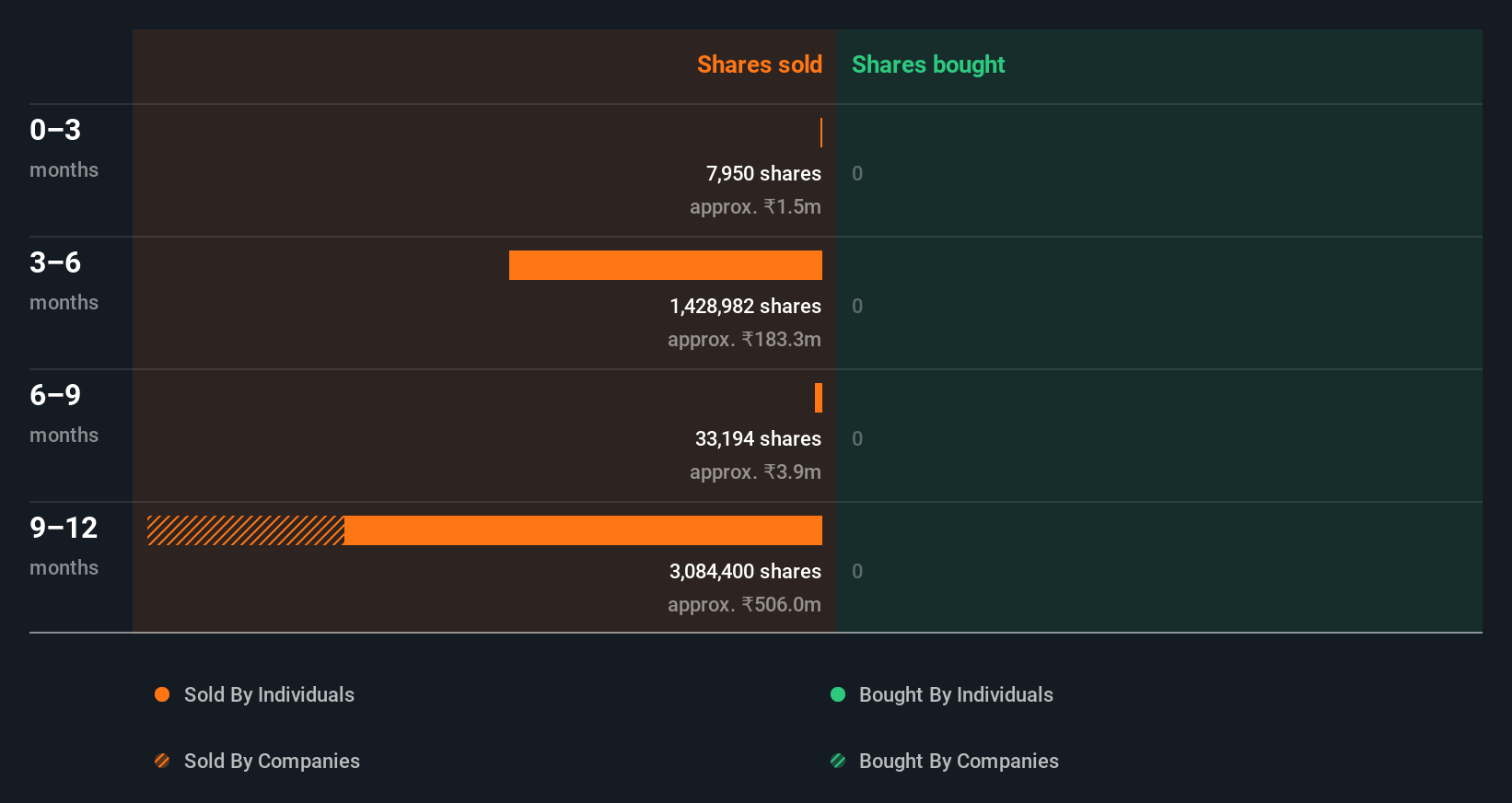

Avantel Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the Chairman, Abburi Vidyasagar, sold ₹230m worth of shares at a price of ₹152 per share. So it's clear an insider wanted to take some cash off the table, even below the current price of ₹202. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was just 3.7% of Abburi Vidyasagar's stake.

In the last year Avantel insiders didn't buy any company stock. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

View our latest analysis for Avantel

I will like Avantel better if I see some big insider buys. While we wait, check out this free list of undervalued and small cap stocks with considerable, recent, insider buying.

Avantel Insiders Are Selling The Stock

Over the last three months, we've seen a bit of insider selling at Avantel. insider P. Ramakrishna only netted ₹1.5m selling shares, in that period. Neither the lack of buying nor the presence of selling is heartening. But the amount sold isn't enough for us to put any weight on it.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that Avantel insiders own 43% of the company, worth about ₹23b. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Does This Data Suggest About Avantel Insiders?

An insider sold stock recently, but they haven't been buying. And there weren't any purchases to give us comfort, over the last year. It is good to see high insider ownership, but the insider selling leaves us cautious. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Avantel. Every company has risks, and we've spotted 1 warning sign for Avantel you should know about.

Of course Avantel may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AVANTEL

Avantel

Designs, develops, manufactures and sells wireless communication products in India.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)