Zensar Technologies Insiders Sell ₹62m Of Stock, Possibly Signalling Caution

Quite a few Zensar Technologies Limited (NSE:ZENSARTECH) insiders sold their shares over the past year, which may be a cause for concern. When analyzing insider transactions, it is usually more valuable to know whether insiders are buying versus knowing if they are selling, as the latter sends an ambiguous message. However, if numerous insiders are selling, shareholders should investigate more.

While insider transactions are not the most important thing when it comes to long-term investing, we do think it is perfectly logical to keep tabs on what insiders are doing.

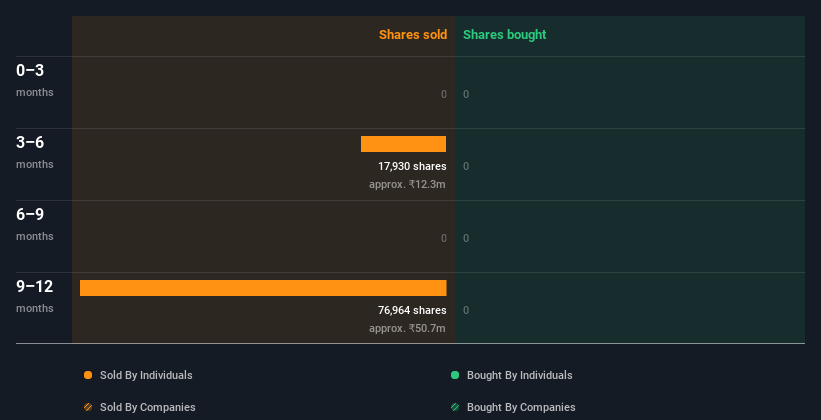

Zensar Technologies Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the Executive VP & Head of Telecommunication, Harish Lala, for ₹18m worth of shares, at about ₹613 per share. That means that even when the share price was below the current price of ₹679, an insider wanted to cash in some shares. When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. While insider selling is not a positive sign, we can't be sure if it does mean insiders think the shares are fully valued, so it's only a weak sign. This single sale was just 29% of Harish Lala's stake.

In the last year Zensar Technologies insiders didn't buy any company stock. The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

Check out our latest analysis for Zensar Technologies

For those who like to find hidden gems this free list of small cap companies with recent insider purchasing, could be just the ticket.

Insider Ownership

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Based on our data, Zensar Technologies insiders have about 0.1% of the stock, worth approximately ₹221m. But they may have an indirect interest through a corporate structure that we haven't picked up on. We consider this fairly low insider ownership.

So What Does This Data Suggest About Zensar Technologies Insiders?

It doesn't really mean much that no insider has traded Zensar Technologies shares in the last quarter. It's great to see high levels of insider ownership, but looking back over the last year, we don't gain confidence from the Zensar Technologies insiders selling. Therefore, you should definitely take a look at this FREE report showing analyst forecasts for Zensar Technologies.

Of course Zensar Technologies may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zensar Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ZENSARTECH

Zensar Technologies

A digital solutions and technology services company, provides technology consulting and system integration services in India, Americas, Europe, Africa, and internationally.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)