Some Confidence Is Lacking In Oracle Financial Services Software Limited's (NSE:OFSS) P/E

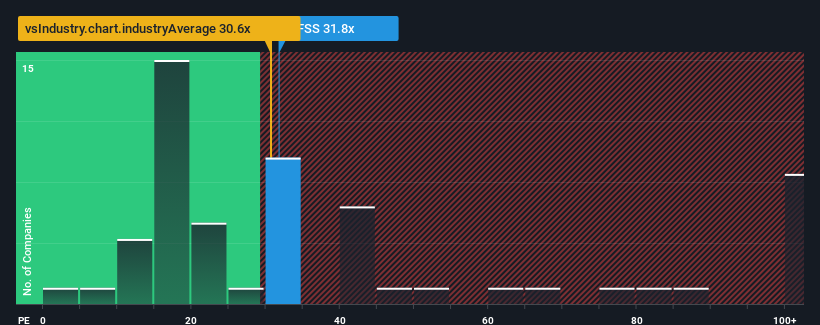

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 27x, you may consider Oracle Financial Services Software Limited (NSE:OFSS) as a stock to potentially avoid with its 31.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Recent times haven't been advantageous for Oracle Financial Services Software as its earnings have been rising slower than most other companies. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Oracle Financial Services Software

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Oracle Financial Services Software's is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 7.0% last year. The solid recent performance means it was also able to grow EPS by 25% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 9.1% over the next year. With the market predicted to deliver 24% growth , the company is positioned for a weaker earnings result.

With this information, we find it concerning that Oracle Financial Services Software is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

What We Can Learn From Oracle Financial Services Software's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Oracle Financial Services Software currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for Oracle Financial Services Software that you should be aware of.

If you're unsure about the strength of Oracle Financial Services Software's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:OFSS

Oracle Financial Services Software

Provides information technology (IT) solutions to the financial services industry worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)