Syncom Formulations (India) Limited's (NSE:SYNCOMF) 27% Price Boost Is Out Of Tune With Earnings

Syncom Formulations (India) Limited (NSE:SYNCOMF) shares have continued their recent momentum with a 27% gain in the last month alone. The annual gain comes to 132% following the latest surge, making investors sit up and take notice.

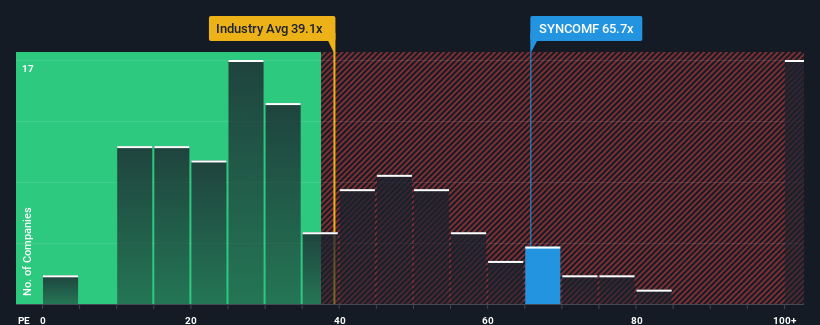

After such a large jump in price, Syncom Formulations (India) may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 65.7x, since almost half of all companies in India have P/E ratios under 34x and even P/E's lower than 19x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

The earnings growth achieved at Syncom Formulations (India) over the last year would be more than acceptable for most companies. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Syncom Formulations (India)

Is There Enough Growth For Syncom Formulations (India)?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Syncom Formulations (India)'s to be considered reasonable.

Retrospectively, the last year delivered a decent 14% gain to the company's bottom line. Still, lamentably EPS has fallen 28% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 26% shows it's an unpleasant look.

With this information, we find it concerning that Syncom Formulations (India) is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Syncom Formulations (India)'s P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Syncom Formulations (India) revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Syncom Formulations (India) with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Syncom Formulations (India)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SYNCOMF

Syncom Formulations (India)

Manufactures, markets, and sells pharmaceutical formulation products in India and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026