- India

- /

- Entertainment

- /

- NSEI:PVRINOX

Exploring Undervalued Opportunities: 3 Indian Exchange Stocks With Intrinsic Discounts Ranging From 21.6% To 36.6%

Reviewed by Simply Wall St

The Indian market has shown robust growth, climbing 2.3% in the last week and an impressive 45% over the past year, with earnings expected to grow by 16% annually. In such a thriving environment, identifying stocks that are trading below their intrinsic value could present attractive opportunities for investors.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Updater Services (NSEI:UDS) | ₹290.30 | ₹476.87 | 39.1% |

| Allied Digital Services (NSEI:ADSL) | ₹147.40 | ₹227.88 | 35.3% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹412.80 | ₹574.52 | 28.1% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹470.30 | ₹801.15 | 41.3% |

| Strides Pharma Science (NSEI:STAR) | ₹987.75 | ₹1520.38 | 35% |

| TV18 Broadcast (NSEI:TV18BRDCST) | ₹43.00 | ₹70.84 | 39.3% |

| PVR INOX (NSEI:PVRINOX) | ₹1403.25 | ₹2214.17 | 36.6% |

| Delhivery (NSEI:DELHIVERY) | ₹398.75 | ₹612.48 | 34.9% |

| Camlin Fine Sciences (BSE:532834) | ₹108.82 | ₹156.58 | 30.5% |

| Godrej Properties (NSEI:GODREJPROP) | ₹3088.90 | ₹4581.17 | 32.6% |

Underneath we present a selection of stocks filtered out by our screen

PVR INOX (NSEI:PVRINOX)

Overview: PVR INOX Limited operates as a theatrical exhibition company, focusing on the exhibition, distribution, and production of movies in India and Sri Lanka, with a market capitalization of approximately ₹137.69 billion.

Operations: The company generates ₹60.71 billion from movie exhibition and ₹3.17 billion from various other activities including movie production and distribution, as well as gaming.

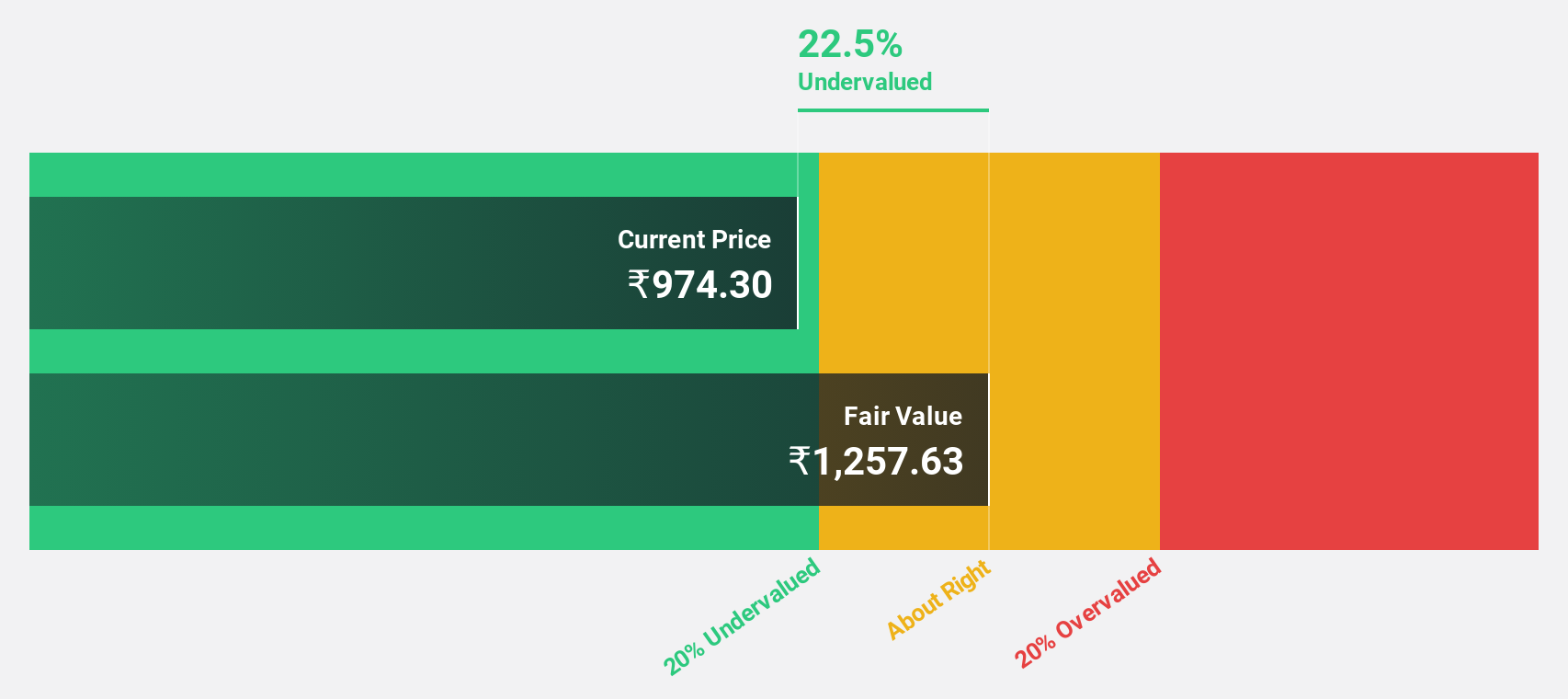

Estimated Discount To Fair Value: 36.6%

PVR INOX, priced at ₹1403.25, is significantly undervalued compared to its fair value estimate of ₹2208.54, reflecting a potential opportunity based on discounted cash flow analysis. Despite currently trading 36.5% below its estimated fair value and showing strong future profit growth expectations with profitability anticipated within three years, challenges remain such as a lower forecast return on equity at 9.8%. Recent strategic expansions and executive changes indicate proactive management but need to translate effectively into financial performance to realize underlying value fully.

- In light of our recent growth report, it seems possible that PVR INOX's financial performance will exceed current levels.

- Take a closer look at PVR INOX's balance sheet health here in our report.

Shyam Metalics and Energy (NSEI:SHYAMMETL)

Overview: Shyam Metalics and Energy Limited is an integrated metal company based in India, specializing in the production and sale of long steel products and ferro alloys, both domestically and internationally, with a market capitalization of approximately ₹181.86 billion.

Operations: The company generates ₹131.95 billion primarily through the sale of iron and steel products.

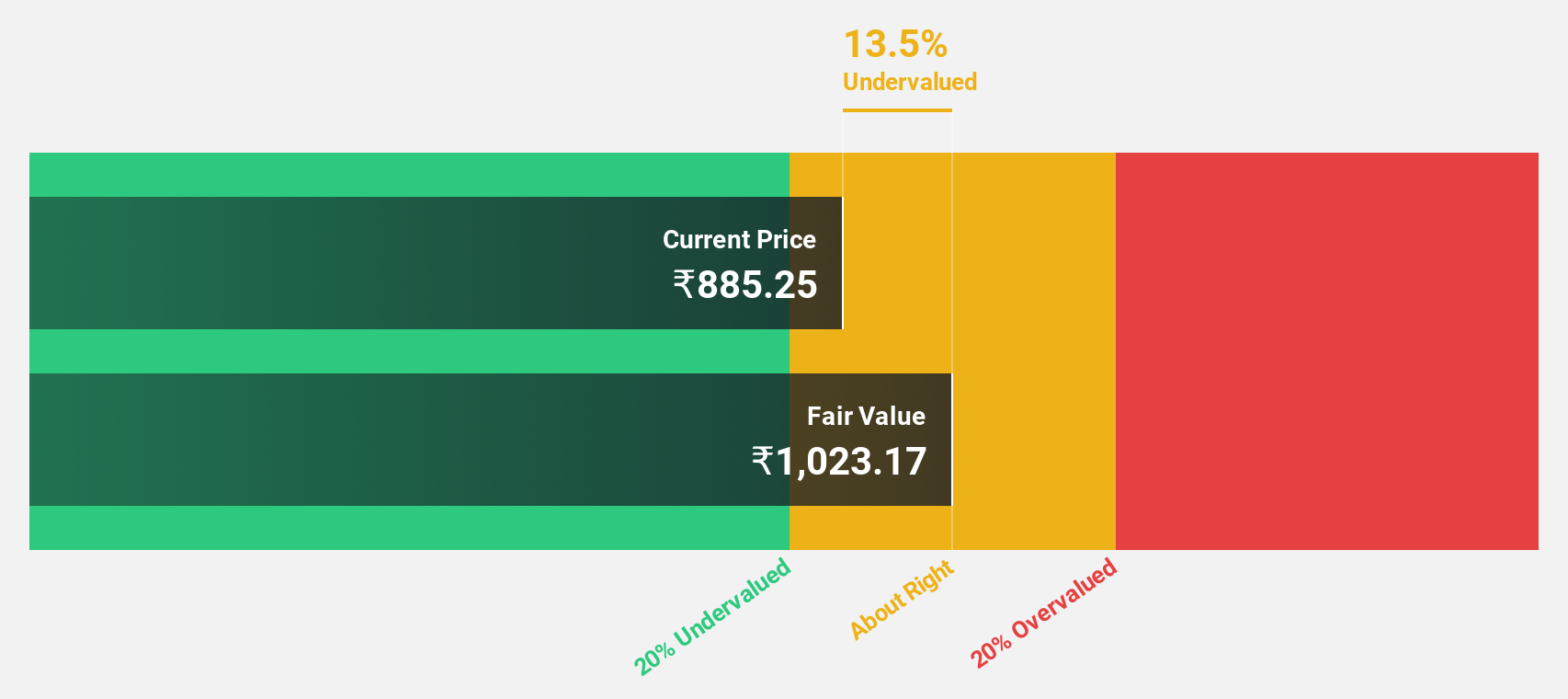

Estimated Discount To Fair Value: 21.6%

Shyam Metalics and Energy, valued at ₹671.7, is trading under its fair value by over 20%, indicating potential undervaluation based on cash flow analysis. With revenue and earnings growth forecasts outpacing the Indian market significantly, the company shows strong future prospects. However, concerns include a low forecasted Return on Equity of 16% and poor dividend coverage by cash flows. Recent expansions in rail infrastructure and operational enhancements at acquired plants underscore efforts to bolster efficiency and capacity for sustained growth.

- The analysis detailed in our Shyam Metalics and Energy growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Shyam Metalics and Energy.

Strides Pharma Science (NSEI:STAR)

Overview: Strides Pharma Science Limited is a pharmaceutical company that develops, manufactures, and sells products across continents including Africa, Australia, North America, Europe, Asia, and India with a market capitalization of approximately ₹90.79 billion.

Operations: The pharmaceutical business, excluding the bio-pharmaceutical segment, generated revenue of ₹40.51 billion.

Estimated Discount To Fair Value: 35%

Strides Pharma Science, with a significant turnaround in its financial performance, reported a substantial increase in quarterly sales to INR 10.84 billion and shifted from a net loss to a profit of INR 181.75 million year-over-year. This improvement is supported by robust revenue growth projections at 11.2% annually, outpacing the Indian market's average. Despite these gains, the company's Return on Equity is expected to remain low at 16.2%, suggesting potential challenges in generating shareholder value relative to its equity base. Recent executive restructuring could influence future strategic directions and operational efficiencies.

- Our comprehensive growth report raises the possibility that Strides Pharma Science is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Strides Pharma Science stock in this financial health report.

Turning Ideas Into Actions

- Discover the full array of 15 Undervalued Indian Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PVRINOX

PVR INOX

A theatrical exhibition company, engages in the exhibition, distribution, and production of movies in India and Sri Lanka.

Good value with reasonable growth potential.

Market Insights

Community Narratives