With EPS Growth And More, SMS Lifesciences India (NSE:SMSLIFE) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like SMS Lifesciences India (NSE:SMSLIFE), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for SMS Lifesciences India

SMS Lifesciences India's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Over the last three years, SMS Lifesciences India has grown EPS by 12% per year. That's a pretty good rate, if the company can sustain it.

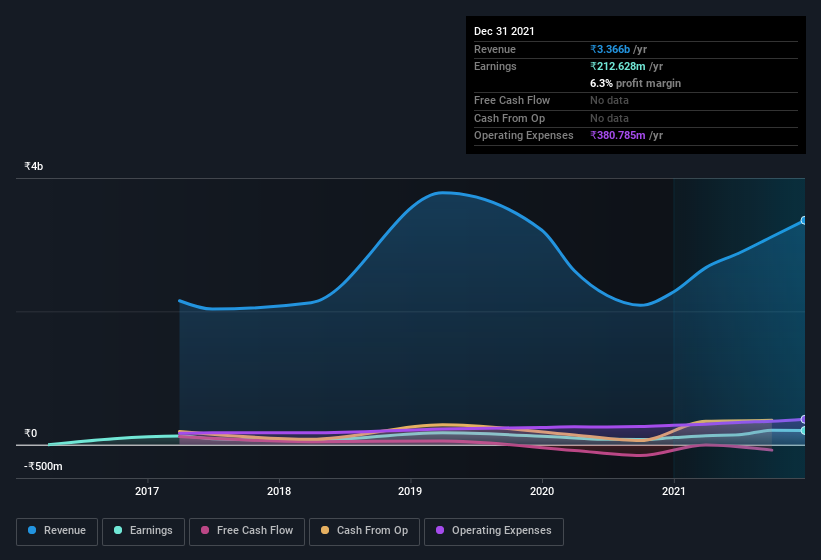

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. SMS Lifesciences India maintained stable EBIT margins over the last year, all while growing revenue 47% to ₹3.4b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since SMS Lifesciences India is no giant, with a market capitalization of ₹1.7b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are SMS Lifesciences India Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

SMS Lifesciences India insiders both bought and sold shares over the last twelve months, but they did end up spending ₹1.5m more on stock than they received from selling it. So, on balance, the insider transactions are mildly encouraging. We also note that it was the , Annapurna Talluri, who made the biggest single acquisition, paying ₹4.8m for shares at about ₹700 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since SMS Lifesciences India insiders own more than a third of the company. In fact, they own 76% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. In terms of absolute value, insiders have ₹1.3b invested in the business, using the current share price. That's nothing to sneeze at!

Should You Add SMS Lifesciences India To Your Watchlist?

One important encouraging feature of SMS Lifesciences India is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. It's still necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with SMS Lifesciences India , and understanding them should be part of your investment process.

The good news is that SMS Lifesciences India is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Haleos Labs might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HALEOSLABS

Haleos Labs

Engages in the manufacturing of active pharmaceutical ingredients (API) and intermediates in India.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)