Top Undervalued Small Caps With Insider Action For July 2024

Reviewed by Simply Wall St

As global markets continue to navigate a mixed economic landscape, small-cap stocks have shown resilience, outpacing their large-cap counterparts in recent weeks. With the S&P 600 and Russell 2000 indices reflecting this trend, investors are increasingly turning their attention to undervalued small caps that exhibit strong fundamentals and insider action. In the current market environment, identifying promising small-cap stocks involves looking for companies with solid financial health, growth potential, and significant insider buying—indicating confidence from those closest to the business.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Tokmanni Group Oyj | 14.4x | 0.4x | 45.78% | ★★★★★★ |

| Bytes Technology Group | 25.0x | 5.7x | 0.77% | ★★★★★☆ |

| THG | NA | 0.4x | 42.18% | ★★★★★☆ |

| Nexus Industrial REIT | 2.8x | 3.4x | 14.10% | ★★★★☆☆ |

| Norcros | 7.8x | 0.5x | -12.45% | ★★★☆☆☆ |

| Studsvik | 21.1x | 1.3x | 33.51% | ★★★☆☆☆ |

| PowerCell Sweden | NA | 4.4x | 41.89% | ★★★☆☆☆ |

| NSI | NA | 4.5x | 39.12% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -134.80% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

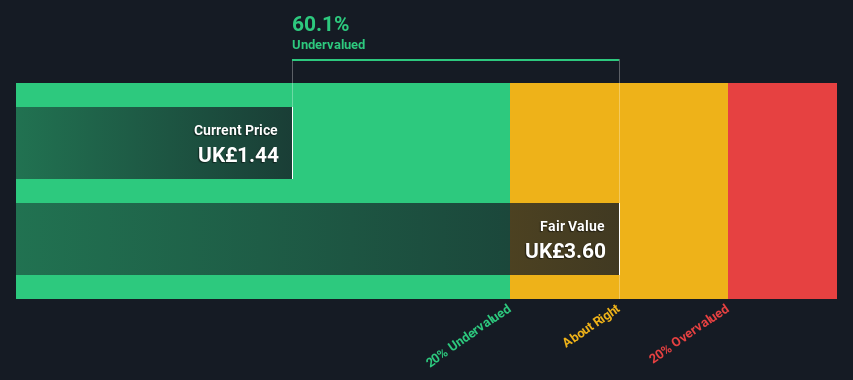

Aston Martin Lagonda Global Holdings (LSE:AML)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aston Martin Lagonda Global Holdings is a luxury automotive manufacturer known for producing high-performance sports cars and grand tourers, with a market cap of approximately £1.20 billion.

Operations: Aston Martin Lagonda Global Holdings generates its revenue primarily from automotive sales, with a gross profit margin of 40.80% as of the latest period. The company incurs significant costs, including £922.6 million in cost of goods sold and £730.9 million in operating expenses for the same period.

PE: -4.5x

Aston Martin Lagonda Global Holdings, a small-cap luxury carmaker, recently reported H1 2024 sales of £603 million, down from £677.4 million last year, with a net loss widening to £207.8 million. Despite these challenges, insider confidence is evident with recent share purchases by executives. The company has set ambitious revenue targets of £2.5 billion for 2027-28 and will see leadership change on September 1, 2024, as Adrian Hallmark steps in as CEO.

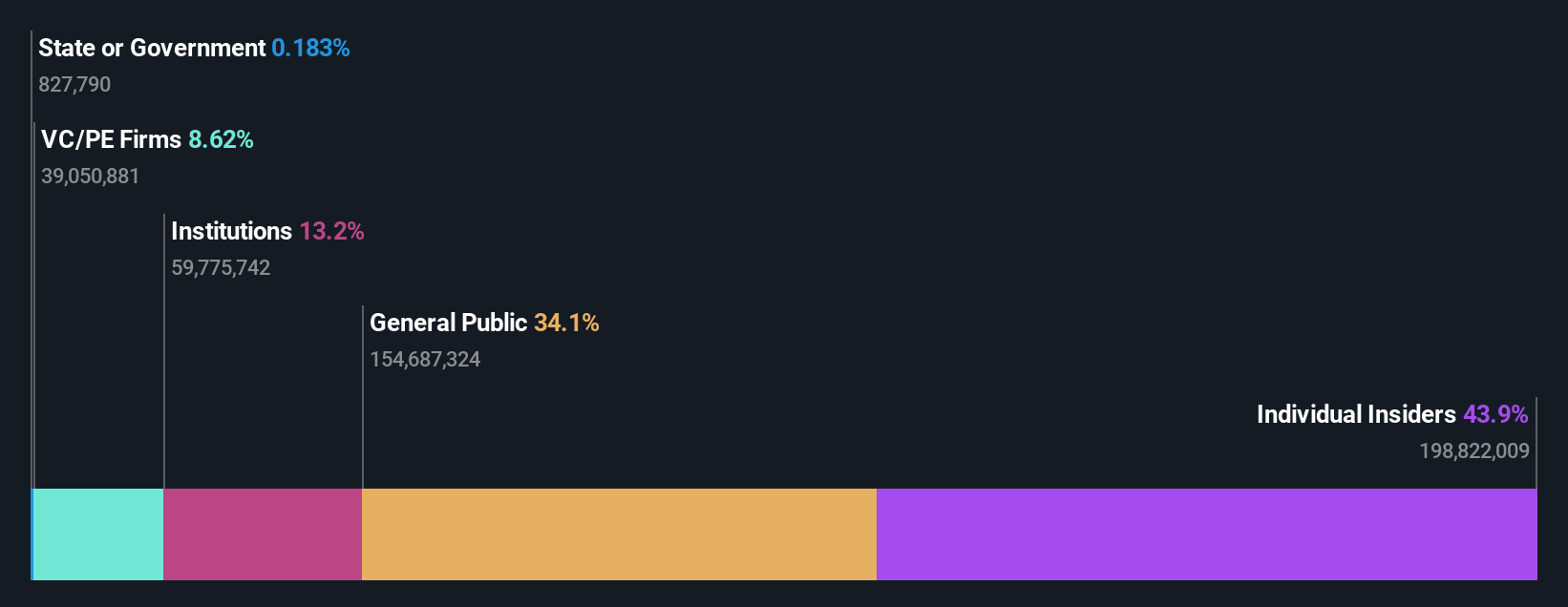

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Marksans Pharma is a pharmaceutical company engaged in the development, manufacture, and marketing of generic pharmaceutical formulations with a market cap of ₹36.82 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, with gross profit margins showing an upward trend, reaching 52.32% as of March 2024. Operating expenses and cost of goods sold are significant components impacting the overall profitability.

PE: 29.6x

Marksans Pharma reported a strong annual revenue growth, rising from INR 19.11 billion to INR 22.28 billion for the year ending March 31, 2024. Despite a slight dip in Q4 net income from INR 819.32 million to INR 782.9 million, the full-year net income increased to INR 3.14 billion from INR 2.66 billion previously. Insider confidence is evident as they purchased shares recently, indicating potential undervaluation and future growth prospects for this company in the pharmaceutical sector.

- Delve into the full analysis valuation report here for a deeper understanding of Marksans Pharma.

Assess Marksans Pharma's past performance with our detailed historical performance reports.

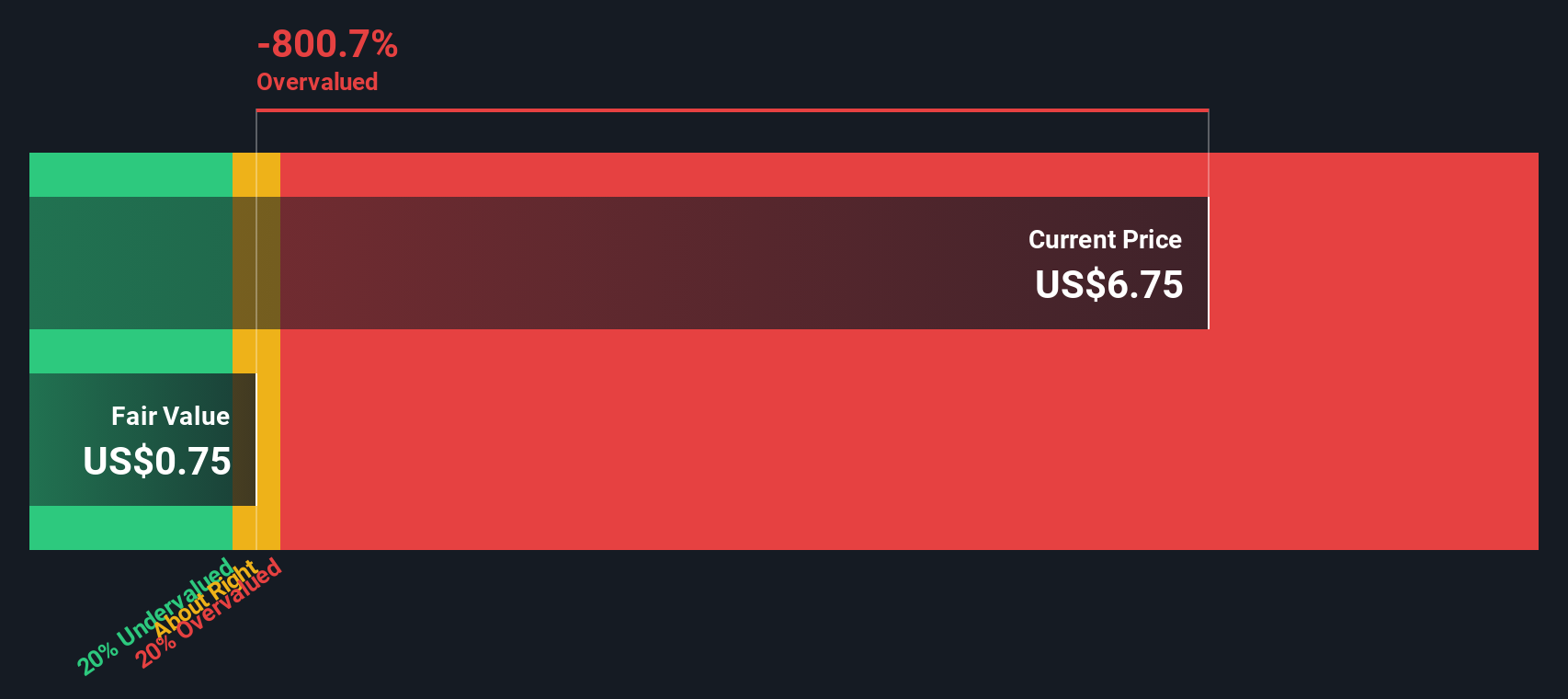

Lumen Technologies (NYSE:LUMN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lumen Technologies is a telecommunications company that provides a range of communication and network services to business and mass market segments, with a market cap of approximately $1.92 billion.

Operations: With primary revenue streams from Business ($11.16 billion) and Mass Markets ($2.95 billion), the company has experienced fluctuations in its gross profit margins, which ranged from 61.25% to 50.54% over the observed periods. Recent data indicates a gross profit margin of 50.54%.

PE: -0.2x

Lumen Technologies, a small-cap stock, has seen significant insider confidence with recent purchases. The company is undergoing a digital transformation through a strategic partnership with Microsoft, leveraging AI and cloud technologies to enhance network capabilities and reduce costs by over US$20 million in the next year. Despite reporting lower sales of US$3.29 billion for Q1 2024 compared to last year, earnings are forecasted to grow annually at 113.85%.

- Click to explore a detailed breakdown of our findings in Lumen Technologies' valuation report.

Gain insights into Lumen Technologies' past trends and performance with our Past report.

Make It Happen

- Embark on your investment journey to our 220 Undervalued Small Caps With Insider Buying selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Marksans Pharma, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MARKSANS

Marksans Pharma

Engages in the research, manufacturing, marketing, and sale of pharmaceutical formulations in the United States, North America, Europe, the United Kingdom, Australia, New Zealand, and internationally.

Flawless balance sheet and good value.