Does Ipca Laboratories' (NSE:IPCALAB) CEO Salary Compare Well With Industry Peers?

The CEO of Ipca Laboratories Limited (NSE:IPCALAB) is Premchand Godha, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Ipca Laboratories pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Ipca Laboratories

How Does Total Compensation For Premchand Godha Compare With Other Companies In The Industry?

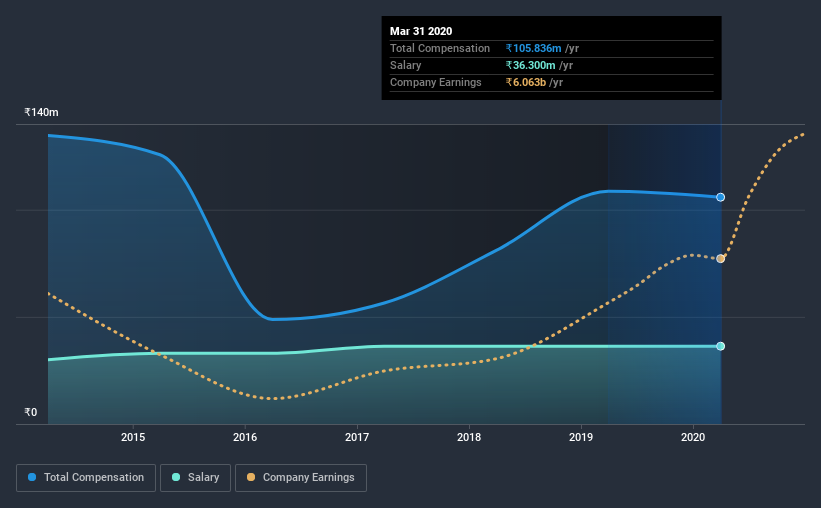

According to our data, Ipca Laboratories Limited has a market capitalization of ₹250b, and paid its CEO total annual compensation worth ₹106m over the year to March 2020. That's mostly flat as compared to the prior year's compensation. While we always look at total compensation first, our analysis shows that the salary component is less, at ₹36m.

On comparing similar companies from the same industry with market caps ranging from ₹146b to ₹466b, we found that the median CEO total compensation was ₹93m. So it looks like Ipca Laboratories compensates Premchand Godha in line with the median for the industry. Furthermore, Premchand Godha directly owns ₹5.7b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹36m | ₹36m | 34% |

| Other | ₹70m | ₹72m | 66% |

| Total Compensation | ₹106m | ₹109m | 100% |

Speaking on an industry level, nearly 99% of total compensation represents salary, while the remainder of 1.2% is other remuneration. It's interesting to note that Ipca Laboratories allocates a smaller portion of compensation to salary in comparison to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Ipca Laboratories Limited's Growth Numbers

Ipca Laboratories Limited has seen its earnings per share (EPS) increase by 64% a year over the past three years. In the last year, its revenue is up 21%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Ipca Laboratories Limited Been A Good Investment?

Boasting a total shareholder return of 228% over three years, Ipca Laboratories Limited has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

As we noted earlier, Ipca Laboratories pays its CEO in line with similar-sized companies belonging to the same industry. The company is growing EPS and total shareholder returns have been pleasing. Although the pay is close to the industry median, overall performance is excellent, so we don't think the CEO is paid too generously. In fact, shareholders might even think the CEO deserves a raise as a reward due to the fantastic returns generated.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for Ipca Laboratories that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Ipca Laboratories, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:IPCALAB

Ipca Laboratories

A pharmaceutical company, manufactures and markets formulations and active pharmaceutical ingredients (APIs) for various therapeutic segments in India, Europe, Africa, the Americas, Asia, CIS, and Australasia.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives