For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like FDC (NSE:FDC). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for FDC

How Fast Is FDC Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That makes EPS growth an attractive quality for any company. It certainly is nice to see that FDC has managed to grow EPS by 21% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

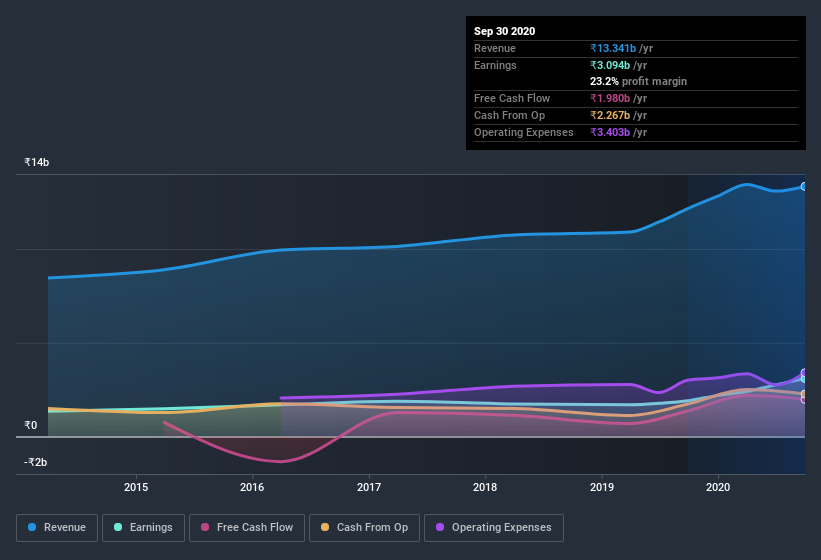

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that FDC is growing revenues, and EBIT margins improved by 6.3 percentage points to 24%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for FDC?

Are FDC Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So as you can imagine, the fact that FDC insiders own a significant number of shares certainly appeals to me. In fact, they own 37% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. At the current share price, that insider holding is worth a whopping ₹20b. Now that's what I call some serious skin in the game!

Is FDC Worth Keeping An Eye On?

For growth investors like me, FDC's raw rate of earnings growth is a beacon in the night. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if FDC is trading on a high P/E or a low P/E, relative to its industry.

Although FDC certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading FDC or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:FDC

FDC

Manufactures and trades in pharmaceutical products in India, the United States, and internationally.

Flawless balance sheet unattractive dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)