The Indian market has shown robust performance, rising 1.1% in the last 7 days and an impressive 42% over the past year, with earnings projected to grow by 17% annually in the coming years. In this favorable environment, dividend stocks that offer consistent payouts and potential for capital appreciation stand out as strong investment options.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.26% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 3.99% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 5.01% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.19% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.64% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.55% | ★★★★★☆ |

| Canara Bank (NSEI:CANBK) | 3.05% | ★★★★★☆ |

| Bank of Baroda (NSEI:BANKBARODA) | 3.17% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.10% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.70% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top Indian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

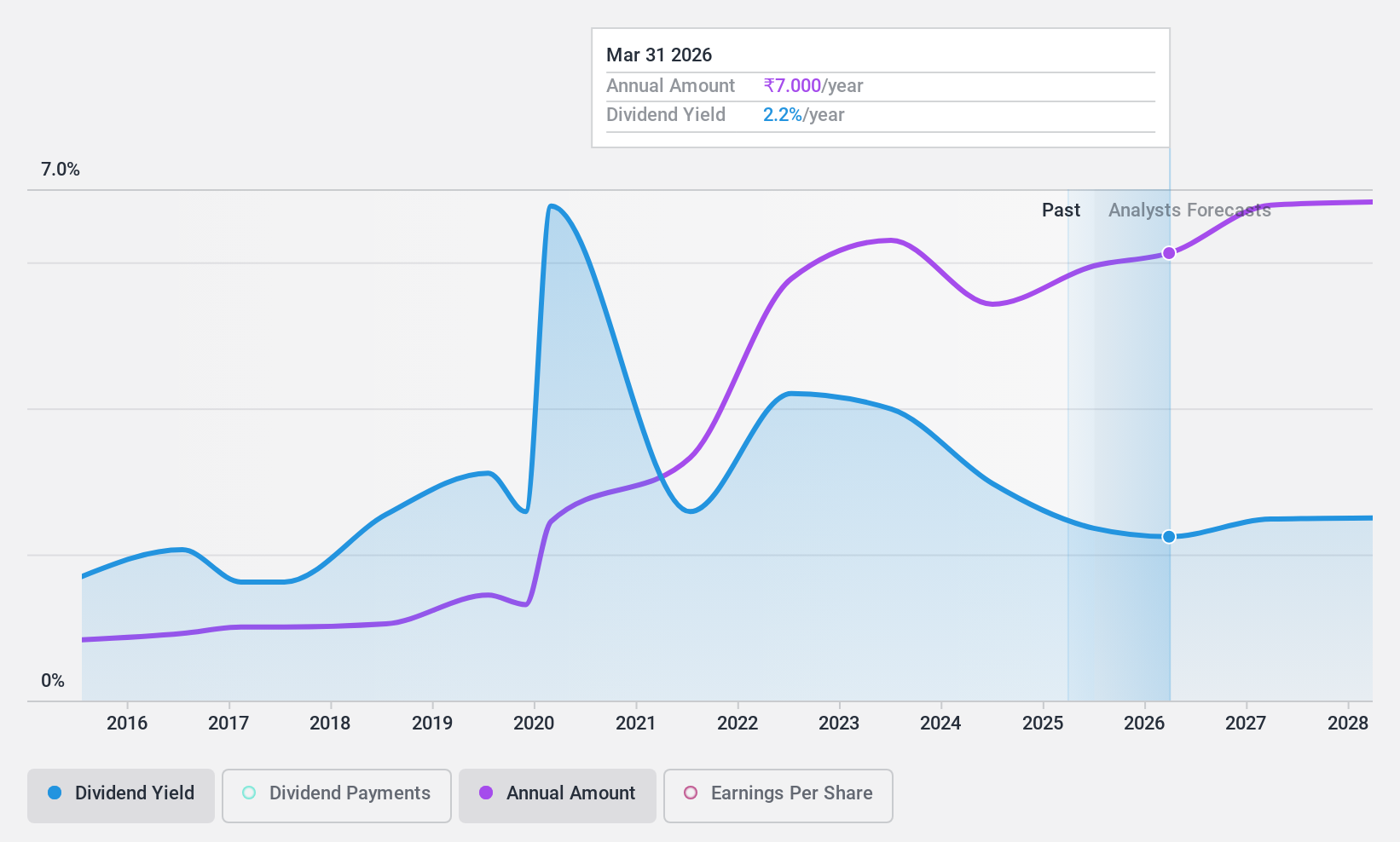

D. B (NSEI:DBCORP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: D. B. Corp Limited operates in newspaper printing and publishing, radio broadcasting, and digital news platforms for news and event management businesses in India and internationally, with a market cap of ₹60.47 billion.

Operations: D. B. Corp Limited generates revenue primarily from its printing, publishing, and allied business segment (₹22.77 billion) and radio broadcasting segment (₹1.62 billion).

Dividend Yield: 5%

D. B. Corp Limited's dividend payments have been volatile over the past decade, but its current payout ratios are sustainable, with a 65.2% earnings payout and a 57% cash flow coverage. The stock trades at a good value relative to peers and is priced 12.7% below its estimated fair value. Recent earnings growth of INR 4.26 billion from INR 1.69 billion last year supports future dividend stability despite recent decreases in interim dividends to INR 7 per share in July 2024.

- Dive into the specifics of D. B here with our thorough dividend report.

- Upon reviewing our latest valuation report, D. B's share price might be too pessimistic.

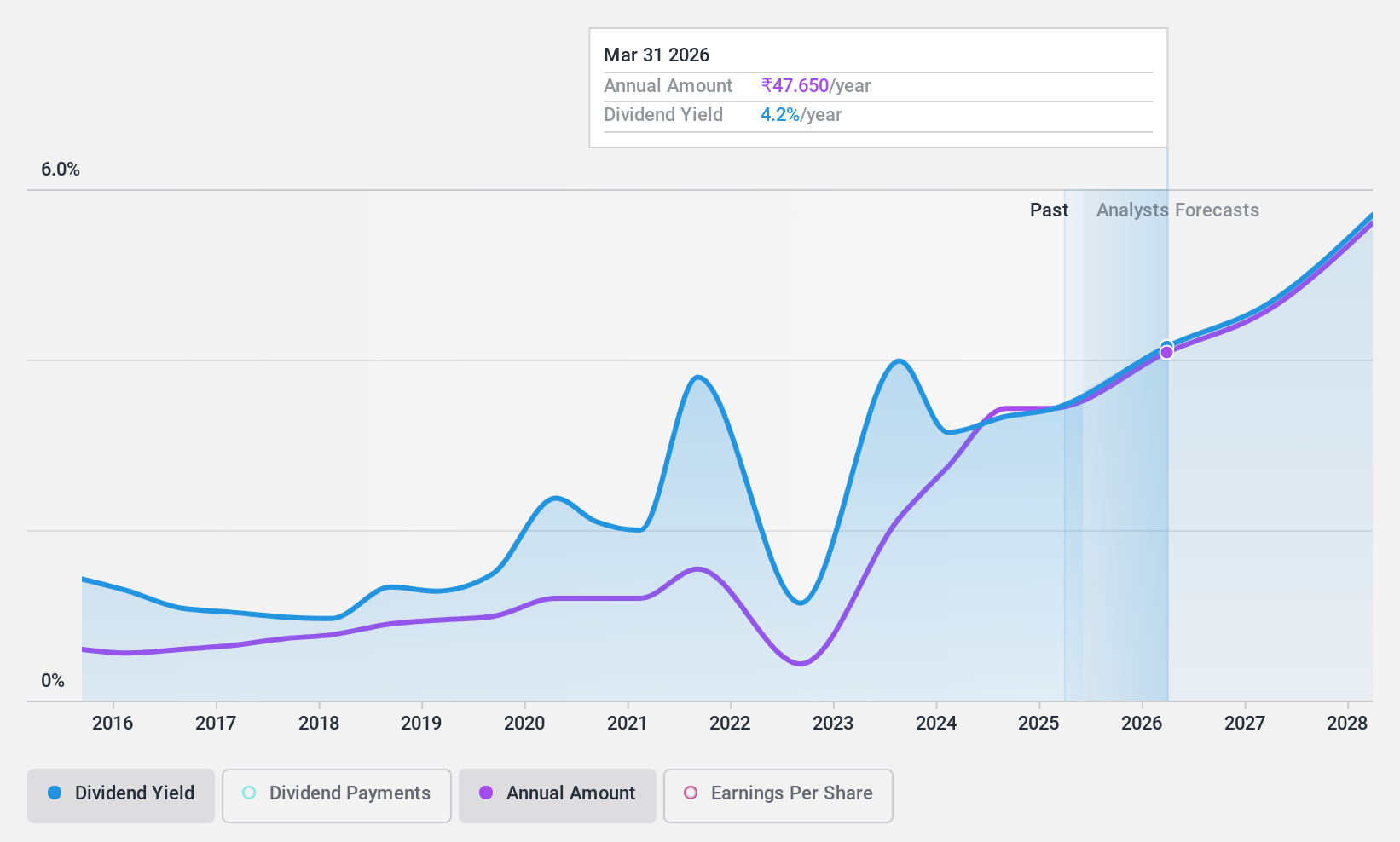

Gulf Oil Lubricants India (NSEI:GULFOILLUB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gulf Oil Lubricants India Limited manufactures, markets, and trades lubricants for the automobile and industrial sectors in India, with a market cap of ₹65.41 billion.

Operations: The company's revenue primarily comes from its lubricants segment, generating ₹33.83 billion.

Dividend Yield: 3%

Gulf Oil Lubricants India’s dividend payments, covered by earnings (57.4% payout ratio) and cash flows (62.7% cash payout ratio), are among the top 25% in the Indian market with a 3.01% yield, though historically volatile over the past decade. The stock trades at a favorable P/E ratio of 20.1x compared to the market average of 33.2x, supported by strong recent earnings growth and significant revenue increases in Q1 2024 to INR 9.12 billion from INR 8.26 billion last year.

- Navigate through the intricacies of Gulf Oil Lubricants India with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Gulf Oil Lubricants India's current price could be quite moderate.

Redington (NSEI:REDINGTON)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Redington Limited provides supply chain solutions in India and internationally, with a market cap of ₹152.74 billion.

Operations: Redington Limited's revenue segments include IT products at ₹470,000 million and mobility products at ₹310,000 million.

Dividend Yield: 3.1%

Redington's dividend yield of 3.1% places it in the top 25% of Indian market payers, though its dividend history has been volatile over the past decade. Despite a recent decrease to INR 6.20 per share, dividends are well-covered by earnings (39.8% payout ratio) and cash flows (50.6% cash payout ratio). Trading at a P/E ratio of 12.9x, Redington offers good relative value compared to peers and the broader market average of 33.2x.

- Delve into the full analysis dividend report here for a deeper understanding of Redington.

- Our valuation report here indicates Redington may be undervalued.

Taking Advantage

- Dive into all 21 of the Top Indian Dividend Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GULFOILLUB

Gulf Oil Lubricants India

Manufactures, markets, and trades lubricating oils, greases, and other derivatives for use in the automobile and industrial sectors in India.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)