- India

- /

- Metals and Mining

- /

- NSEI:VSSL

Does Vardhman Special Steels (NSE:VSSL) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Vardhman Special Steels (NSE:VSSL). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Vardhman Special Steels

How Quickly Is Vardhman Special Steels Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Who among us would not applaud Vardhman Special Steels's stratospheric annual EPS growth of 59%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Vardhman Special Steels is growing revenues, and EBIT margins improved by 3.3 percentage points to 12%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

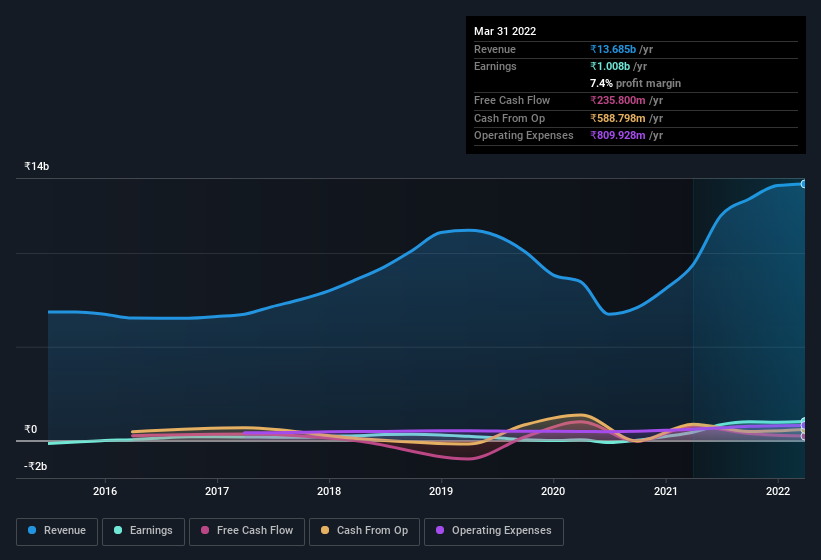

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Vardhman Special Steels is no giant, with a market capitalization of ₹8.6b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Vardhman Special Steels Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Vardhman Special Steels top brass are certainly in sync, not having sold any shares, over the last year. But my excitement comes from the ₹11m that Vice Chairman & MD Sachit Jain spent buying shares (at an average price of about ₹203).

The good news, alongside the insider buying, for Vardhman Special Steels bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold ₹1.8b worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 21% of the company, demonstrating a degree of high-level alignment with shareholders.

Is Vardhman Special Steels Worth Keeping An Eye On?

Vardhman Special Steels's earnings have taken off like any random crypto-currency did, back in 2017. The cherry on top is that insiders own a bunch of shares, and one has been buying more. Because of the potential that it has reached an inflection point, I'd suggest Vardhman Special Steels belongs on the top of your watchlist. You should always think about risks though. Case in point, we've spotted 2 warning signs for Vardhman Special Steels you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Vardhman Special Steels, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VSSL

Vardhman Special Steels

Engages in the manufacture and sale of billets, steel bars, and bright bars of various categories of special and alloy steels in India and internationally.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)