Should You Be Adding Shree Tirupati Balajee FIBC (NSE:TIRUPATI) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Shree Tirupati Balajee FIBC (NSE:TIRUPATI). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Shree Tirupati Balajee FIBC

Shree Tirupati Balajee FIBC's Improving Profits

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So EPS growth can certainly encourage an investor to take note of a stock. To the delight of shareholders, Shree Tirupati Balajee FIBC's EPS soared from ₹4.71 to ₹6.91, over the last year. That's a fantastic gain of 47%.

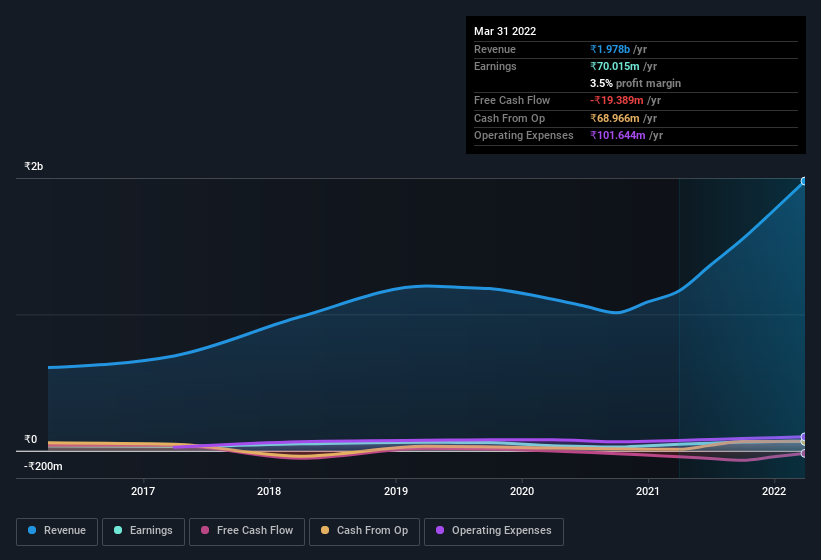

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. EBIT margins for Shree Tirupati Balajee FIBC remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 69% to ₹2.0b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Shree Tirupati Balajee FIBC is no giant, with a market capitalisation of ₹1.0b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Shree Tirupati Balajee FIBC Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

With strong conviction, Shree Tirupati Balajee FIBC insiders have stood united by refusing to sell shares over the last year. But the real excitement comes from the ₹5.9m that company insider Sunita Agrawal spent buying shares (at an average price of about ₹41.86). It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

It's reassuring that Shree Tirupati Balajee FIBC insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. To be specific, the CEO is paid modestly when compared to company peers of the same size. The median total compensation for CEOs of companies similar in size to Shree Tirupati Balajee FIBC, with market caps under ₹16b is around ₹3.2m.

The CEO of Shree Tirupati Balajee FIBC was paid just ₹526k in total compensation for the year ending March 2021. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Shree Tirupati Balajee FIBC Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Shree Tirupati Balajee FIBC's strong EPS growth. But wait, it gets better. We have seen insider buying and the executive pay seems on the modest side of things. On balance the message seems to be that this stock is worth looking at, at least for a while. We should say that we've discovered 3 warning signs for Shree Tirupati Balajee FIBC (2 can't be ignored!) that you should be aware of before investing here.

Keen growth investors love to see insider buying. Thankfully, Shree Tirupati Balajee FIBC isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TIRUPATI

Shree Tirupati Balajee FIBC

Manufactures and supplies flexible intermediate bulk containers (FIBCs) and plastic woven sacks in India.

Low risk with questionable track record.

Similar Companies

Market Insights

Community Narratives