- India

- /

- Metals and Mining

- /

- NSEI:RKFORGE

Industry Analysts Just Made A Meaningful Upgrade To Their Ramkrishna Forgings Limited (NSE:RKFORGE) Revenue Forecasts

Ramkrishna Forgings Limited (NSE:RKFORGE) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The revenue forecast for this year has experienced a facelift, with the analysts now much more optimistic on its sales pipeline.

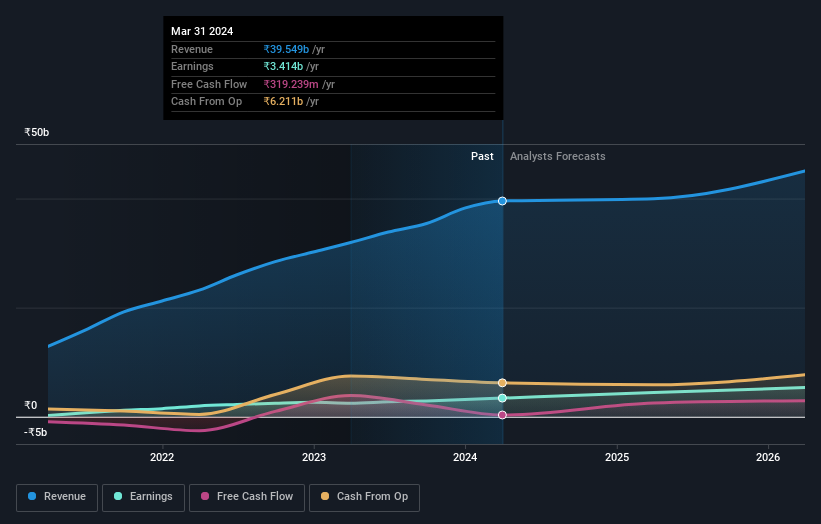

After this upgrade, Ramkrishna Forgings' six analysts are now forecasting revenues of ₹48b in 2025. This would be a major 21% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to jump 42% to ₹26.80. Before this latest update, the analysts had been forecasting revenues of ₹43b and earnings per share (EPS) of ₹26.99 in 2025. There's clearly been a surge in bullishness around the company's sales pipeline, even if there's no real change in earnings per share forecasts.

Check out our latest analysis for Ramkrishna Forgings

Even though revenue forecasts increased, there was no change to the consensus price target of ₹775, suggesting the analysts are focused on earnings as the driver of value creation.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Ramkrishna Forgings' past performance and to peers in the same industry. The period to the end of 2025 brings more of the same, according to the analysts, with revenue forecast to display 21% growth on an annualised basis. That is in line with its 24% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 9.2% per year. So although Ramkrishna Forgings is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with analysts reconfirming that earnings per share are expected to continue performing in line with their prior expectations. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Ramkrishna Forgings.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Ramkrishna Forgings going out to 2026, and you can see them free on our platform here..

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RKFORGE

Ramkrishna Forgings

Engages in the manufacture and sale of forged components for automobiles, railway wagons and coaches, and engineering parts in India and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion