- India

- /

- Metals and Mining

- /

- NSEI:MANAKCOAT

Does Manaksia Coated Metals & Industries (NSE:MANAKCOAT) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Manaksia Coated Metals & Industries (NSE:MANAKCOAT). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Manaksia Coated Metals & Industries

How Quickly Is Manaksia Coated Metals & Industries Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. I, for one, am blown away by the fact that Manaksia Coated Metals & Industries has grown EPS by 45% per year, over the last three years. That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While Manaksia Coated Metals & Industries did well to grow revenue over the last year, EBIT margins were dampened at the same time. So it seems the future my hold further growth, especially if EBIT margins can stabilize.

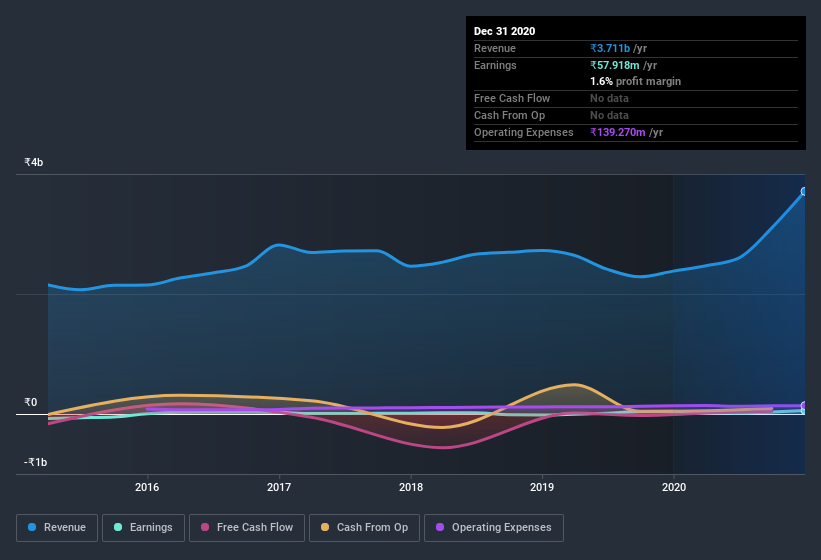

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Manaksia Coated Metals & Industries isn't a huge company, given its market capitalization of ₹836m. That makes it extra important to check on its balance sheet strength.

Are Manaksia Coated Metals & Industries Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Manaksia Coated Metals & Industries insiders own a meaningful share of the business. In fact, they own 72% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Valued at only ₹836m Manaksia Coated Metals & Industries is really small for a listed company. That means insiders only have ₹606m worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

Should You Add Manaksia Coated Metals & Industries To Your Watchlist?

Manaksia Coated Metals & Industries's earnings per share have taken off like a rocket aimed right at the moon. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So to my mind Manaksia Coated Metals & Industries is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. However, before you get too excited we've discovered 3 warning signs for Manaksia Coated Metals & Industries (1 is potentially serious!) that you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Manaksia Coated Metals & Industries, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Manaksia Coated Metals & Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:MANAKCOAT

Manaksia Coated Metals & Industries

Manufactures and sells coated metal products in India and internationally.

Proven track record with mediocre balance sheet.

Market Insights

Community Narratives