What Can We Conclude About Krishana Phoschem's (NSE:KRISHANA) CEO Pay?

This article will reflect on the compensation paid to Praveen Ostwal who has served as CEO of Krishana Phoschem Limited (NSE:KRISHANA) since 2008. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Krishana Phoschem.

See our latest analysis for Krishana Phoschem

How Does Total Compensation For Praveen Ostwal Compare With Other Companies In The Industry?

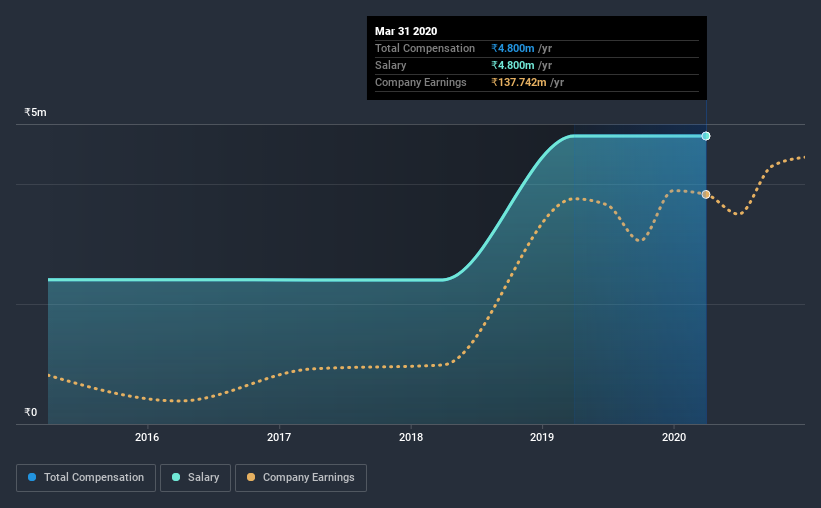

Our data indicates that Krishana Phoschem Limited has a market capitalization of ₹1.8b, and total annual CEO compensation was reported as ₹4.8m for the year to March 2020. That is, the compensation was roughly the same as last year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹4.8m.

In comparison with other companies in the industry with market capitalizations under ₹14b, the reported median total CEO compensation was ₹6.4m. So it looks like Krishana Phoschem compensates Praveen Ostwal in line with the median for the industry. Moreover, Praveen Ostwal also holds ₹49m worth of Krishana Phoschem stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹4.8m | ₹4.8m | 100% |

| Other | - | - | - |

| Total Compensation | ₹4.8m | ₹4.8m | 100% |

On an industry level, around 89% of total compensation represents salary and 11% is other remuneration. On a company level, Krishana Phoschem prefers to reward its CEO through a salary, opting not to pay Praveen Ostwal through non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Krishana Phoschem Limited's Growth Numbers

Krishana Phoschem Limited has seen its earnings per share (EPS) increase by 65% a year over the past three years. It saw its revenue drop 7.5% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Krishana Phoschem Limited Been A Good Investment?

Most shareholders would probably be pleased with Krishana Phoschem Limited for providing a total return of 104% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Krishana Phoschem rewards its CEO solely through a salary, ignoring non-salary benefits completely. As we noted earlier, Krishana Phoschem pays its CEO in line with similar-sized companies belonging to the same industry. Few would be critical of the leadership, since returns have been juicy and EPS are moving in the right direction. So one could argue that CEO compensation is quite modest, if you consider company performance! Also, such solid returns might lead to shareholders warming to the idea of a bump in pay.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 2 warning signs for Krishana Phoschem that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Krishana Phoschem, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Krishana Phoschem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:KRISHANA

Krishana Phoschem

Engages in the manufacture and sale of fertilizers and chemicals under the Annadata and Bharat brands in India.

Outstanding track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion