- India

- /

- Entertainment

- /

- NSEI:PVRINOX

Top Growth Companies With Significant Insider Ownership November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are eyeing potential growth opportunities amidst expectations of looser regulations and lower corporate taxes. In this environment, companies with significant insider ownership can offer unique insights into growth potential, as insiders often have a deep understanding of their company's prospects and challenges, aligning their interests closely with those of shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 36.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 42.1% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's uncover some gems from our specialized screener.

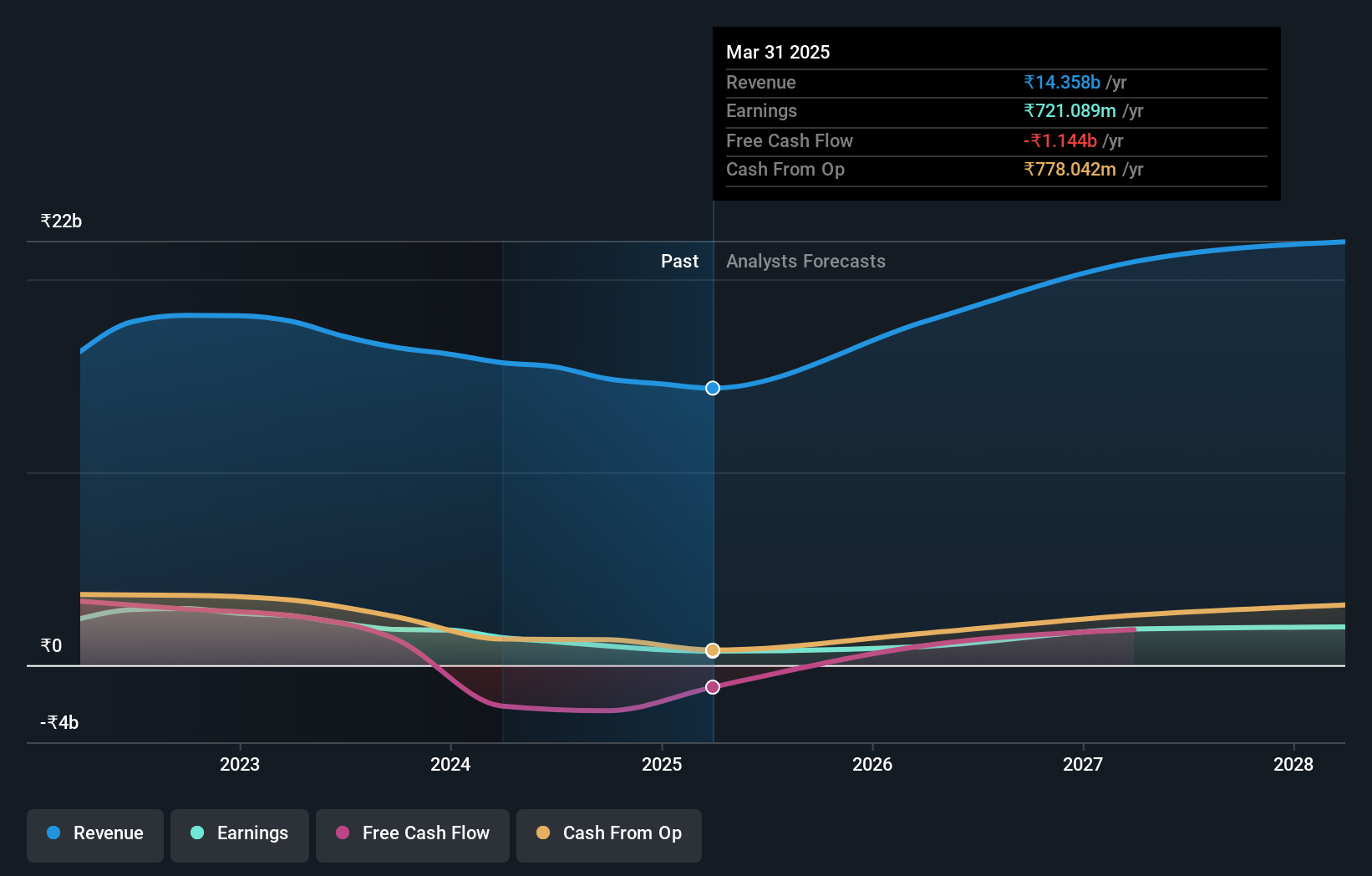

Greenpanel Industries (NSEI:GREENPANEL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Greenpanel Industries Limited is involved in the manufacturing, marketing, and sale of plywood, medium density fibre board (MDF), and allied products both in India and internationally, with a market cap of ₹43.36 billion.

Operations: The company's revenue primarily comes from Medium Density Fibre Boards and Allied Products, generating ₹13.41 billion, while Plywood and Allied Products contribute ₹1.43 billion.

Insider Ownership: 13.6%

Earnings Growth Forecast: 42.8% p.a.

Greenpanel Industries demonstrates strong growth potential, with earnings expected to grow significantly at 42.8% annually, outpacing the Indian market. While revenue growth of 19.7% per year is slightly below the high-growth threshold, it remains robust compared to the broader market. Insider ownership is substantial, though recent insider trading activity is not notable. However, profit margins have decreased from last year and dividends are not well-covered by free cash flows.

- Take a closer look at Greenpanel Industries' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Greenpanel Industries is trading beyond its estimated value.

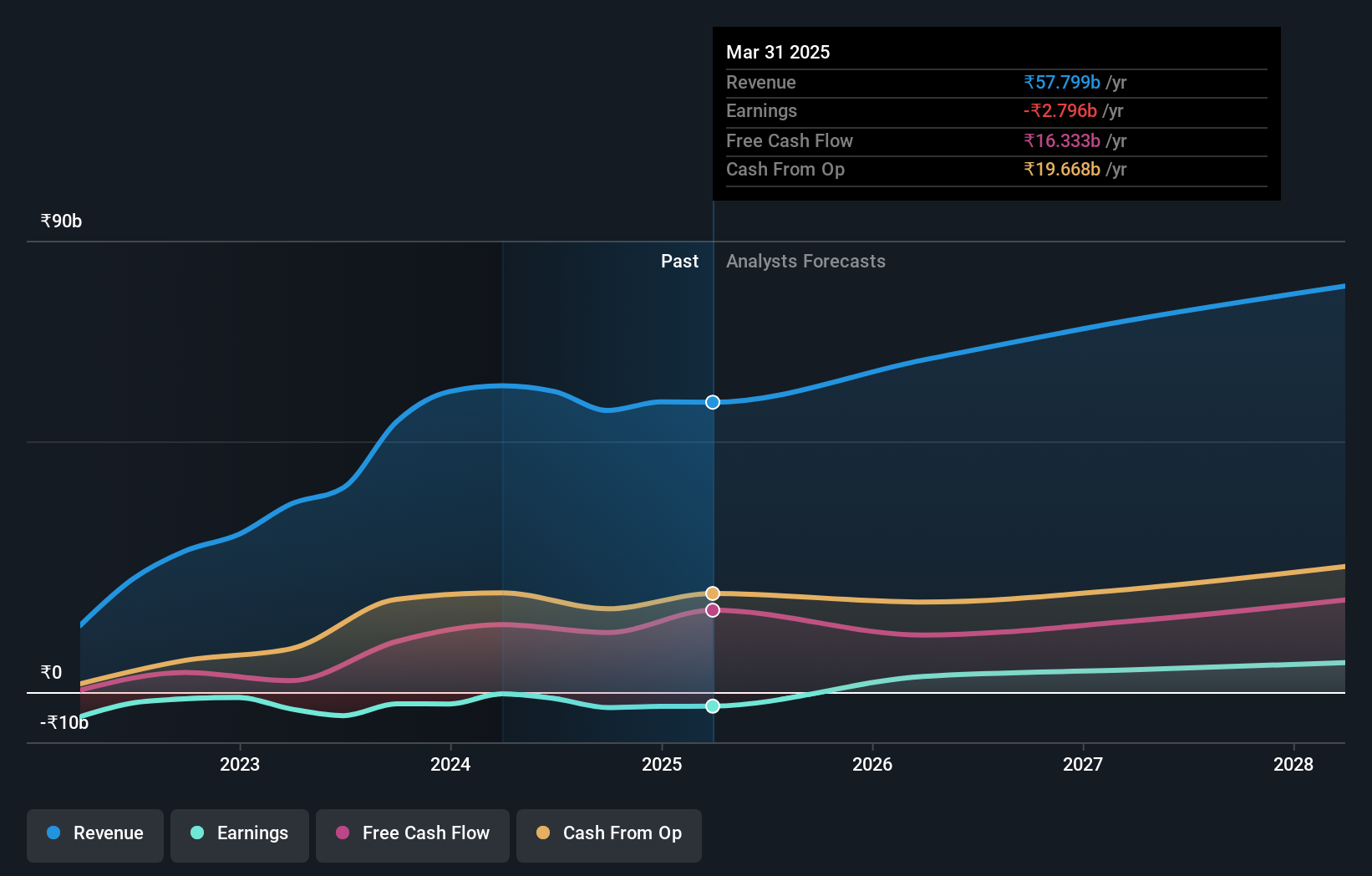

PVR INOX (NSEI:PVRINOX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PVR INOX Limited is a theatrical exhibition company involved in the exhibition, distribution, and production of movies in India and Sri Lanka, with a market cap of ₹145.10 billion.

Operations: The company's revenue primarily comes from its movie exhibition segment, which generated ₹54.02 billion.

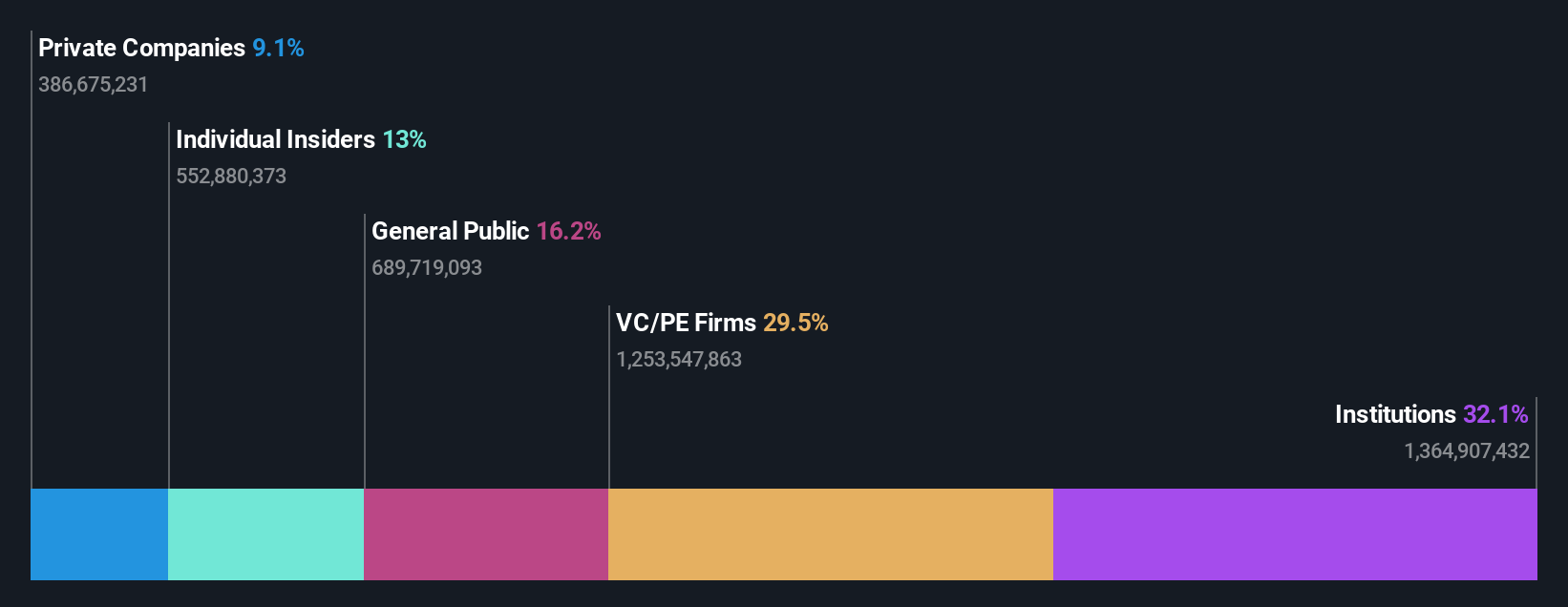

Insider Ownership: 11.2%

Earnings Growth Forecast: 68.9% p.a.

PVR INOX is forecast to achieve profitability within three years, with earnings expected to grow significantly at 68.9% annually, surpassing the Indian market's average growth. Although revenue growth of 14.6% per year is slower than the high-growth benchmark, it remains above market averages. The company trades at good value relative to peers and industry standards despite recent losses reported in Q2 2024 results. Recent board changes and strategic expansions in South India highlight ongoing corporate developments and regional focus.

- Dive into the specifics of PVR INOX here with our thorough growth forecast report.

- According our valuation report, there's an indication that PVR INOX's share price might be on the cheaper side.

ESR Group (SEHK:1821)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ESR Group Limited is involved in logistics real estate development, leasing, and management across various regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, Europe and internationally with a market cap of HK$46.70 billion.

Operations: The company's revenue segments are comprised of Fund Management ($627.98 million) and New Economy Development ($113.33 million).

Insider Ownership: 13%

Earnings Growth Forecast: 112.0% p.a.

ESR Group, with significant insider ownership, is poised for revenue growth at 15.3% annually, outpacing the Hong Kong market average. Despite a recent net loss of US$218.72 million due to non-cash asset revaluations and reduced promote fee income, analysts anticipate profitability within three years with earnings growth forecasted at 112.05% per year. Recent board changes include Brett Krause's appointment as interim chairman following Jeffrey Perlman's transition to CEO of Warburg Pincus.

- Unlock comprehensive insights into our analysis of ESR Group stock in this growth report.

- Our expertly prepared valuation report ESR Group implies its share price may be lower than expected.

Where To Now?

- Explore the 1525 names from our Fast Growing Companies With High Insider Ownership screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PVRINOX

PVR INOX

A theatrical exhibition company, engages in the exhibition, distribution, and production of movies in India and Sri Lanka.

Good value with reasonable growth potential.