- India

- /

- Metals and Mining

- /

- NSEI:GEEKAYWIRE

Here's Why I Think Geekay Wires (NSE:GEEKAYWIRE) Is An Interesting Stock

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Geekay Wires (NSE:GEEKAYWIRE). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Geekay Wires

Geekay Wires's Improving Profits

Over the last three years, Geekay Wires has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a wedge-tailed eagle on the wind, Geekay Wires's EPS soared from ₹4.98 to ₹7.37, in just one year. That's a commendable gain of 48%.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Geekay Wires's EBIT margins are flat but, of some concern, its revenue is actually down. Suffice it to say that is not a great sign of growth.

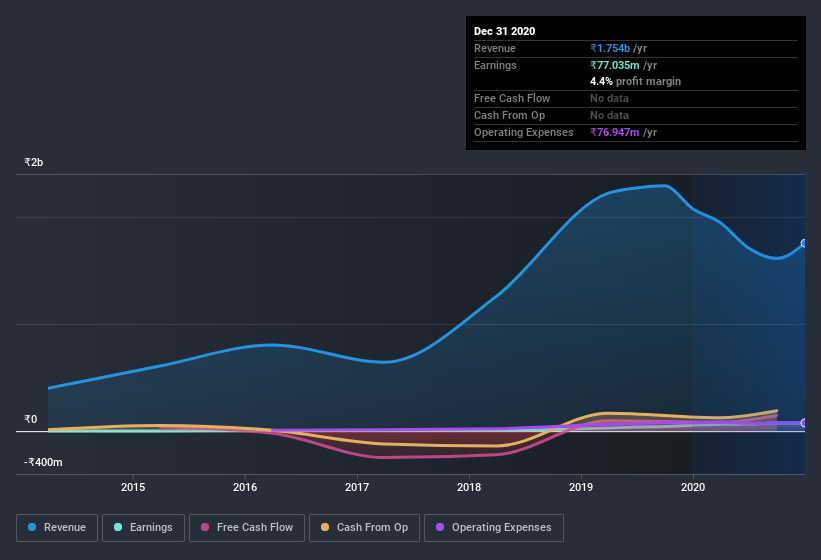

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since Geekay Wires is no giant, with a market capitalization of ₹829m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Geekay Wires Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Geekay Wires insiders refrain from selling stock during the year, but they also spent ₹10m buying it. That puts the company in a nice light, as it makes me think its leaders are feeling confident. It is also worth noting that it was Chairman & MD Ghanshyam Dass who made the biggest single purchase, worth ₹779k, paying ₹65.42 per share.

It's reassuring that Geekay Wires insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. For companies with market capitalizations under ₹14b, like Geekay Wires, the median CEO pay is around ₹3.2m.

The CEO of Geekay Wires was paid just ₹1.3m in total compensation for the year ending . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Geekay Wires Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Geekay Wires's strong EPS growth. But wait, it gets better. We have seen insider buying and the executive pay seems on the modest side of things. The message I'd take from this quick rundown is that, yes, this stock is worth investigating further. We don't want to rain on the parade too much, but we did also find 4 warning signs for Geekay Wires (1 is a bit concerning!) that you need to be mindful of.

The good news is that Geekay Wires is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Geekay Wires, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:GEEKAYWIRE

Geekay Wires

Manufactures and sells galvanized steel wires galvanized steel wires, steel nails and nuts, and bolts in India and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)