Unpleasant Surprises Could Be In Store For The Fertilisers and Chemicals Travancore Limited's (NSE:FACT) Shares

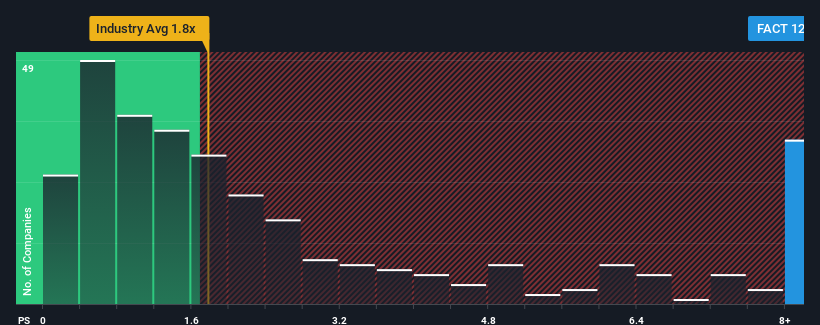

When you see that almost half of the companies in the Chemicals industry in India have price-to-sales ratios (or "P/S") below 1.8x, The Fertilisers and Chemicals Travancore Limited (NSE:FACT) looks to be giving off strong sell signals with its 12.6x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Fertilisers and Chemicals Travancore

How Fertilisers and Chemicals Travancore Has Been Performing

As an illustration, revenue has deteriorated at Fertilisers and Chemicals Travancore over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Fertilisers and Chemicals Travancore will help you shine a light on its historical performance.How Is Fertilisers and Chemicals Travancore's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Fertilisers and Chemicals Travancore's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 55% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that to the industry, which is predicted to deliver 16% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that Fertilisers and Chemicals Travancore's P/S exceeds that of its industry peers. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

What Does Fertilisers and Chemicals Travancore's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Fertilisers and Chemicals Travancore revealed its three-year revenue trends aren't impacting its high P/S as much as we would have predicted, given they look similar to current industry expectations. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Having said that, be aware Fertilisers and Chemicals Travancore is showing 3 warning signs in our investment analysis, and 1 of those is a bit concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:FACT

Fertilisers and Chemicals Travancore

Manufactures and markets fertilizers and petrochemicals in India.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)