Chemplast Sanmar Limited (NSE:CHEMPLASTS) Stock Rockets 30% As Investors Are Less Pessimistic Than Expected

Chemplast Sanmar Limited (NSE:CHEMPLASTS) shares have continued their recent momentum with a 30% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

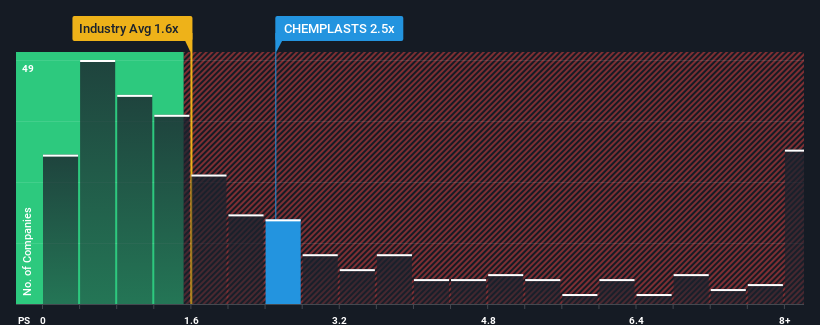

Following the firm bounce in price, given close to half the companies operating in India's Chemicals industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Chemplast Sanmar as a stock to potentially avoid with its 2.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Chemplast Sanmar

What Does Chemplast Sanmar's P/S Mean For Shareholders?

With revenue that's retreating more than the industry's average of late, Chemplast Sanmar has been very sluggish. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Chemplast Sanmar's future stacks up against the industry? In that case, our free report is a great place to start.How Is Chemplast Sanmar's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Chemplast Sanmar's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 12% per year as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 14% per annum, which is not materially different.

In light of this, it's curious that Chemplast Sanmar's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

The large bounce in Chemplast Sanmar's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Chemplast Sanmar currently trades on a higher than expected P/S. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

It is also worth noting that we have found 1 warning sign for Chemplast Sanmar that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:CHEMPLASTS

Chemplast Sanmar

Engages in manufacturing and selling of specialty chemicals in India.

Good value with reasonable growth potential.

Market Insights

Community Narratives