- India

- /

- Paper and Forestry Products

- /

- NSEI:CENTURYPLY

Century Plyboards (India) (NSE:CENTURYPLY) stock performs better than its underlying earnings growth over last three years

We think that it's fair to say that the possibility of finding fantastic multi-year winners is what motivates many investors. Not every pick can be a winner, but when you pick the right stock, you can win big. One bright shining star stock has been Century Plyboards (India) Limited (NSE:CENTURYPLY), which is 351% higher than three years ago. It's even up 4.1% in the last week.

Since the stock has added ₹4.2b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Century Plyboards (India)

SWOT Analysis for Century Plyboards (India)

- Debt is not viewed as a risk.

- Dividends are covered by earnings and cash flows.

- Earnings growth over the past year underperformed the Forestry industry.

- Dividend is low compared to the top 25% of dividend payers in the Forestry market.

- Expensive based on P/E ratio and estimated fair value.

- Annual revenue is forecast to grow faster than the Indian market.

- Annual earnings are forecast to grow slower than the Indian market.

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

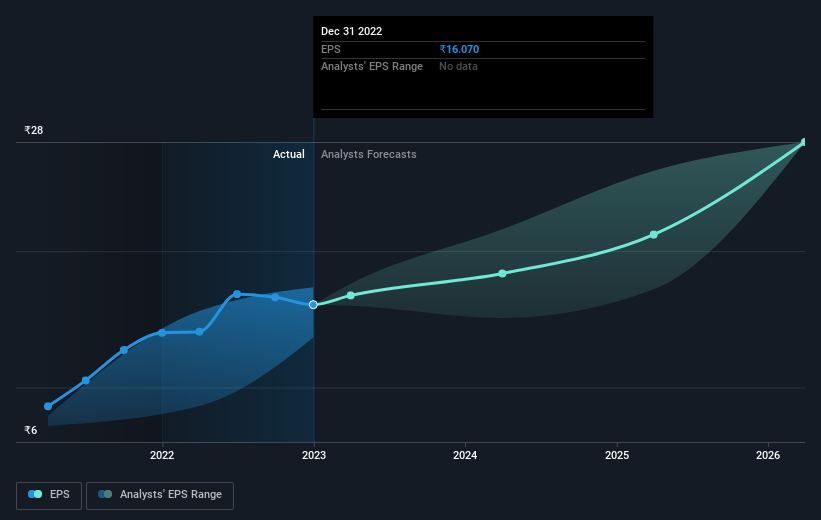

Century Plyboards (India) was able to grow its EPS at 37% per year over three years, sending the share price higher. This EPS growth is lower than the 65% average annual increase in the share price. This indicates that the market is feeling more optimistic on the stock, after the last few years of progress. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Century Plyboards (India) has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Century Plyboards (India)'s TSR for the last 3 years was 353%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

We regret to report that Century Plyboards (India) shareholders are down 27% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 4.7%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 8% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Is Century Plyboards (India) cheap compared to other companies? These 3 valuation measures might help you decide.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CENTURYPLY

Century Plyboards (India)

Manufactures and sells plywood, laminates, decorative veneers, medium density fiber boards (MDF), pre-laminated boards, particle boards, and flush doors in India.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives