Over the last 7 days, the Indian market has remained flat, yet it has shown a significant rise of 40% over the past year with earnings forecasted to grow by 17% annually. In such an environment, identifying stocks that are potentially undervalued can offer investors opportunities to capitalize on future growth while minimizing risk.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Titagarh Rail Systems (NSEI:TITAGARH) | ₹1139.30 | ₹2164.31 | 47.4% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1012.30 | ₹1829.70 | 44.7% |

| RITES (NSEI:RITES) | ₹300.50 | ₹517.43 | 41.9% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹406.85 | ₹762.32 | 46.6% |

| Vedanta (NSEI:VEDL) | ₹475.00 | ₹901.25 | 47.3% |

| Patel Engineering (BSE:531120) | ₹53.64 | ₹91.29 | 41.2% |

| Orchid Pharma (NSEI:ORCHPHARMA) | ₹1312.95 | ₹2142.32 | 38.7% |

| Tarsons Products (NSEI:TARSONS) | ₹409.30 | ₹706.32 | 42.1% |

| Manorama Industries (BSE:541974) | ₹967.80 | ₹1665.51 | 41.9% |

| Strides Pharma Science (NSEI:STAR) | ₹1638.55 | ₹2704.30 | 39.4% |

Underneath we present a selection of stocks filtered out by our screen.

Archean Chemical Industries (NSEI:ACI)

Overview: Archean Chemical Industries Limited manufactures and sells specialty marine chemicals both in India and internationally, with a market cap of ₹81.31 billion.

Operations: The company generates its revenue primarily from the marine chemicals segment, amounting to ₹11.99 billion.

Estimated Discount To Fair Value: 18.1%

Archean Chemical Industries is trading at ₹646.05, below its estimated fair value of ₹788.62, indicating undervaluation based on cash flows. With revenue growth forecasted at 28.5% per year, significantly outpacing the Indian market's 10.1%, and expected earnings growth of 34% annually over three years, it shows strong potential despite recent regulatory penalties and a decline in first-quarter earnings compared to the previous year.

- Insights from our recent growth report point to a promising forecast for Archean Chemical Industries' business outlook.

- Click here to discover the nuances of Archean Chemical Industries with our detailed financial health report.

Bandhan Bank (NSEI:BANDHANBNK)

Overview: Bandhan Bank Limited provides banking and financial services to personal and business customers in India, with a market cap of ₹297.85 billion.

Operations: The company's revenue segments include Treasury at ₹22.72 billion, Retail Banking at ₹190.31 billion, Wholesale Banking at ₹17.10 billion, and Other Banking Business at ₹3.13 billion.

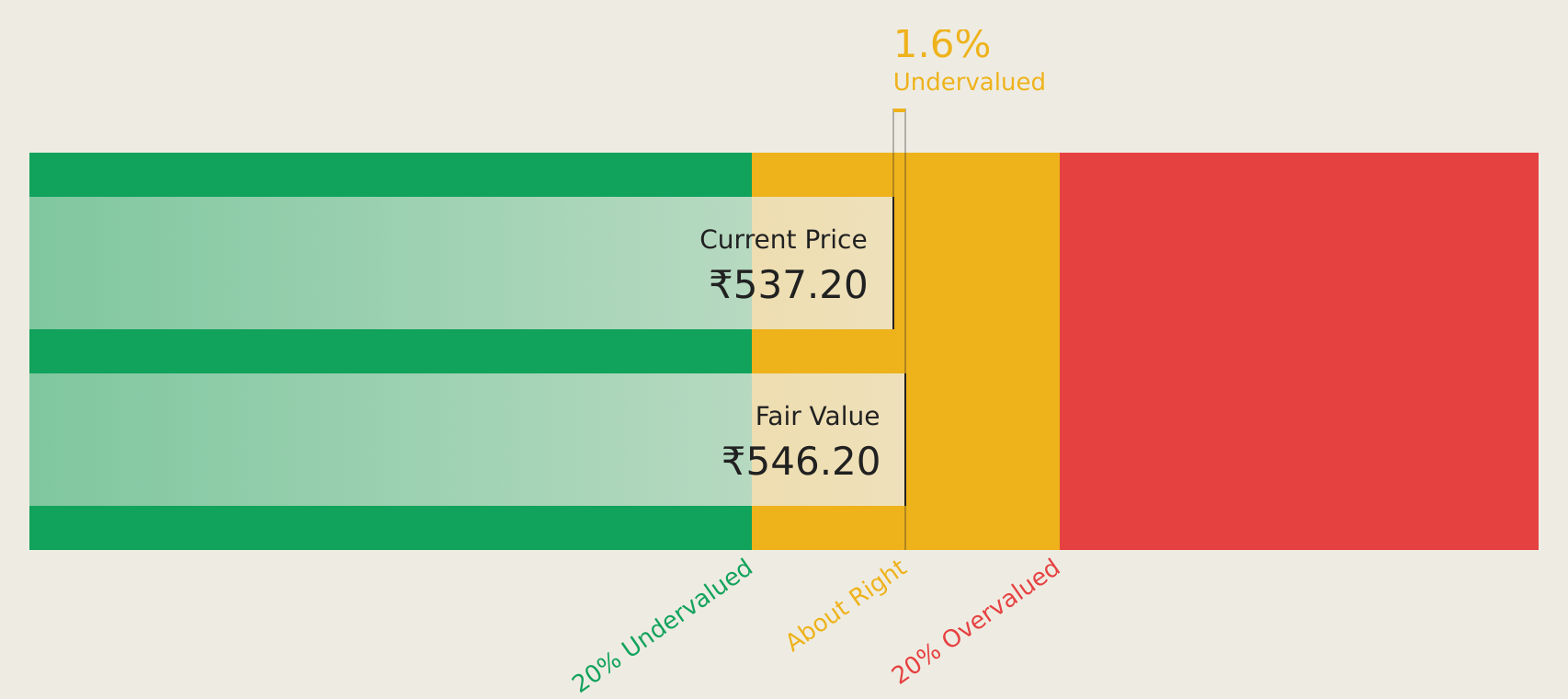

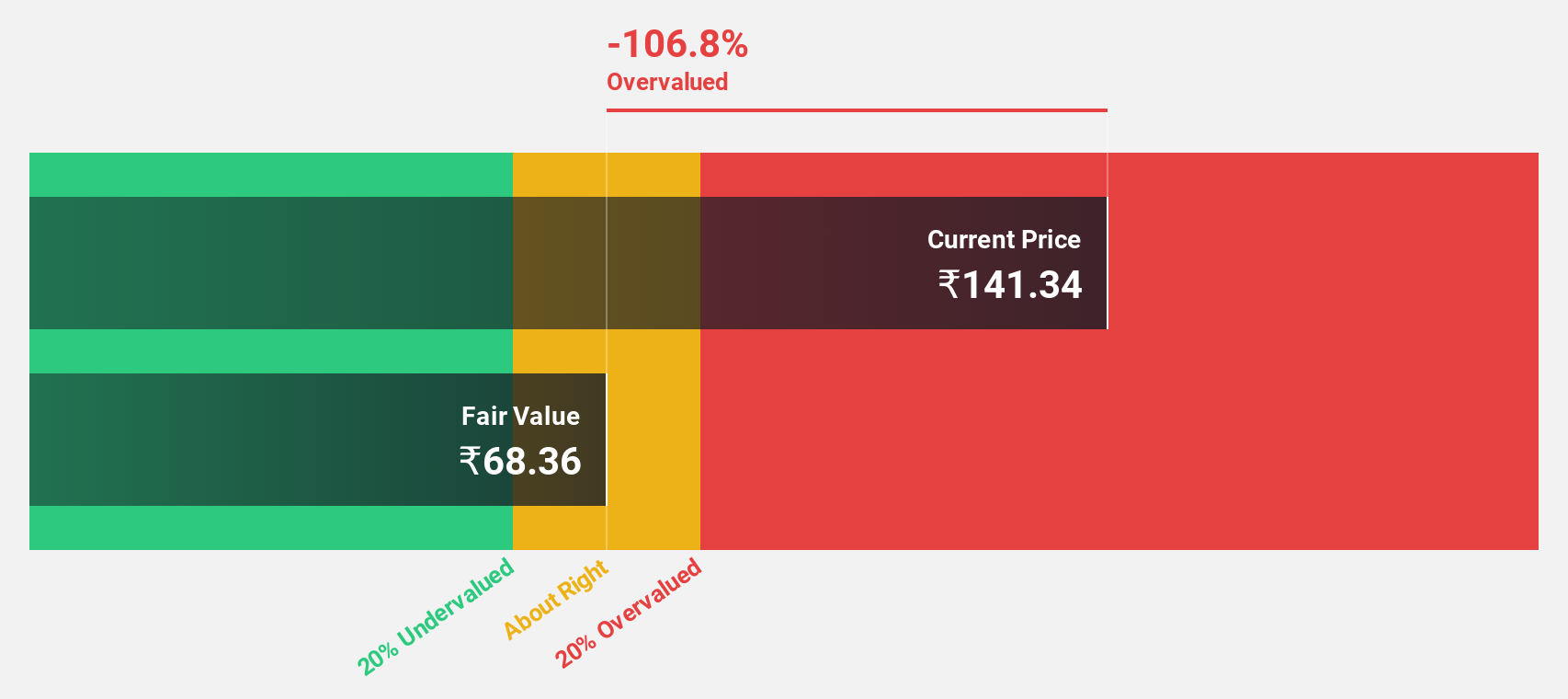

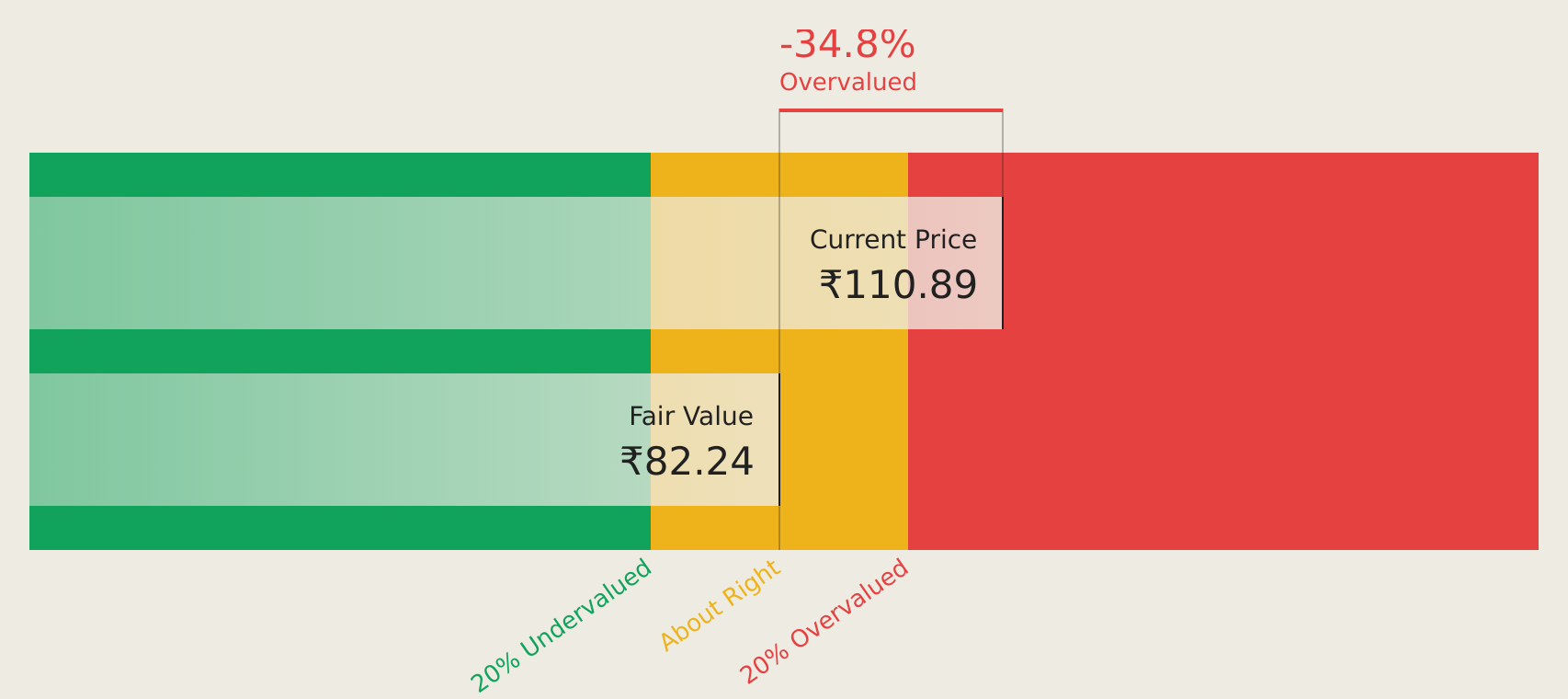

Estimated Discount To Fair Value: 11.8%

Bandhan Bank, trading at ₹184.89, is undervalued relative to its fair value of ₹209.54 based on cash flows. The bank anticipates robust revenue growth of 24.5% annually, surpassing the market's 10.1%, with earnings expected to grow significantly at 23.2% per year over three years despite a high bad loans ratio of 3.8%. Recent regulatory issues concerning GST matters have not materially impacted financials or operations.

- Our earnings growth report unveils the potential for significant increases in Bandhan Bank's future results.

- Click to explore a detailed breakdown of our findings in Bandhan Bank's balance sheet health report.

Everest Kanto Cylinder (NSEI:EKC)

Overview: Everest Kanto Cylinder Limited, along with its subsidiaries, manufactures and sells gas cylinders in India and has a market cap of ₹21.55 billion.

Operations: The company generates revenue from its core business of manufacturing and selling gas cylinders.

Estimated Discount To Fair Value: 38.3%

Everest Kanto Cylinder, trading at ₹192.08, is significantly undervalued relative to its fair value of ₹311.13 based on cash flow analysis. The company reported strong Q1 2024 results with net income rising to ₹280.5 million from ₹217.5 million year-on-year and forecasts suggest annual earnings growth of 27.5%, outpacing the Indian market's 17.4%. Despite high share price volatility recently, Everest Kanto's revenue growth prospects remain robust at 16.9% annually.

- Our expertly prepared growth report on Everest Kanto Cylinder implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Everest Kanto Cylinder stock in this financial health report.

Seize The Opportunity

- Access the full spectrum of 30 Undervalued Indian Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bandhan Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:BANDHANBNK

Bandhan Bank

Engages in the provision of banking and financial services for personal and business customers in India.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives