- India

- /

- Personal Products

- /

- NSEI:GODREJCP

Analysts Are Updating Their Godrej Consumer Products Limited (NSE:GODREJCP) Estimates After Its Second-Quarter Results

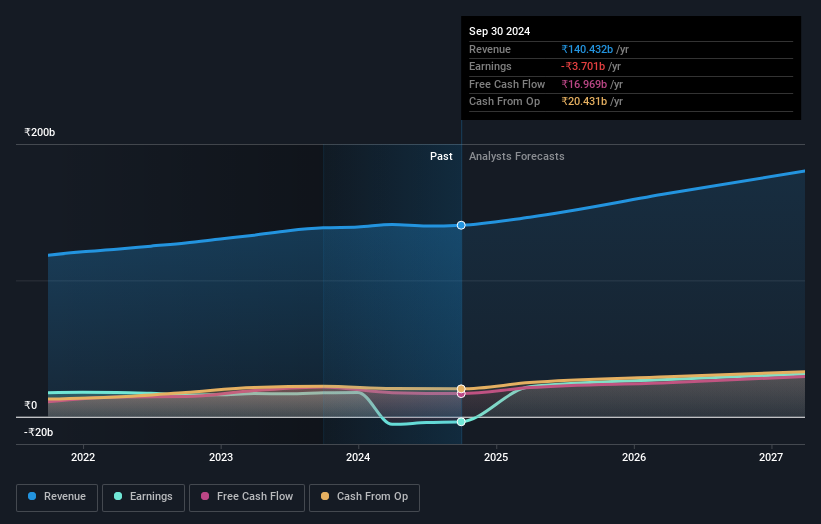

Godrej Consumer Products Limited (NSE:GODREJCP) shareholders are probably feeling a little disappointed, since its shares fell 3.4% to ₹1,291 in the week after its latest quarterly results. Results were roughly in line with estimates, with revenues of ₹37b and statutory earnings per share of ₹4.80. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

Check out our latest analysis for Godrej Consumer Products

Following the latest results, Godrej Consumer Products' 34 analysts are now forecasting revenues of ₹146.3b in 2025. This would be a reasonable 4.2% improvement in revenue compared to the last 12 months. Godrej Consumer Products is also expected to turn profitable, with statutory earnings of ₹21.45 per share. Yet prior to the latest earnings, the analysts had been anticipated revenues of ₹149.5b and earnings per share (EPS) of ₹22.58 in 2025. The analysts are less bullish than they were before these results, given the reduced revenue forecasts and the small dip in earnings per share expectations.

The analysts made no major changes to their price target of ₹1,472, suggesting the downgrades are not expected to have a long-term impact on Godrej Consumer Products' valuation. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Godrej Consumer Products, with the most bullish analyst valuing it at ₹1,680 and the most bearish at ₹1,035 per share. This shows there is still a bit of diversity in estimates, but analysts don't appear to be totally split on the stock as though it might be a success or failure situation.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The period to the end of 2025 brings more of the same, according to the analysts, with revenue forecast to display 8.6% growth on an annualised basis. That is in line with its 8.1% annual growth over the past five years. Juxtapose this against our data, which suggests that other companies (with analyst coverage) in the industry are forecast to see their revenues grow 8.2% per year. It's clear that while Godrej Consumer Products' revenue growth is expected to continue on its current trajectory, it's only expected to grow in line with the industry itself.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Sadly, they also downgraded their revenue forecasts, but the business is still expected to grow at roughly the same rate as the industry itself. The consensus price target held steady at ₹1,472, with the latest estimates not enough to have an impact on their price targets.

With that in mind, we wouldn't be too quick to come to a conclusion on Godrej Consumer Products. Long-term earnings power is much more important than next year's profits. We have forecasts for Godrej Consumer Products going out to 2027, and you can see them free on our platform here.

You should always think about risks though. Case in point, we've spotted 1 warning sign for Godrej Consumer Products you should be aware of.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GODREJCP

Godrej Consumer Products

A fast-moving consumer goods company, manufactures and sells personal care and home care products in India, Africa, Indonesia, the Middle East, the United States, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)