- India

- /

- Healthcare Services

- /

- NSEI:LOTUSEYE

We Ran A Stock Scan For Earnings Growth And Lotus Eye Hospital and Institute (NSE:LOTUSEYE) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Lotus Eye Hospital and Institute (NSE:LOTUSEYE), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Lotus Eye Hospital and Institute

How Fast Is Lotus Eye Hospital and Institute Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Recognition must be given to the that Lotus Eye Hospital and Institute has grown EPS by 56% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

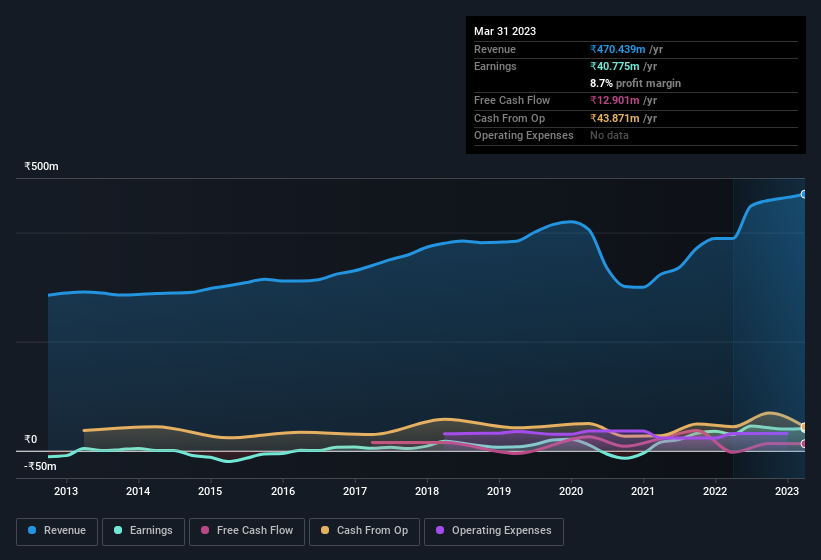

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Lotus Eye Hospital and Institute maintained stable EBIT margins over the last year, all while growing revenue 21% to ₹470m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Lotus Eye Hospital and Institute is no giant, with a market capitalisation of ₹1.8b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Lotus Eye Hospital and Institute Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's nice to see that there have been no reports of any insiders selling shares in Lotus Eye Hospital and Institute in the previous 12 months. Add in the fact that Rajkumar Sundaramoorthy, the Vice President of Administration of the company, paid ₹3.6m for shares at around ₹81.51 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Lotus Eye Hospital and Institute will reveal that insiders own a significant piece of the pie. To be exact, company insiders hold 64% of the company, so their decisions have a significant impact on their investments. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Although, with Lotus Eye Hospital and Institute being valued at ₹1.8b, this is a small company we're talking about. So this large proportion of shares owned by insiders only amounts to ₹1.1b. That might not be a huge sum but it should be enough to keep insiders motivated!

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because Lotus Eye Hospital and Institute's CEO, Kuttapalayam Ramalingam, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations under ₹16b, like Lotus Eye Hospital and Institute, the median CEO pay is around ₹3.3m.

Lotus Eye Hospital and Institute's CEO only received compensation totalling ₹1.1m in the year to March 2022. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Lotus Eye Hospital and Institute To Your Watchlist?

Lotus Eye Hospital and Institute's earnings have taken off in quite an impressive fashion. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Lotus Eye Hospital and Institute belongs near the top of your watchlist. However, before you get too excited we've discovered 2 warning signs for Lotus Eye Hospital and Institute that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Lotus Eye Hospital and Institute isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LOTUSEYE

Lotus Eye Hospital and Institute

A specialty eye care hospital, provides eye care and related services in India.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives