- India

- /

- Healthcare Services

- /

- NSEI:LOTUSEYE

Here's Why Lotus Eye Hospital and Institute (NSE:LOTUSEYE) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Lotus Eye Hospital and Institute (NSE:LOTUSEYE). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Lotus Eye Hospital and Institute with the means to add long-term value to shareholders.

View our latest analysis for Lotus Eye Hospital and Institute

How Fast Is Lotus Eye Hospital and Institute Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Shareholders will be happy to know that Lotus Eye Hospital and Institute's EPS has grown 25% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

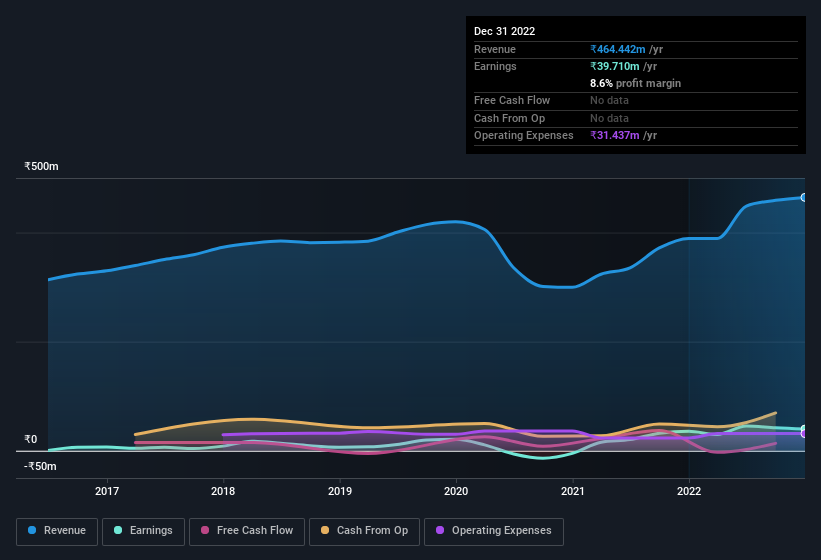

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Lotus Eye Hospital and Institute remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 19% to ₹464m. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Lotus Eye Hospital and Institute isn't a huge company, given its market capitalisation of ₹1.3b. That makes it extra important to check on its balance sheet strength.

Are Lotus Eye Hospital and Institute Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that Lotus Eye Hospital and Institute insiders own a significant number of shares certainly is appealing. To be exact, company insiders hold 64% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Valued at only ₹1.3b Lotus Eye Hospital and Institute is really small for a listed company. That means insiders only have ₹859m worth of shares, despite the large proportional holding. This isn't an overly large holding but it should still keep the insiders motivated to deliver the best outcomes for shareholders.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to Lotus Eye Hospital and Institute, with market caps under ₹16b is around ₹3.6m.

The CEO of Lotus Eye Hospital and Institute was paid just ₹1.1m in total compensation for the year ending March 2022. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Lotus Eye Hospital and Institute To Your Watchlist?

You can't deny that Lotus Eye Hospital and Institute has grown its earnings per share at a very impressive rate. That's attractive. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. The overarching message here is that Lotus Eye Hospital and Institute has underlying strengths that make it worth a look at. However, before you get too excited we've discovered 2 warning signs for Lotus Eye Hospital and Institute that you should be aware of.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Lotus Eye Hospital and Institute, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:LOTUSEYE

Lotus Eye Hospital and Institute

A specialty eye care hospital, provides eye care and related services in India.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives