- India

- /

- Consumer Finance

- /

- NSEI:REPCOHOME

Here's Why We Think Repco Home Finance (NSE:REPCOHOME) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Repco Home Finance (NSE:REPCOHOME), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Repco Home Finance with the means to add long-term value to shareholders.

View our latest analysis for Repco Home Finance

How Quickly Is Repco Home Finance Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Repco Home Finance grew its EPS by 10% per year. That's a good rate of growth, if it can be sustained.

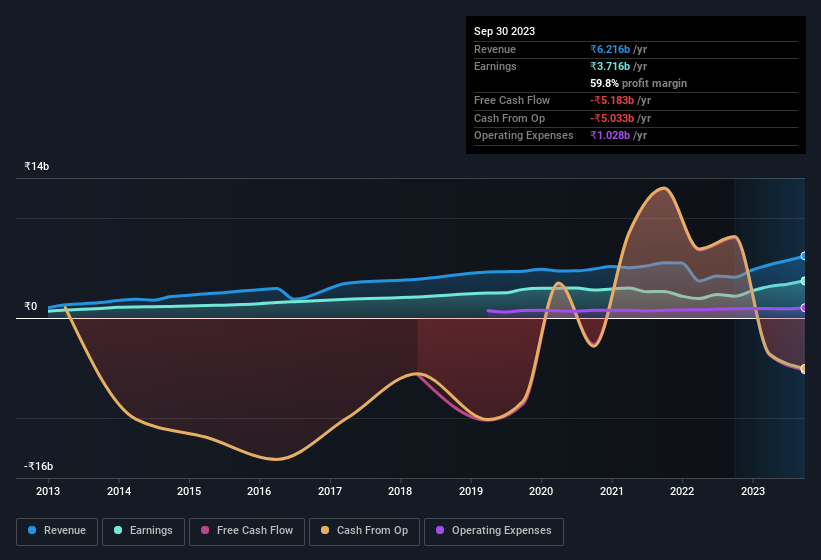

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Repco Home Finance's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for Repco Home Finance remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 52% to ₹6.2b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Repco Home Finance's future profits.

Are Repco Home Finance Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations between ₹8.3b and ₹33b, like Repco Home Finance, the median CEO pay is around ₹16m.

Repco Home Finance's CEO took home a total compensation package of ₹5.3m in the year prior to March 2023. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Repco Home Finance Worth Keeping An Eye On?

One positive for Repco Home Finance is that it is growing EPS. That's nice to see. To add to this, the modest CEO compensation should tell investors that the directors have an active interest in delivering the best for shareholders. So all in all Repco Home Finance is worthy at least considering for your watchlist. Still, you should learn about the 2 warning signs we've spotted with Repco Home Finance (including 1 which is significant).

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:REPCOHOME

Proven track record average dividend payer.

Market Insights

Community Narratives