- India

- /

- Consumer Finance

- /

- NSEI:FIVESTAR

Indian Growth Companies With High Insider Ownership For October 2024

Reviewed by Simply Wall St

In the last week, the Indian market has been flat, but over the past 12 months, it has risen by an impressive 45%, with earnings forecasted to grow by 17% annually. In such a robust environment, identifying growth companies with high insider ownership can be crucial as it often signals strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34.2% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31.6% |

| Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 22.2% |

| Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

| Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.2% |

| Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

| KEI Industries (BSE:517569) | 18.7% | 22.4% |

| Aether Industries (NSEI:AETHER) | 31.1% | 45.9% |

Here's a peek at a few of the choices from the screener.

Five-Star Business Finance (NSEI:FIVESTAR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Five-Star Business Finance Limited, with a market cap of ₹241.40 billion, operates as a non-banking financial company in India.

Operations: Revenue Segments (in millions of ₹): MSME Loans, Housing Loans & Property Loans: 17794.07

Insider Ownership: 18.7%

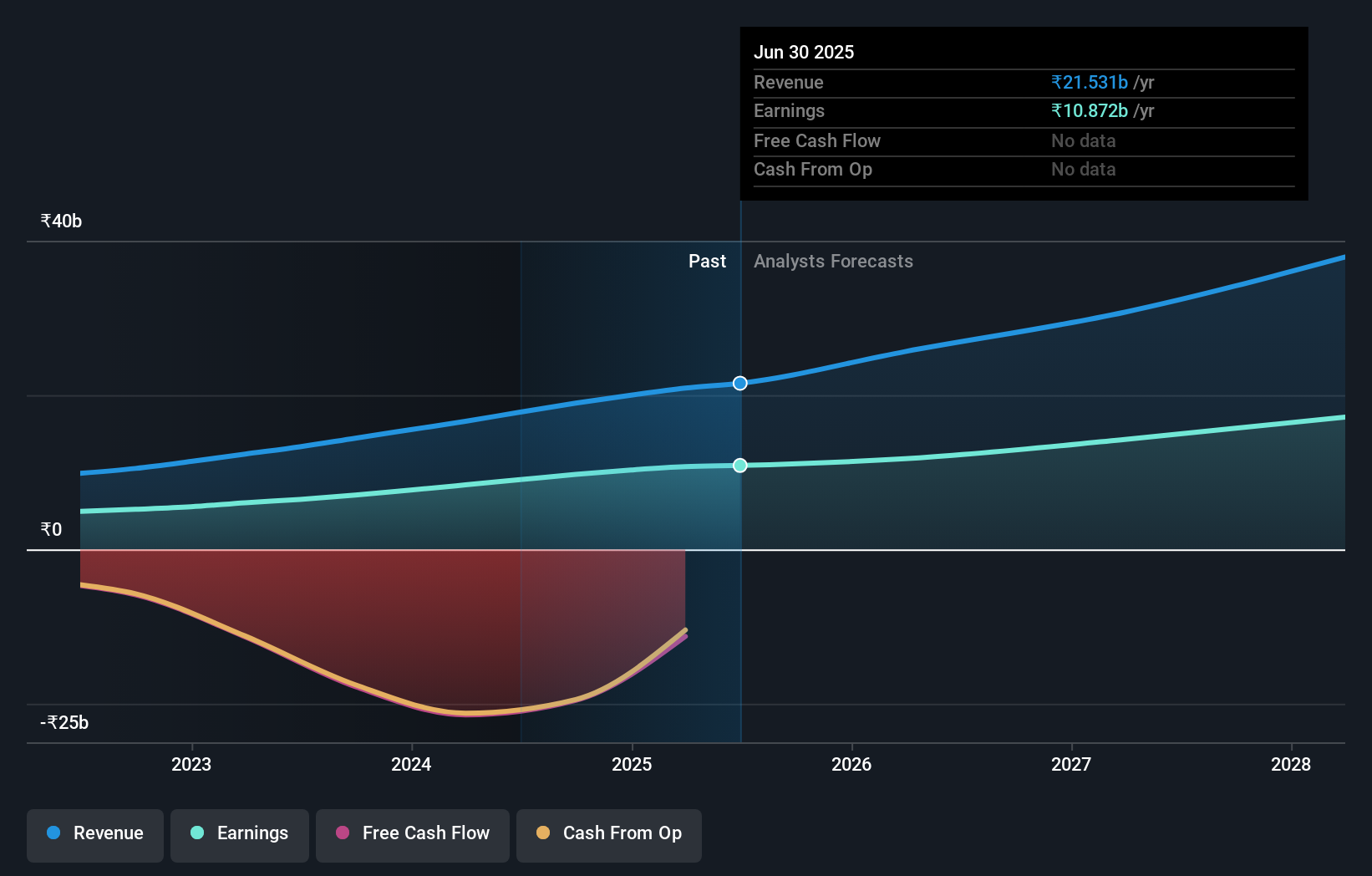

Five-Star Business Finance shows strong growth potential with significant insider ownership. The company’s revenue is forecasted to grow at 22.2% annually, outpacing the Indian market's average of 10.1%. Recent earnings reports indicate a robust performance, with Q1 revenue reaching ₹6.69 billion and net income at ₹2.52 billion. However, debt coverage by operating cash flow remains a concern despite the company's solid profitability and governance improvements highlighted by recent board appointments and debt financing approvals worth ₹25 billion through non-convertible debentures.

- Navigate through the intricacies of Five-Star Business Finance with our comprehensive analyst estimates report here.

- The analysis detailed in our Five-Star Business Finance valuation report hints at an inflated share price compared to its estimated value.

Info Edge (India) (NSEI:NAUKRI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Info Edge (India) Limited operates as an online classifieds company in recruitment, matrimony, real estate, and education services both in India and internationally, with a market cap of ₹1.06 trillion.

Operations: The company's revenue segments include ₹19.05 billion from recruitment solutions and ₹3.67 billion from 99acres for real estate.

Insider Ownership: 37.7%

Info Edge (India) demonstrates growth potential with high insider ownership. Earnings are forecast to grow 23.61% annually, outpacing the Indian market's 17.2%. Recent Q1 results show revenue at ₹8.28 billion and net income at ₹2.33 billion, reflecting profitability improvements. However, return on equity is expected to be low at 4.6%. Recent investments in Nexstem India and strategic board appointments underscore its commitment to growth despite an unstable dividend track record and recent tax demands under appeal.

- Click here and access our complete growth analysis report to understand the dynamics of Info Edge (India).

- Our expertly prepared valuation report Info Edge (India) implies its share price may be too high.

One97 Communications (NSEI:PAYTM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: One97 Communications Limited offers payment, commerce and cloud, and financial services to consumers and merchants in India with a market cap of ₹465.61 billion.

Operations: Revenue segments for One97 Communications Limited include Data Processing, which generated ₹91.38 billion.

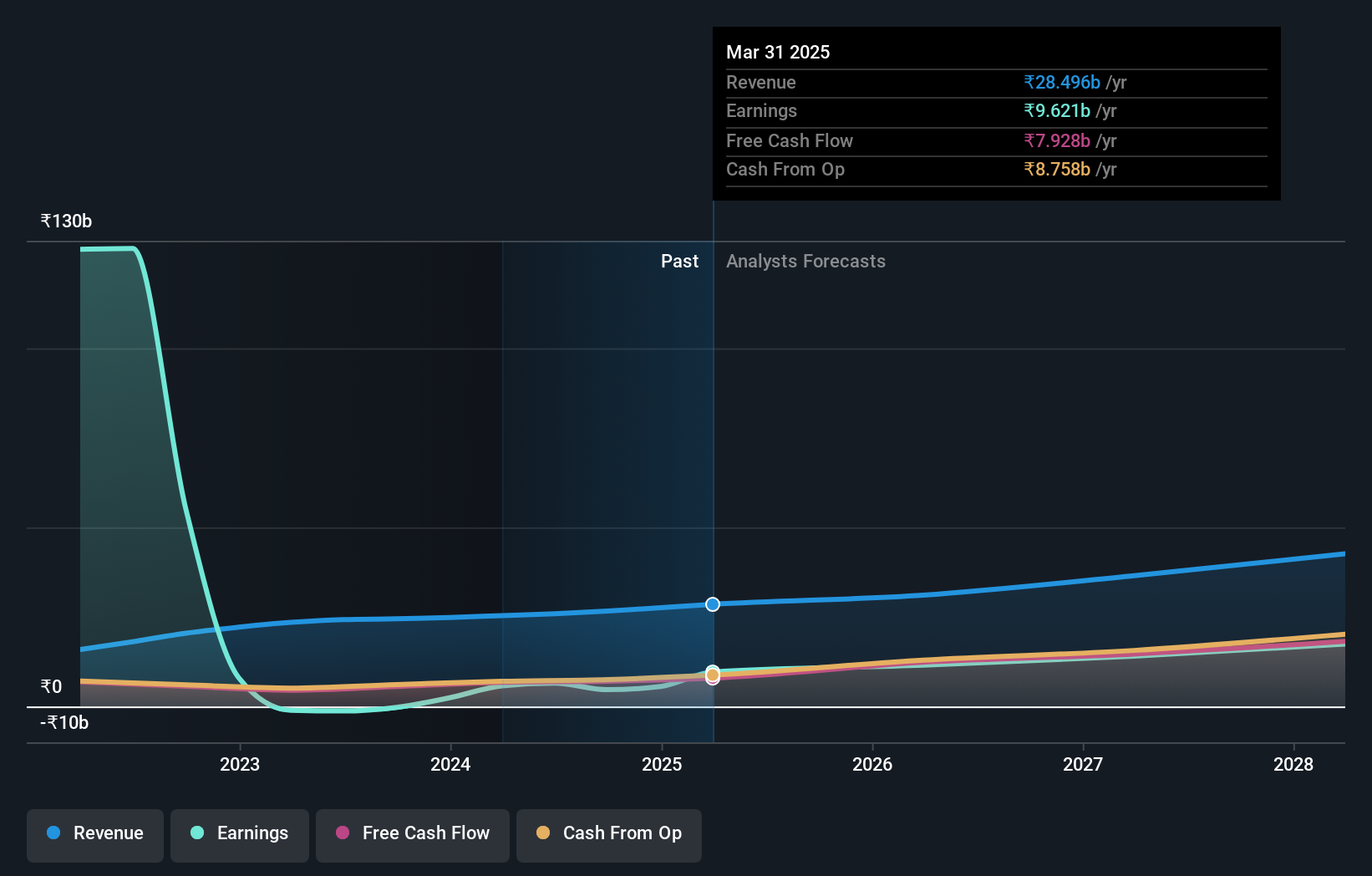

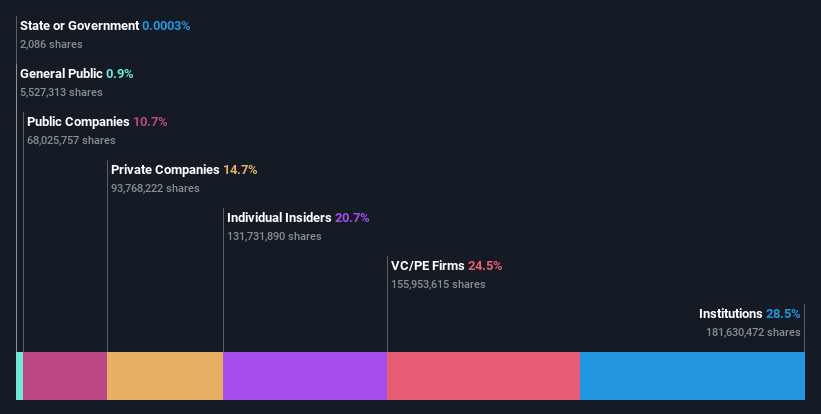

Insider Ownership: 20.7%

One97 Communications, known for its Paytm brand, exhibits significant growth potential with high insider ownership. Despite recent regulatory penalties and a net loss of ₹8.39 billion in Q1 2024, revenue is forecast to grow at 12.1% annually, outpacing the Indian market's 10.1%. The sale of its entertainment ticketing business to Zomato for ₹20.48 billion strengthens its balance sheet and aligns with its core focus on payments and financial services distribution.

- Click here to discover the nuances of One97 Communications with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, One97 Communications' share price might be too optimistic.

Seize The Opportunity

- Get an in-depth perspective on all 93 Fast Growing Indian Companies With High Insider Ownership by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:FIVESTAR

Five-Star Business Finance

Operates as a non-banking financial company in India.

Proven track record and slightly overvalued.