- India

- /

- Electronic Equipment and Components

- /

- NSEI:KERNEX

Insiders Who Sold ₹292m Of Kernex Microsystems (India) Made The Right Call

While Kernex Microsystems (India) Limited (NSE:KERNEX) shareholders have enjoyed a good week with stock up 28%, they need remain vigilant. The fact that insiders chose to dispose of ₹292m worth of stock in the past 12 months even though prices were relatively low could be indicative of some anticipated weakness.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

View our latest analysis for Kernex Microsystems (India)

The Last 12 Months Of Insider Transactions At Kernex Microsystems (India)

The insider, Jai Singh, made the biggest insider sale in the last 12 months. That single transaction was for ₹292m worth of shares at a price of ₹975 each. That means that even when the share price was below the current price of ₹1,525, an insider wanted to cash in some shares. We generally consider it a negative if insiders have been selling, especially if they did so below the current price, because it implies that they considered a lower price to be reasonable. However, while insider selling is sometimes discouraging, it's only a weak signal. This single sale was 100% of Jai Singh's stake. The only individual insider seller over the last year was Jai Singh.

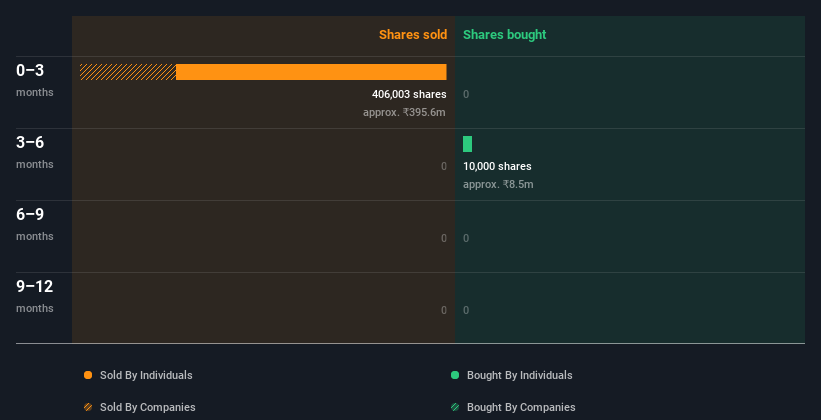

The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

Kernex Microsystems (India) Insiders Are Selling The Stock

Over the last three months, we've seen significant insider selling at Kernex Microsystems (India). In total, insider Jai Singh sold ₹292m worth of shares in that time, and we didn't record any purchases whatsoever. In light of this it's hard to argue that all the insiders think that the shares are a bargain.

Does Kernex Microsystems (India) Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Kernex Microsystems (India) insiders own about ₹11b worth of shares (which is 43% of the company). I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Do The Kernex Microsystems (India) Insider Transactions Indicate?

An insider sold stock recently, but they haven't been buying. And our longer term analysis of insider transactions didn't bring confidence, either. It is good to see high insider ownership, but the insider selling leaves us cautious. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. At Simply Wall St, we've found that Kernex Microsystems (India) has 4 warning signs (2 don't sit too well with us!) that deserve your attention before going any further with your analysis.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kernex Microsystems (India) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KERNEX

Kernex Microsystems (India)

Engages in the manufacture and sale of safety systems and software services for railways in India and internationally.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion